Weekly Update: Gold, Silver, Bitcoin – 03.24.2017

Greetings fellow amateurs,

Another astounding week is in the books! The drama of the Obamacare replacement failure was simply the initial phase of several stories that are set to unfold as April swiftly approaches. Stay tuned for a follow up article from Ross Powell on that subject. In other systemically threatening and historically significant news, something is definitely rotten in Denmark as it pertains to the whole Obama vs. Trump spying narrative. Will we see a smoking gun soon? At this point all options are on the table, and even though it may be stretching probability to expect an overt denouement, the dynamics behind the scenes are clearly being felt.

In a time when narratives turn on a dime one thing remains clear: President Trump’s enemies are so bloodthirsty that they are endlessly blowing their own cover. If the establishment Republican cronies get the blame, then perhaps the charade of the current two-party nomenclature will finally be obliterated past the critical point of repairing the deception. Something doesn’t quite feel right, but these days such intuitions happen on a regular basis. Either our President is totally clueless or he has some bombshells ready to be strategically interposed at the right moment. CNN screeches the former, so I’m inclined to believe the latter.

Please continue to remember that our alternative was most likely a controlled demolition of America – perhaps figurative but likely literal as well – so that out of the chaos the final iteration of the tyrannical globalist utopia could rise. Nonetheless, this has certainly been a tough wait. Speaking of the difficulty of waiting:

Gold

This has all the feeling of another holding pattern. As much as it’s tempting to want to call up China and just have them get the show on the road, we must be careful what we wish for. The manipulation game is still being played, and as a result, despite all of the intense theoretical uncertainty, we got three ugly but constructive range days to end the week. This is a frustrating pause even if it appears necessary. Taking out $1,260 with momentum would put the $1,300 target in play. Looking at the economic data, we see that the real economy is crumbling around us while the Federal Reserve raises rates. Fortunately I’ve managed to train myself to not have a heart attack when the fundamentals don’t line up with asset prices. Sometimes the hardest thing to do is sit tight. I’m going to scream if they plunge gold below the $1,200 mark, but with the miners not participating in this latest price recovery that’s always a possibility. This is my effort to dispassionately articulate the titanic emotions that pull us every which way through this garbage regime of fraud and fake prices. In the end it won’t matter. You know what? Forget it. Take it down to $1,000. How about $500 while we’re at it. I’d love to get my hands on some for $20. Give it your best shot you degenerates. We are the strong hands. The truth will prevail. Your evil will be exposed. We will win.

Silver

Now that I got that rant behind me, let’s take a look at my personal favorite and the largest weight in my GSB portfolio: silver. It dropped more than gold in this latest pullback, but it caught back up a bit more to end the week while gold was being contained in order to take the last vestiges of the all is well mindset through the weekend. We can’t have stocks down and gold up too much after all. I’d talk more about the relative positioning of the technicals, but I’ll spare you the fake paper price jawboning. Keep stacking. The $18.50 break is key, but I wouldn’t blame you if you hibernated until you saw a price above $20.00 again before paying attention. Selling is for the weak until we get 10-1 silver to gold, but it’d be better to wait for parity. It seems outrageous, but I view that scenario as having more than an outside chance. It looks more probable than a nuclear holocaust, but we’ll likely have to live through other horrors before the true unwinding and reset takes place. On the other hand, it could all come apart at the seams tomorrow for dozens of different reasons both expected and unexpected. I hope not. We’re not ready for that if we’re honest with ourselves. Even if we might be, our families certainly aren’t. Each day is a blessing even while we have to muddle through this frustrating phase.

