[Trading Cryptocurrencies] - Crypto Academy / S4W6- Homework Post for @reminiscence01"

Am gladdened once again for yet another opportunity of this wonderful edition by the cryptoacademy. From the lecture offered by Professor @reminiscence01, reading through this lecture series have given me a better insight on trading cryptocurrencies. To this, I will be writing based on the task given by the Professor.

1. Explain the following stating its advantages and disadvantages:

Spot trading

Spot trading is a type of cryptocurrency trading that involves an investor or trader buying up an asset and holding it to make profit when the price of the asset rises. It involves a trader being able to spot a good position to buy up and hold an asset for some period of time and sell it out to make profit when the price of the asset bought rises or is in bullish.

Advantages of Spot trading

It allows traders to buy up asset with a minimum capital thus making profit when the price increases.

In this type of trading, the trader cannot run into loss because he/she will hold the asset till whenever it rises more than the capital he/she invested so as to make profit.

It allows traders to own digital assets for some period and it is easy for beginner trader to follow.

Disadvantages of Spot trading

It takes a longer period before a trader makes profit out of his/her investment.

It requires experience of traders on the right time to buy up asset so as not to risk his/her capital.

Margin trading

Margin trading is a type of cryptocurrency trading that involves an investor or trader taking advantage of the market by borrowing funds from exchangers to boost its purchasing power. This purchasing power must be more than the trader’s trading capital. The trader now uses the purchasing power via the leveraging to buy larger contracts with low purchasing power to make profit.

Advantages of Margin trading

It helps traders with less capital to be able to trade large asset and make huge profit.

It allows traders to be able to split positions with low funds via more purchasing power incurred through borrowing from exchangers.

Disadvantages of Margin trading

Traders can run liquidity of their account via leveraging.

It needs an experience high level of trading so as to make good trading decision.

Futures trading

Futures trading is a type of cryptocurrency trading that involves a trader or investor being able to forecast the future price of an asset based on the swings in the movement of price of an asset. In this type of trading, investors take advantage of the bearish and the bullish movement when investing.

They can buy an asset in a bearish trend anticipating a potential bullish trend of the asset to make profit and vice versa. It involves a practical knowhow on how the market trend of an asset is via the help of technical indicators and price actions of the asset. In this type of trading, investors are given the leverage (power) to be able to buy larger contracts with low capital to make profit as well as liquidity depending on the market movement of the asset.

Advantages of Futures trading

Larger contracts can be bought with small capital via leveraging.

Much profit can be made via leveraging in a short time.

Investment can be made on an asset either in a bullish or bearish market.

Disadvantages of Futures trading

It needs a professional understanding of price movement.

It involves risk which can lead to liquidation.

An in-depth studies of market trends is expected for a positive price forecast.

2. a) Explain the different types of orders in trading.

In trading, there are three types of orders namely: the market order, the pending order and the exit orders

Market Order

Market Order is a type of order that can be placed for a particular asset to be bought or sold in the current market price of the asset. It takes into consideration the current market price when executing a position.

Pending Orders

Pending order is a type of order that has to do with a trader placing a particular asset to be bought or sold at a particular price which is not the current market price, just as the name implies, the order remains pending until the market order reaches the fixed price of the asset before it is executed. Pending orders are of different types, namely: Limit orders, stop-limit order and the OCO order.

