Risk Management and Trade Criteria - Crypto Academy / S5W7- Homework Post for @reminiscence01

Getting all the knowledge about technical analysis and strategies is likely to raise a lot of enthusiasm in anyone and it will not be surprising to see such a person hurrying to start taking trades.

In reality, knowing how to take trades alone has proven to be a very fatal mistake if it is not combined with a sufficient means of managing risks and following stipulated criteria.

A whole lot of losses will come to any trader who does not stick to trading criteria and has no risk management in place before opening a position in the market. Thankfully, this lesson by Prof. @reminiscence01 is enlightening enough in this aspect. I will now our forward my assignment answers.

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Risk Management

Risk management simply implies how we deal with risk. It refers to steps taken and methods applied to ensure that the rate of failed trades do not exceed the rate of win trades.

It includes measures out in place to protect ones trading capital and ensure that the number of losses is below the number of gains. It entails that a trader will first evaluate the market and when taking a trade will be able to ascertain that the chances of winning that trade are higher than the chances of lossing the trade.

It involves determining the degree of losses that can be comfortably borne without jeopardizing a trading account and this must be lower than the percentage of profit.

It is interesting to note here that, the concept does not refer avoiding risks but managing risks. This means that there is an assurance of risks. Trading the market is full of risks and as such no need denying it or running away but finding ways to deal with the inherent risks unless one does not want to venture into the market.

Importance of Risk Management

As can be deduced from the submission above, risk management has serious importance in trading the cryptocurrency market. Some of these importance include;

It will Serve as a Guide: with a properly structured risks management, the operations of a trader will be guided adequately to avoid taking any risky or unnecessary steps.

It will Protect Capital: The risks management strategy has all the details including how much losses should be incurred for a particular trade. This helps the trader while setting his stop loss and in other cases knowing when to close a losing trade so he doesn't loose his capital.

It will Ensure Profit: A good risks management always ensures that more positive than negative results are gotten. Therefore, this helps a trader to experience profit as he would be able to have more winning than losing trades.

It will Prevent Negative Emotions: Following risk management with discipline and commitment guarantees that a trader will not succumb to negative emotions. The trader will not get greedy in winning situations and will not have too much fear of re-entering the market after experiencing a loss.

It Promotes Control: By having a sequence of actions and a code to operate with, the trader is put in total control of his trading regime and he feels very confident and set for the market. With his clear entry and exit strategies, he will know exactly what to do in any situation in the market.

Facilitate Decision Making*: Sometimes uncertainty and lack of coordination can make the process of taking decisions very difficult which might cause some harm in critical situations. However, with a risks management strategy, making trading decisions become much easier.

Explain the following Risk Management tools and give an illustrative example of each of them. a) 1% Rule. b) Risk-reward ratio. c) Stop loss and take profit.

1% RULE

This risk management tool suggest what proportion of ones trading capital should be staked or risked on a trading position. The concept in this rule is that a trader should only risk 1% of his trading capital per trade position opened. This means that, a trader should execute the trade such that if a loss should occur or if the trade fails, the amount lost will be equal to just 1% of the total capital in the account.

For instance, if my trading account has $40 as capital, if I was to open a trade using the 1% rule and it happens that the trade did not go as I planned and I lose it, what this means is that I would have lost $0.4 which is 1% of my $40 capital.

In this way, when I lose, my capital is not significantly affected as I will still have $39.6 to continue trading. In this way, even if a trader were to open multiple positions like up to 10, he will only lose $4 and still have his capital intact.

If he were to use like 5% of the capital and happens to lose up to 10 trades, it means that such a trader would have lost $20 which will seriously reduce his trading equity.

Risk-Reward Ratio

Because of the uncertainties in trading crytopcurrencies, no trader, irrespective of experience can boast of not losing a trade. A times, it even looks like there are equal chances of winning and losing trades.

The risk-reward ration is a method of determining amount of losses to the amount of gain that a particular trade can produce. It involves gauging how promising and how detrimental a trade can be. To what extent losses or gains can occur and then deciding on the positions to place stop loss and take profit.

