Two Rules Of Trading - Cryptocurrency Trading

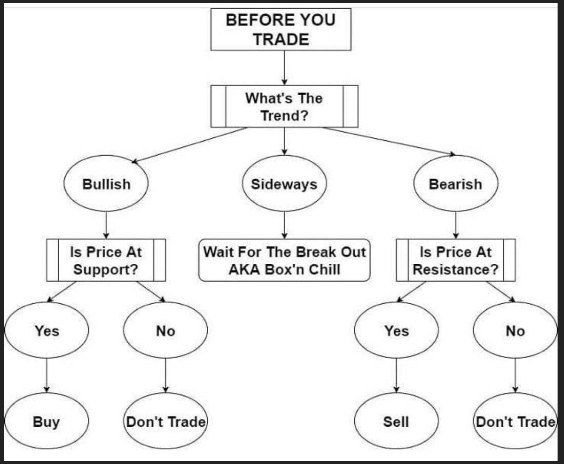

Come up with an algorithmic approach to your investment decisions. That process from start to finish must produce desired results 66% of the time. When you 'pull the trigger' you must have total confidence in this statistical outcome.

Never risk more than 5% of your 'stake' in any one single investment idea. There are many different ways to manage that risk, but it must never breach the 5% threshold.

..

These are rules that cannot be broken if you want to ensure consistent profits through trading.

We don't expect you all to have an exact plan which you know generates desired results 2/3 of the time.

The good news is the trades we share here are rooted from a plan which we know for a fact produces desired results more than 66% of the time. So long as you don't risk too much, you will win more than you lose, you'll make money, and you'll never have to worry about blowing your account up.

This also requires you actually follow the plan from start to finish. We enter at a set price and we sell at a set price. There's no amount of news or people on planet earth who can sway us in another direction. The plan must be followed.

Also keep in mind less than 5% of all traders work off these rules. Also less than 5% of traders are consistently profitable.

95% of traders have no idea what they're doing. Make no mistake about it, if you don't know what you're doing and you're not following a plan, you'll be apart of someone else's plan.

It's beyond easy to blow by this kind of information and think "yeah right." This is why so few are successful.

The information provided by @arjunsingh is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs.