Weekly Update: Gold, Silver, Bitcoin – 03.17.2017

Greetings fellow amateurs,

Another eventful week saw continued salvos of propaganda and accusations. The ghost of the debt ceiling flitted by with nary a peep, leaving observers rather uncertain about where the process will go from here. The manufactured outrage against Attorney General Sessions died away. Rachel Maddow committed a blunder with President Trump’s tax returns that will go down in obsolete media history. The Federal Reserve raised rates as expected, even if the reaction didn’t necessarily match what forecasters were looking for – more on that later. The pro-EU establishment held the line in the Netherlands. For now it looks like Article 50 will have to wait until the end of the month before the Brexit process will pick up steam. John McCain appears ready to continue his all-in push against everything President Trump has to offer. Cowardly Republicans proposed a non-solution to the healthcare debacle. Finally, the Ides of March did not bring about the end of life as we know it.

Never mind that life as we know it is continuously going extinct and rebirthing itself at an escalating pace these days. When the status quo is eccentric change and a total lack of predictability, it only makes sense that stock prices would continue to grind higher with nary a sell button in sight.

I had an appearance on The Hagmann & Hagmann Report, my third in the past six months and a distinct honor:

This Sunday I will be a guest in hour three of The Common Sense Show as Doug and Joe Hagmann pinch hit for Dave Hodges during his well-deserved break. Incredible things are happening every week it seems, but let’s get to the GSB action, shall we?

Gold

The big move this week came on the back of the Federal Reserve rate hike and subsequent press conference from Janet Yellen that was apparently taken as a ‘dovish hike’ signal. Frankly I don’t care about the exact semantics or the stated reasoning that expectations about the pace of rate hikes wasn’t met. Some clever questions about why the Fed is raising rates when the GDP forecast and the rest of the ‘hard data’ is so weak were deflected by the standard economics PhD boilerplate nonsense. More relevant is the line in the sand that we have now at $1,200. The chart – to the extent that it has any meaning whatsoever – looks rather weak below that. Continue to buy the dips. I didn’t grab any more on this latest one, as I’ll be waiting either for a better price on capitulation selling or evidence that we’re ready to go right away.

Silver

Silver was able to recover some ground alongside gold, but it still has a bit further to climb to recoup the latest unexplained – aka more sellers than buyers, aka the central banks needed it to go down – downmove in advance of the Fed meeting. The same pattern applies in that below the recent lows around $16.80 we could see a hit back down below $16.00. Should we get back above $18.00 this coming week we’ll need to watch the price action a bit closer to see how everything shapes out. Also somewhat noteworthy is the low volume over the past month. Because of high frequency trading and algorithms, volume is a much less useful metric than it once was. However, it still has something to say despite being much less determinative. The pattern of lower volume recently is rather interesting, and I’d welcome any theories from some fellow amateurs! Silver is, as always, a permanent buy at these levels or lower or higher. Buy silver.

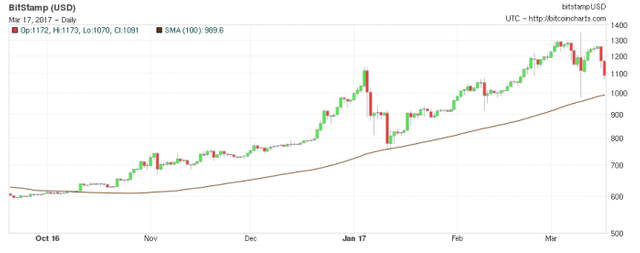

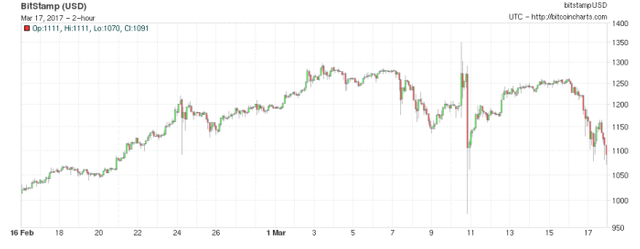

Bitcoin

I’m zooming in a bit here on the bitcoin charts so that we can see the action more clearly from last week’s ETF denial through the speedy recovery to the latest smackdown on news out of China. Reading a bit more on Zero Hedge, we find that China had the audacity to propose imposing elements an actual financial regulatory structure onto the cryptocurrency. The nerve of these guys! Remember the last three times China came out with some statement about bitcoin that had to do with eliminating fraud and other issues with exchanges? Those didn’t stop the uptrend, and I don’t think this will either. It’s more evidence of the mainstreaming of bitcoin that points to its ultimate utility to bring the unbanked online via the New Silk Road. Ethereum, another cryptocurrency, has been taking a moonshot recently, but we’ll keep our analysis centered on bitcoin for the moment. It looks like $1,000 is the buy spot if you can get it. We’ll see how the price reacts over the weekend. If it gets below there then we may want to wait and see how the price responds, but if the past is any guide – less reliable than usual – this dip will also be bought.

Conclusion

Try not to drive yourself insane by following the ins and outs of each news cycle. Your investment strategies don’t matter if you give yourself a heart attack. Take it seriously, but take some time to refresh yourself. You’re going to need every ounce of strength you have for what’s coming.

Disclaimer: These are one amateur’s fallible opinions. Holding any asset is risky, so do your own research and make your own investment decisions.

Thanks for sharing again. Have a nice Weekend ! What is your opinion about steem?

Thanks! I'm honestly not much of an adept with the technologies that are at play here, but I'm a fan of the steemit platform and the general concept of how steem operates. Seems like there's a decent chance for it to expand a niche in the next technological ecosystem, but even if it doesn't live up to the highest imagination of what it could be, I'm still grateful for the extra reach - albeit modest - that the platform has provided me. A rather lengthy non-answer I'm afraid, but I can only give you what I have. I try my best to be authentic since it's much easier that way; you don't have to keep track of all the bravado and manufactured explanations.

Cheers!

Thanks for your answer. Unfortunately I am a money idiot incl. crypto. However I like the whole concept of this platform and have met already a lot of great people... still try to learn. I like reading your post- well written and the tone is quite relaxed.

Thanks, I appreciate the kind feedback!

Nice report:-)

Thanks!