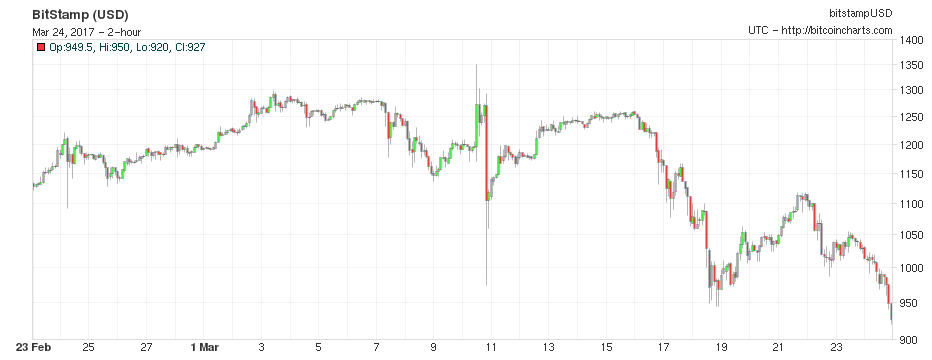

Bitcoin

The trend in bitcoin has been incredibly regular, so to see the latest bounce from the 100 day moving average area fail certainly catches my eye as a change in pattern. Most of the chatter surrounding the latest round of steady pummeling that looks rather like a violent breakdown on the daily chart (lower lows and lower highs) concerns the potential for a hard fork in the bitcoin architecture. We certainly have seen what looks like some significant selling in bitcoin and buying of altcoins such as Ethereum, Monero, Dash, and others. For more commentary on this dynamic you’ll have to go right to the insiders as this column doesn’t have the space to cover all of the details. For those interested in exploring further, you’ll get more utility out of the following videos:

In general, you’ll want to hang tight to see how bitcoin behaves in this new trading pattern. I’m waiting for some more information before picking another buy spot, but it would be difficult to avoid jumping in on an unwarranted massive waterfall. Let’s see how it plays out, but the upside break is now clearly at the $1,300 line. This is a feisty one for sure. Get educated and don’t be dismayed: even if this is the first you’re hearing about cryptocurrencies you can still be among the early adopters.

Conclusion

Waiting for a breakthrough is painful sometimes. If it shakes you up, then take a breather from monitoring the price. The thesis is still intact because the monetary system has been living on borrowed time for a decade. Stand your ground and continue to accumulate assets with real value and utility.

Disclaimer: These are one amateur’s fallible opinions. Holding any asset is risky, so do your own research and make your own investment decisions.

Cheers. Thanks for the info.

You're quite welcome! I publish my weekly updates every Friday so stay tuned for more as the fireworks unfold.

I liked your article....

Its been two years since I started accumulating the best gold, silver and uranium miners. 2016 provided a solid portfolio boost of $180K with much of this given back during the second half of the year's resource correction.

The first 6 weeks of 2017 rocketed my portfolio $115K. Much of this came from two monster positions: NAK and IVPAF. NAK crashed when a hedge fund wrote a mostly fake report claiming the worlds largest copper/gold resource was worth zero. Resource stocks are leveraged to the price of the underlying commodity. When gold is back up to $1400 by year end, I expect good things for my positions and NAK to recover. Ivanho on the other hand just keeps getting better. I have them @ 0.59/share and they are sitting at $3.45. The NPV puts it share price of $6. With the new drilling results that will extend the high grade copper ro over 10 miles, I expect when the updated economic assessment comes in it will double its NPV.

There are too many risks in the world for gold/silver to not continue to rise. It will only take one more European Union member's vote to leave and the EU and the Euro currency will be over. Greece is bankrupt. Italy's banking system is hopelessly sick.

Will the petrodollar last into 2018?

I have started building my portfolio of cryptocurrencies and coin app positions. Like gold/silver, they are an asymmetric bet. You want a little bit of the best ones and then you can move on to a new hobby.

Have some patience and faith that your prudent decisions to be in gold/silver/bitcoin will indeed have a payoff. It only takes a few positions to have monster returns that make a big impact. My IVPAF for instance is up $50K. I have another small position that was up 900% last fall.

Here's to an awesome 2017 and all the portfolio upside I think we will see.