Crypto Academy Week 4 Homework Post for @yohan2on - Introduction to Decentralized Finance (DeFi)

Hello Stemians!!

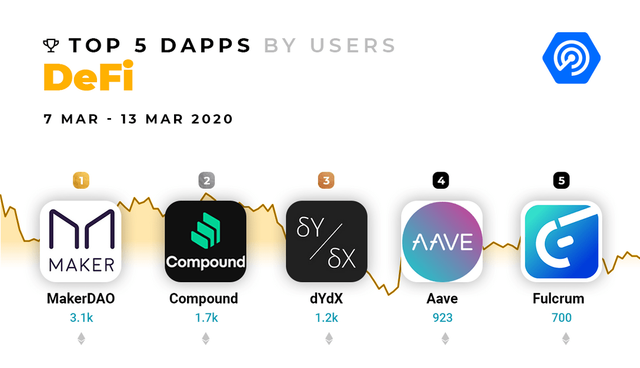

This time I want to make another article that answers the question made by one of the professors at Crypto Academy @yohan2on, as for the questions from the homework given is to briefly explain each of the following DeFi Dapps:

A. Maker

B. Compound

C. Synthetix

D. bZx

E. Uniswap

MAKER

The maker himself was originally created to be able to stabilize his brother, the DAI token, which was planned to be as stable as possible with US dollars. Both are Stable Coins.

Maker is a lending platform. What I mean is that in Maker, we can carry out borrowing and lending transactions between fellow users. And one of the features we can get from Maker is that it provides loans to its users and uses digital assets as collateral.

COMPOUND

For those of you who want to get features in borrowing and lending, Compound is the right choice. This platform is a place where users can borrow or lend cryptocurrency. It doesn't deal with third parties so don't be afraid of losing your resources.

Compound can be useful in terms of both buyer and seller transactions because it only communicates using a protocol. In other words, we're saying it has been handled by a smart contract. Compound can be used anywhere in the world with a crypto wallet and internet connection.

SYNTHETIX

In 2019 this protocol made history in the crypto world, there were more than 180 million US dollars locked in the protocol in the form of SNX tokens. This makes Synthetix one of the biggest projects at DeFi (Decentralized Finance).

Synthetix is a protocol that is responsible for guaranteeing synthetic assets which are financial instruments known as Synths. It does support synthetic commodities such as silver and gold, stocks, and many more. This helps give users the ability to acquire other assets without having to hold onto those assets.

bZx

bZx is a lending platform built on the Ethereum Blockchain that was discovered by Tom Bean and Kyle Listener in 2017. It is also a decentralized application like the others I described above.

The system of bZx is moving and borrowing like Compound (COMP). But at bZx we can trade based on Margin Trading, this makes traders who have been in the trading world for a long time tempted to bZx.

Source

UNISWAP

The Uniswap protocol is a protocol that operates in the crypto world which of course is decentralized and runs on the ethereum token base. A protocol launched in 2019 It uses an automated market maker to process transactions, enabling coin-to-coin transactions. They are automated in the sense that they do not work according to the order book system which is the traditional method of traders looking for reverse orders to provide liquidity to complete transactions.

CONCLUSION

For those of you who are still very new to DApps, I suggest that you research more deeply about these protocols, because DeFi is still very new to most traders in this world and there are still very wide opportunities to play on DeFi.

Thanks for coming to my blog.

See you on next post!

CC: @yohan2on

CC: @steemcurator01

CC: @steemcurator02

Hi @asmaulnurul

Thanks for attending the 4th-week Crypto course and for the effort in doing the homework task.

Feedback/suggestions/corrections

This is good work. Keep it up! Very well explained.

Homework task completed

9

Thank you professor @yohan2on, I appreciate it!!

This post have been shared on Twitter