Since the goal is to make profit, a trader would have to ensure that the value of the take profit is higher than that of the stop loss. This simply means that the ration of risk as identified by the stop loss should be less than the ratio of reward which is represented by the take profit.

As such, when considering a trading setup, the outcome should be such that the take profit covers double (2x) or triple (3×) the stop loss.

That is, for instance a trade where the risk is $5, then the take profit should aim at $10 or $15.

This would make a risk to reward ratio of 1:2 and 1:3 respectively. A trade that attracts equal ratio of risk to reward is not advisable. A trade that the risk is more than the reward should not even be attempted as this is disaster waiting to happen. It is usually said that the capital in your account is more important than that in the market.

Demonstration of risk to reward ratio for a 1:2 trade.

In this chart, the analysis has the price placed at twice the distance of the stop loss from the point of entry.

The stop loss is 8.94% while the take profit is 17.85% approximately 2 times the stop loss. This is also shown by the amount value of 750 for stop loss and 1499 for take profit.

Stop Loss and Take Profit

Fear and greed are two strong emotions that characterize the cryptocurrency market. Fear is demonstrated when people hurry to close positions and leave the market if things seem not to be turning out as predicted. Greed is shown by a trader refusing to close positions even after making enough profit but is still holding out for more which constitutes part of over trading.

The tendencies to get caught up in desperation or in greed can be checked by using stop loss and take profit techniques. With this tool, a trader can automatically close positions when the market becomes unfavourable in the case of a stop loss and also when the market has been profitable in the case of take profit.

Since there is a possibility of a trade not going as planned, setting the stop loss exit order ensures that little losses are incurred by the trader. In such instances when the price is moving in the negative direction and hits the stop loss price, the trade is closed.

And so that a trader does not get overexcited about the good outcome of a trade and decides to remain in the market which may subsequently reverse and cancels out all the profit already made, a take profit is set such that when the price moving in a positive direction reaches that point, the trade is closed, securing the traders profit and capital.

In a buy trade, the take profit order is placed much higher than the entry price and stop loss is placed below the entry price. In a sell trade, the stop loss order is placed much higher than the entry price and take profit is placed below the entry price.

Setting stop loss and take profit is not just done randomly. There are some technical analysis tools that are very effective in indicating points for placing these exit orders.

For instance, if the entry price for at asset is at $43. In a sell trade, the stop loss will be at a price higher than this let's say, $49. The take profit will be set at some point below the entry point such as $61 if a 1:2 risk to reward ratio is used.

Thus, if price should move in either of these directions and reaches these limits, the positions will be closed.

Demonstration of Stop Loss and Take Profit

In this chart, the take profit and the stop loss levels have been marked out as shown. As stated above, this tool helps in exiting the market automatically either at profit or at a loss depending on whether the market is favourable or not.

In this case, if the price of Reef Finance climbs to the take profit level at 0.03295 in the upward direction, the market will close with a profit being that it was a buy trade. When this happens, further movement in the market whether positive or negative does not concern the trader anymore.

If the price should drop to 0.02546 which is the stop loss, the trade will be terminated and will close with a loss since it was a buy trade and movement in the downward direction implies losses.

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). a) Trend Reversal using Market Structure. b) Trend Continuation using Market Structure.

The following are expected from the trade.

- Explain the trade criteria.

- Explain how much you are risking on the $100 account using the 1% rule.

- Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

- Place your stop loss and take profit position using the exit criteria for market structure. (Show demo account balance and proof of trade execution)

Trend reversal using market market structure

The beautiful thing about futures trading in the crytopcurrency market is that in whatever direction the market is moving at, a trader can step in a make profit. Unlike in spot trading where only price hike brings gains. So, in this task I will be using trend reversal on the pair of MANA/USDT marker chart in a one hour time frame.

Analysing for Entry Criteria

Since the tasks is based on market structure, I will using it as my basis. From the point indicated, the market was in a bullish orientation.