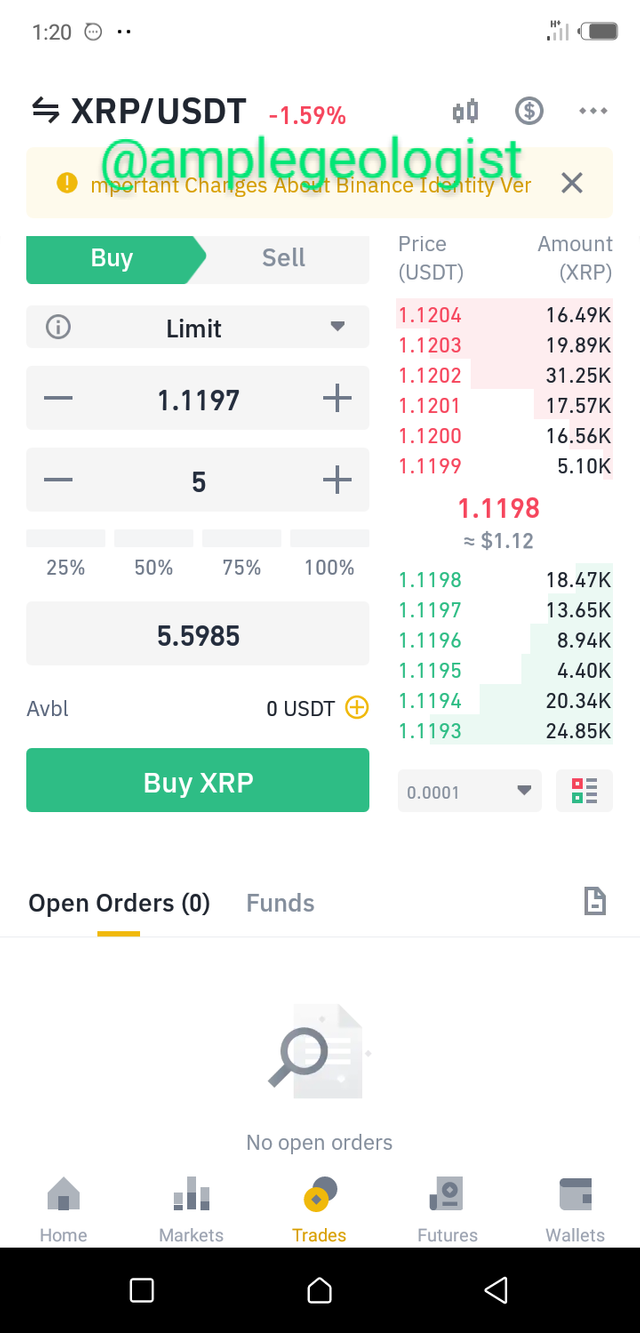

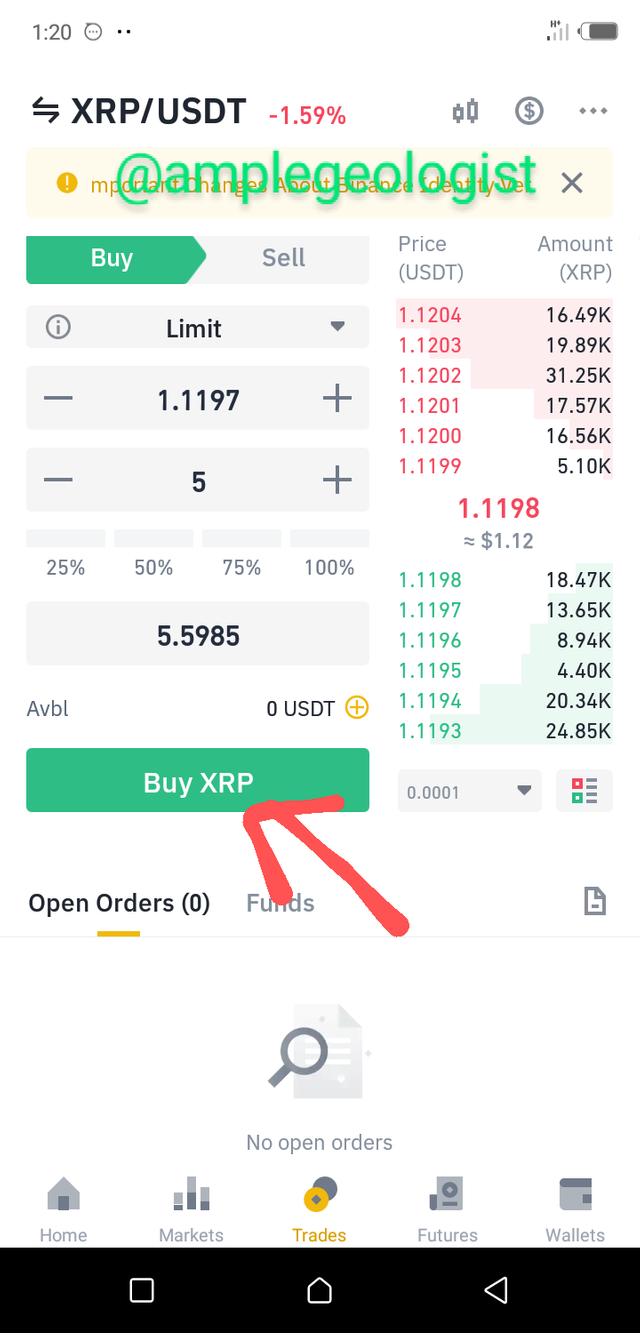

Limit Order: Limit Order is a type of pending order that can be placed by a trader for a particular asset to be bought or sold by an investor or trader at a particular price he/she is willing to sell or buy. He/she must not have to follow the current price value of the asset in the market he/she wants to buy but rather makes a buy and sell order at a price level he/she is willing to. It is when the market price of the asset hits the fixed price that the order will be executed. If it does not, the order will still remain pending.

