Big Data in Insurance. Use Cases of Big Data Technology

When insurance providers tap into the vast repositories of Big Data that is available to them and combine this data with machine learning and AI capabilities, they can develop new policies that can reach new audiences. Beinsure Media has collected the opinions of experts and presents an overview of BigData in insurance.

Most insurance companies don’t use a lot of data to create their products. They rely on demographic information that is 40 years old, and older. They are struggling to price policies correctly and many will miss out on huge financial opportunities because of this.

Insurance companies work to protect us and help us in certain situations. They form a pool of money, taken from different clients which we also call policyholders.

These companies guarantee us to give a sum of money when we require.

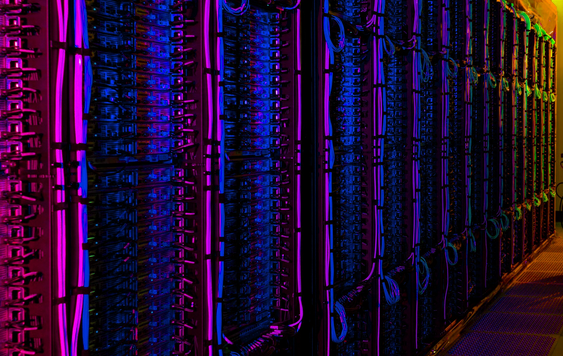

The insurance industry, like any other industry, has also shifted towards digital platforms. So, the exchange of data over the internet allows the insurance companies to utilize the technology of big data.

The implementation of big data results in 30% better access to insurance services, 40-70% cost savings, and 60% higher fraud detection rates that benefit both customers and stakeholders.

The adoption of Big Data Analitycs in the insurance industry is constantly increasing. Insurance companies to invest up to $4.6 bn by 2023.

We can say that big data has revolutionized the insurance industry for good. Its implications have allowed insurers to target customers more precisely.

The insurance industry, for a long time, has been known for leveraging traditional business models. The industry continued its legacy business and products for quite some time. But with the intervention of modern-day technologies, the industry witnessed some favorable outcomes.

Big Data Technology in Insurance

The industry has witnessed the exponential growth of the use of technology like any other sector. Advanced technologies and digital platforms have allowed insurance companies to try new means of tracking, measuring, and controlling risk.

A report from McKinsey Global Institute estimates that Big Data could generate an additional $3 trillion in value every year in just seven industries. Of this, $1.3 trillion would benefit the United States.

Insurance companies form their plan of action/business model on the basic idea of anticipating and diversifying risk. The fundamental insurance model involves consolidating risk from individuals payer and reallocating it across a larger portfolio.

Why is big data analytics important?

Organizations can use big data analytics systems and software to make data-driven decisions that can improve business-related outcomes. The benefits may include more effective marketing, new revenue opportunities, customer personalization and improved operational efficiency.

How insurers use Big Data technology?

The insurance industry, for a long time, has been known for leveraging traditional business models. The industry continued its legacy business and products for quite some time. But with the intervention of modern-day technologies, the industry witnessed some favorable outcomes.

For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling.

The industry has witnessed the exponential growth of the use of technology like any other sector. Advanced technologies and digital platforms have allowed insurance companies to try new means of tracking, measuring, and controlling risk.

How do Big data and data mining affect global business? With the help of big data, companies aim at offering improved customer services, which can help increase profit. Enhanced customer experience is the primary goal of most companies.

New approaches to encourage prudent behavior can be envisaged through Big Data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention.

The introduction of various technologies has evolved the insurance landscape. Tech solutions have enriched the industry. Some of the key technologies that are being used are the Internet of Things, artificial intelligence, Blockchain, Machine Learning, Big data analytics, and Insurance Management platforms.

Big data has the power to provide the information needed to reduce business costs. Specifically, companies are now using this technology to accurately find trends and predict future events within their respective industries. Knowing when something might happen improves forecasts and planning.

Introduction to Data Analytics in Insurance

The technological landscape changes, and so the industries do. In today a worldwide variety of insurance exists. Still, it is challenging for clients to understand through which insurance company they should start their insurance because many questions came into customers minds like:

- Whether this company is safe or not?

- Will this company give the best offer or not?

- What is the reputation of this company in the market? And more.

Similarly, insurers can also not understand customer behavior, frauds, policy risk, and claim surety, which is mandatory before giving policy to someone. It took years for insurers to sell directly to their customers and issue policies online while competing on price comparison websites. Many companies still have not achieved it.

The analytics performed by actuaries are critically important to an insurer’s continued profitability and stability.

Traditionally companies are just looking for what happened in the past with Descriptive analytics. But now, the industry is demanding more such that what will happen in the future (predictive analytics) and how actions can change the outcome (Prescriptive analytics).

As we saw with the Willis Towers Watson study, big data in the insurance industry is highly effective for predictive analytics.

Data collection can predict customer behaviors, such as whether they are about to cancel or take out insurance. It can also be used to set prices by analyzing competitors’ prices or what consumers would be willing to pay.

In addition, as we have seen in other posts in which we talked about the benefits of big data, big data can also be used to save costs in some departments or optimize processes to be more productive: data analysis and visualization improve accounts and make work more efficient.

Cloud computing improves the performance of Data analytics

Cloud computing improves the performance of analytics in real-time and in greater depth. It also speeds up machine learning processes. Thanks to this there is also greater personalization of products and services: premiums are tailored in real time to literally any customer.

This results in better customer experiences and more personalized marketing campaigns to attract new audiences or build loyalty among existing ones through policy renewals.

Because that is another major trend in the use of big data in the insurance industry: big data also serves to predict who is most likely to cancel their insurance and reach out to them to offer them a product of their interest.

What are the challenges of the Insurance Industry?

Customers find the best company, but there might be a possibility that the client is fraud or life impaired that will create a huge problem for the insurer. Consistently evolving business environments are increasing competition and risk. Several other challenges, like theft and fraud, are also plaguing the insurance business.

The above challenges force insurers to generate insights from data to enhance pricing mechanisms, understand customers, safeguard fraud, and analyze risks. Data analytics collate more precise information about several transactions, product performance, customer satisfaction, etc.

by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media

You've got a free upvote from witness fuli.

Peace & Love!