The price is creating higher lows and higher highs. After a while, it ceases and fails to make a new higher high.

At this point, there is a double top formed. The price begins to go down and breaks below the previous higher low. This is a clear trend reversal taking place as the intitial structure had been invalidated. The price then retraced very briefly and retested the broken low point. This then served as a resistance level.

After this retest, I decided to open a short position. I missed the first point I should have entered the trade which was at the beginning of the second bearish candlestick after the retest. But I still opened a position since I observed the trend to be quite strong.

Analysing for Exit criteria

After having established the conditions for the trade above, to get the criteria to exit the trade I still used the already exiting conditions. From the chart, I placed the stop loss above the resistance level which initiated at the point of breakout of the market structure. For the take profit, I placed it at the next support level. All these are shown in the chart.

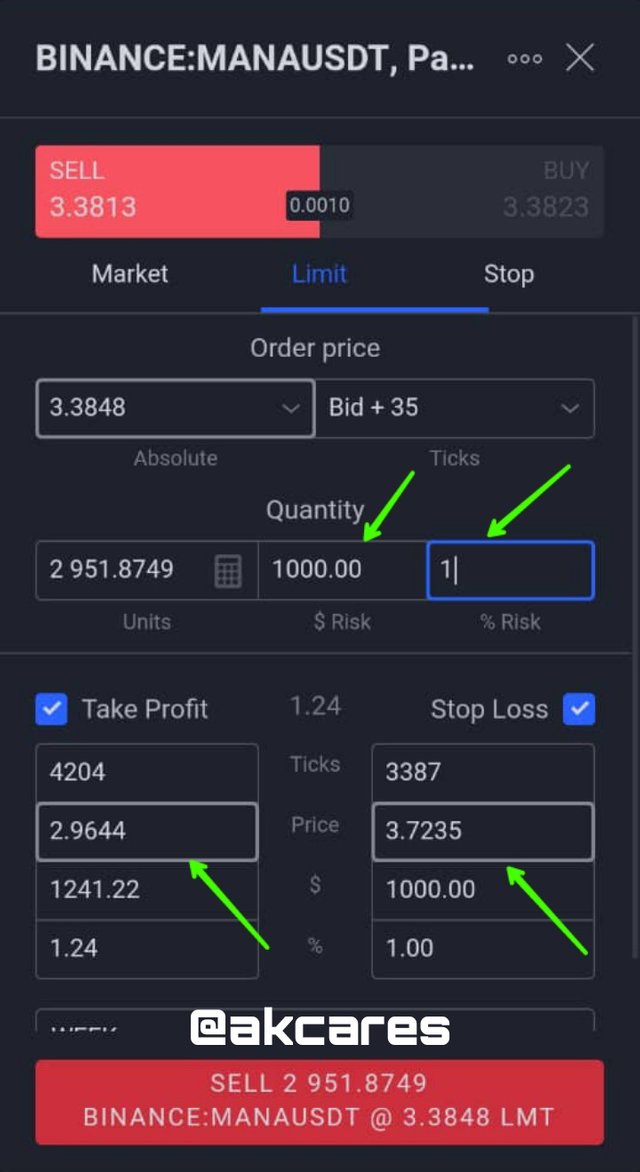

Demo Trade

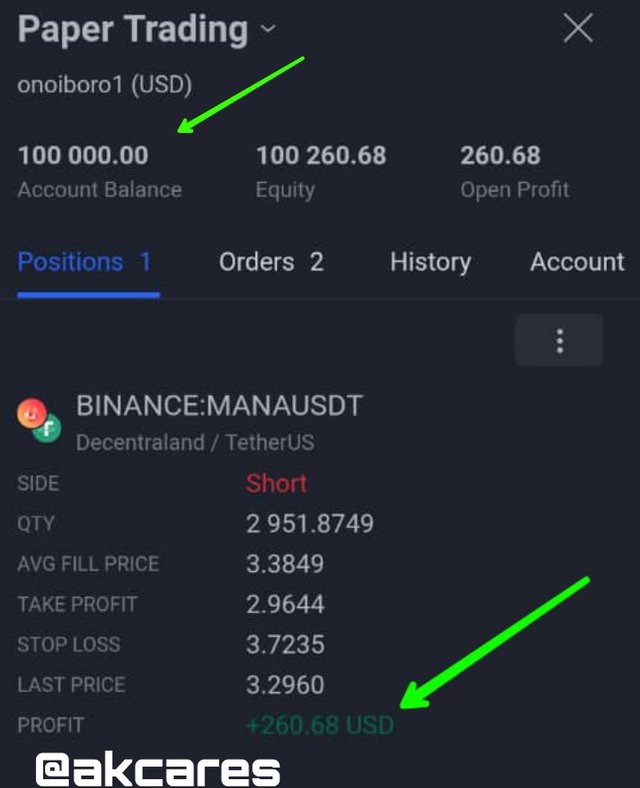

Having completed my analysis of the market and identifying all the entry and exit criteria, I decided to open a short position based on these. I opened a paper trading account on Trading View worth $100,000 (In hope that in reality this will come to pass)

I was able to enter at MANA price or $3.3848. I placed my stop loss at $3.3848 and take profit at $2.9644

Considering the lesson by Prof. @reminiscence01, I decided to implement most part of the lesson in this trade. I employed the 1% rule of capital risk this amounted to $1000.

That is (1÷100) ×100,000.

= 0.01 × $100,000 = $1000

I typed in the percentage of risk, my stop loss and take profit in the provided boxes and it automatically generated the value of the risk to be $1000 as already explained.

I executed the trade. The progress of the trade is shown here and it was positive. All the details of the trade are shown here as well.

Trend Continuation using Market Structure

When there is an established trend and there is an established market structure which is being obeyed, then a trader can make use of this valid market to take a trade in the present direction of the market.

This means that if the market is able to consistently make lower highs and lower lows for a downtrend trend then a trader should be looking to open a long position as it is often adviced, follow the trend, the trend is your friend.

The market price chart of XRP/USDT is what I used for this question.

Analysing for Entry Criteria

A bearish market structure is one of the condition to take a sell trade. This means that the price must be printing lower high points and lower low points. The previous low must be higher than the succeeding low as well as the previous high being higher than the next high for this structure to hold true. This criteria was present in this chart.

To enter the trade, I first observed that they price had broken the previous low and went down to form a new lower low. I waited for the price to retrace after forming this next low point to make a high point. This new high was lower than the previous high. After this new lower high, the price began to go down again. This was my signal to open a trade.

Analysing for Exit Criteria

To exit this trade, the stop loss was placed just above the latest high point.

Take profit was targeted at the next support level below the entry point as shown in the chart.