Stop-limit Order: Stop-limit Order is a type of pending order that enables traders to place a limit order on a particular asset when the price of the assets gets to the stop price that was placed either a buy or sell, the order is accomplished thus the limit order is executed. But if the price of the asset does not hit the stop price, the limit order will still remain pending.

OCO order: OCO Order is a type of pending order also known as “One Cancel the Other” that is not placed at the current market price of the asset. It is an order that allows traders to make more than one openings of order at the same time. Immediately when the first order is accomplished, it cancels the order and places the new order to take profit.

Exit Orders

Stop loss orders: This is an exit order that is placed by a trader to exit a position when the market goes against the prediction of the trader so as not to make more loss on his/her trading capital.

Take profit orders: This is an exit order that is placed by trader to exit a position when the market goes in the direction and in line with the prediction of the trader so as to make more profit

b) How can a trader manage risk using an OCO order? (Technical example needed).

Risk management is on one of the strategies deployed by traders in averting huge losses during trading. It is a step taken by traders on the proper analysis on the trade they want to enter.

To manage risk, traders have to consider placing an OCO order on the trade so as to maximize and also take profit when the price goes in consonant to their prediction and also minimize loss when the price goes against their prediction.

For example, I want to enter a trade that is moving in the resistant level which actually signals a reverse in the trend of the asset to bearish trend. At that point, I can place my OCO order. Here, it can be placed as a sell limit order and as a stop-limit order. Assuming that the resistant level of an asset is $5.87 and since it is in a resistant level, it is signaling a potential reverse in the trend to bearish, the price may likely drop. Here I can place the OCO order with $4.56 as the stop-limit order and sell limit order at $5.87 to avert the risk of running at loss if my prediction is not met. If the asset gets to the $5.87, a sell order will be executed while the stop-limit order will be cancelled, but if the asset gets to the stop-limit order of $4.56, the stop-limit order will be executed while the sell order will be canceled. With this, you can see that have been able to manage the risk of running at loss using the OCO order.