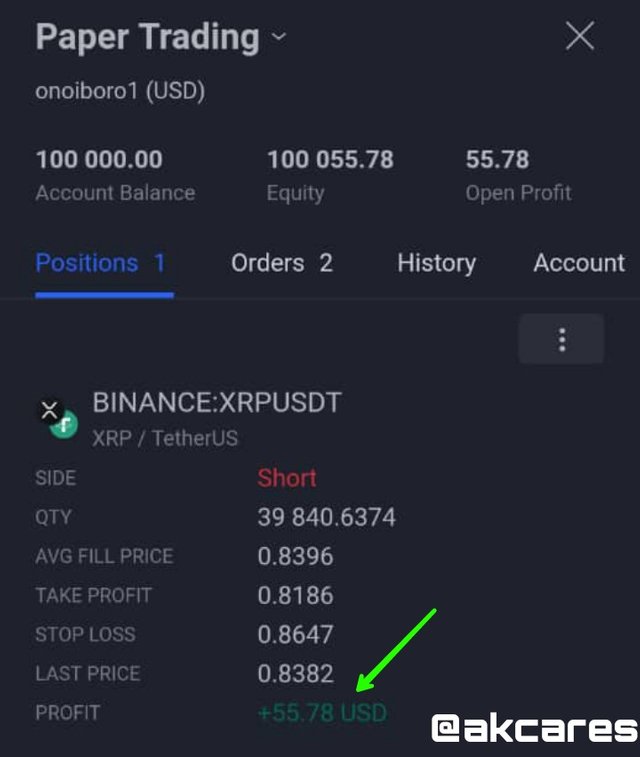

Demo Trade

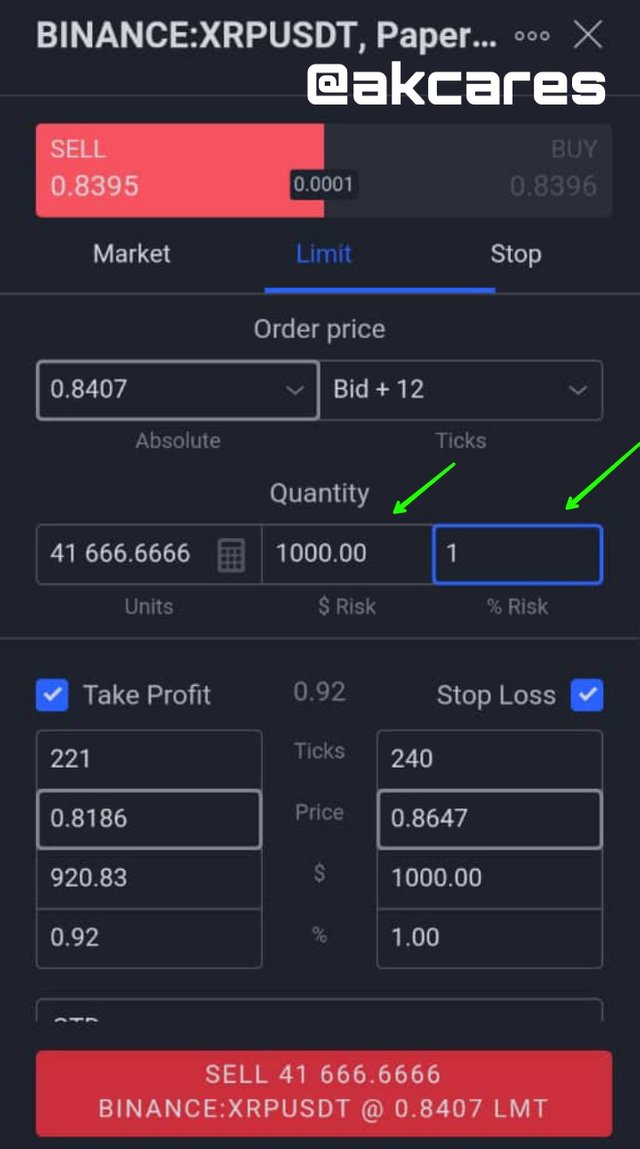

I still made use of my paper trading account on Trading View still worth $100,000.

I opened the trade at at MANA price of $0.8395. I set the stop loss at $0.8647 and take profit at $0.8186.

I took a risk of 1% of my capital which amounted to $1000. This is shown when I typed in my risk ratio in the provided spaces.

That is (1÷100) ×100,000.

= 0.01 × $100,000 = $1000

I went ahead to execute the trade.

My trade seem to be doing quite well as at the time I checked.

All screenshots were taken from Trading View

It will be folly to assume that the market will always favour us all the time. Obviously, everybody wants to win but the reality is that this is not always the case. We will also have to lose. But the trick here is to ensure that our losses are much less than our wins.

This is why we need to effect viable risk management strategies and also meticulously follow established criteria for whatever strategy we want to use. These strategies will help us in safeguarding our trading capital as well as increasing our profitability.

There is need for discipline and cautious while exploiting the crytopcurrency market because any slight carelessness can be very critical. Though there are no assurances, we can help ourselves do better by being diligent and following precautions. Great lesson by Prof. @reminiscence01.

Hello @akcares, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

That's correct.

Recommendation / Feedback:

Thank you for submitting your homework task.