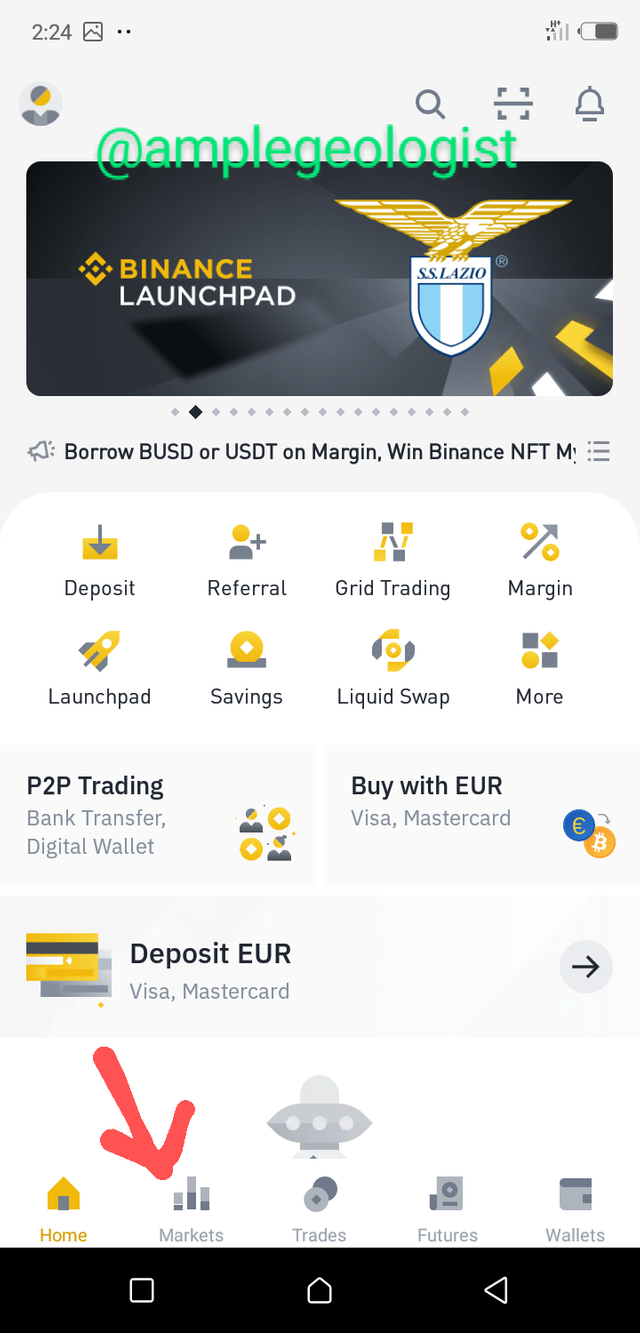

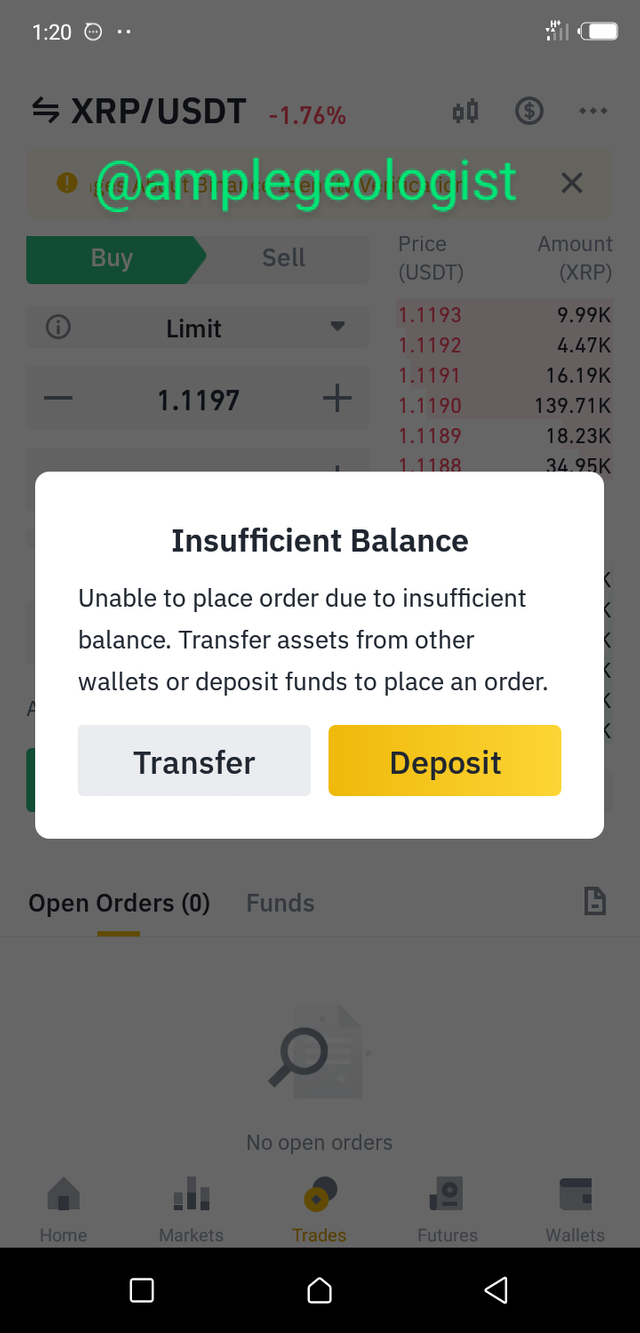

3. Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

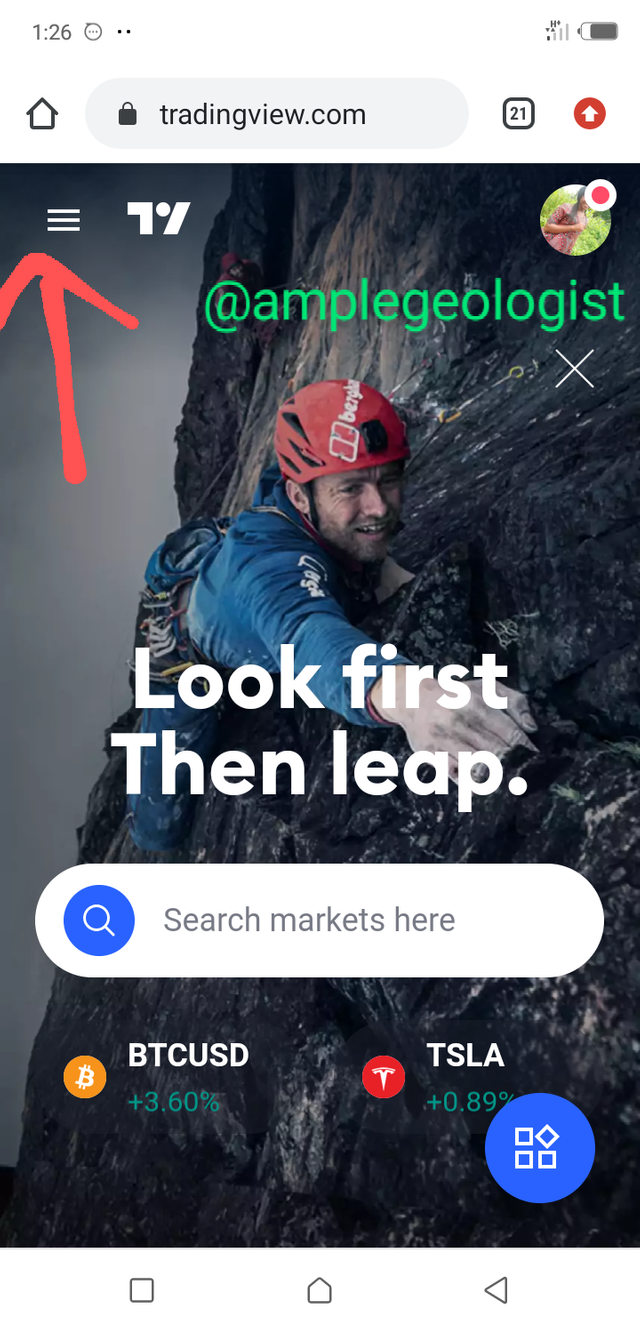

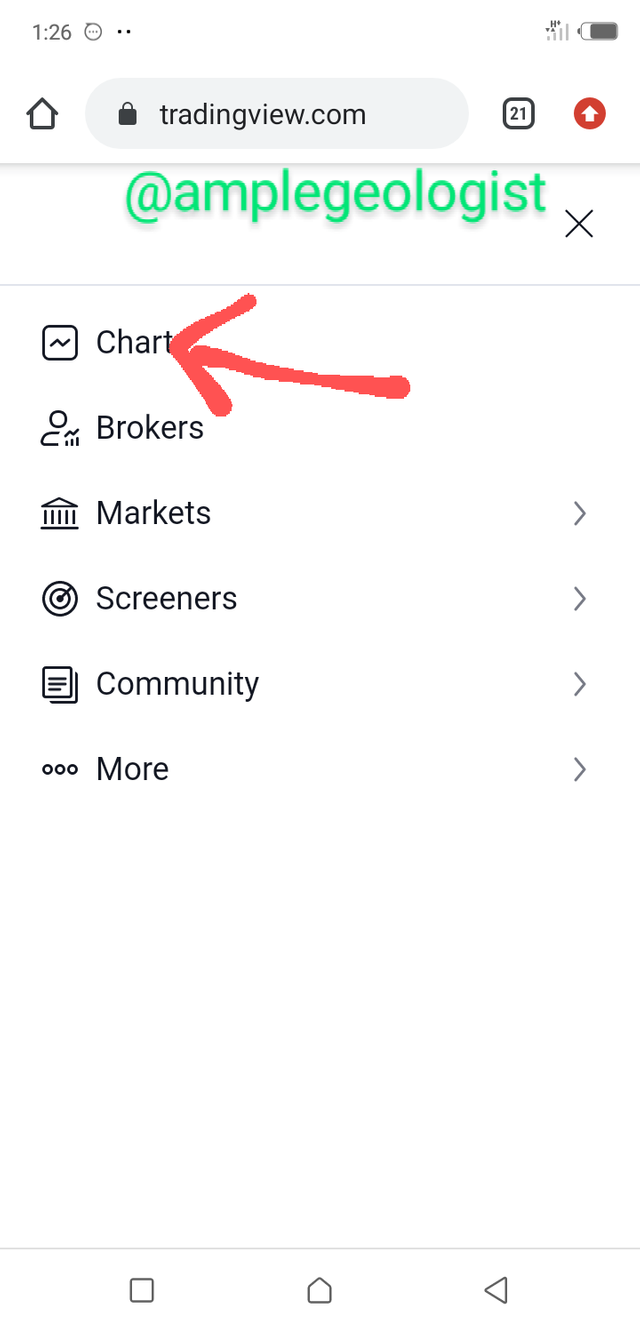

4. Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

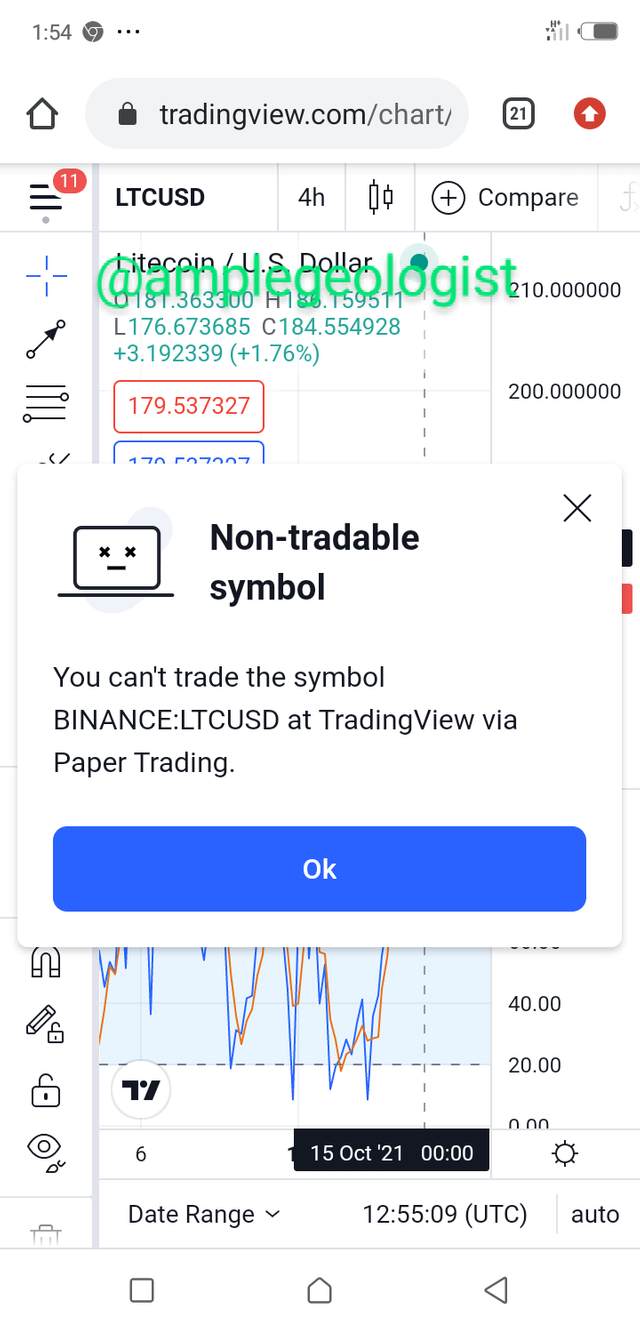

Litecoin (LTC) is one of the digital currencies with a high value ranked 15 in the crypto market. I choose this asset if I buy or trade on this asset either buying it in the bearish, I will make profit from it when it rises in the bullish market. Since the crypto asset has a high market capitalization, it has a good supply rate in the market and as such people invest in it thus making the LTC to have value in the crypto market.

ii)Why you chose the indicator and how it suits your trading style.

I choose to use this technical indicator because it is one of the indicators that is easy to handle so as to make a good decision in investment. It indicates an overbought when the price rises more than 80 level and thus an oversold region when the price goes below the 20 level mark. From the indicator, I discovered that when the price enters the overbought region, it signals a potential reverse in the bullish trend to a bearish trend thus a good time to make a good sell entry and make profit. I also discovered that when the price of the asset enters the oversold region, it indicates a reversal in the bearish trend to a bullish trend thus a good time to buy and accumulate asset to make profit later as the value of the asset rises. This is why I choose this indicator as it suits my trading style.

iii)Indicate the exit orders. (Screenshots required).

Hello @amplegeologist , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.