Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

QUESTION 1

Describe the differences between Staking and Yield Farming.

STAKING

People with a little knowledge about blockchain and cryptocurrencies are aware that blockchains are run based on a specific consensus mechanisms. Some of these consensus mechanisms are proof of work (PoW), proof of stake (PoS) etc. staking has to do with proof of stake. Investors locked up their assets in order to be given the chance to serve as nodes on a blockchain approving and validating transactions on the blockchain and getting rewarded at the end. So **Staking is the process by which investors lock up their funds in order to be nodes of a blockchain which gives them rewards or interest.

YIELD FARMING

In crypto exchanges we have a mechanism called LIQUIDITY which refers to the speed at which a crypto coin or token can be changed into another coin or cash. An exchange with a high liquidity will have a very fast transaction between coins. People provide liquidity to these exchanges by locking up their assets in a liquidity then the locked up funds yields interest, this is done in a process called YIELD FARMING.

DIFFERENCES BETWEEN STAKING AND YIELD FARMING

| STAKING | YIELD FARMING |

|---|---|

| It has a clear spelt out interest rate calculated in APY mostly ranges from (5% to 15%) | interest rate can jump as high as 100% |

| Staking helps blockchain running on a PoS algorithm to reach a consensus and validate blocks. | Yield farming helps exchanges to provide liquidity. |

| Stakers do not suffer impermanent loss of locked up assets. | Investors can suffer impermanent loss of locked up assets. |

| Depending on the blockchain there is a timeframe required for the satking and sometimes minimum amount are set. | there is no timeframe guiding yield farming. |

QUSTION 2

Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options) Show screenshots.

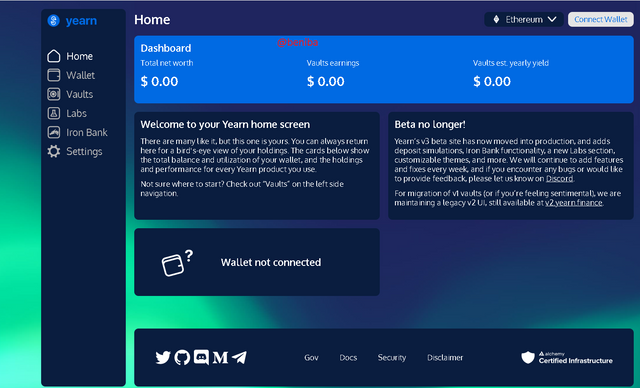

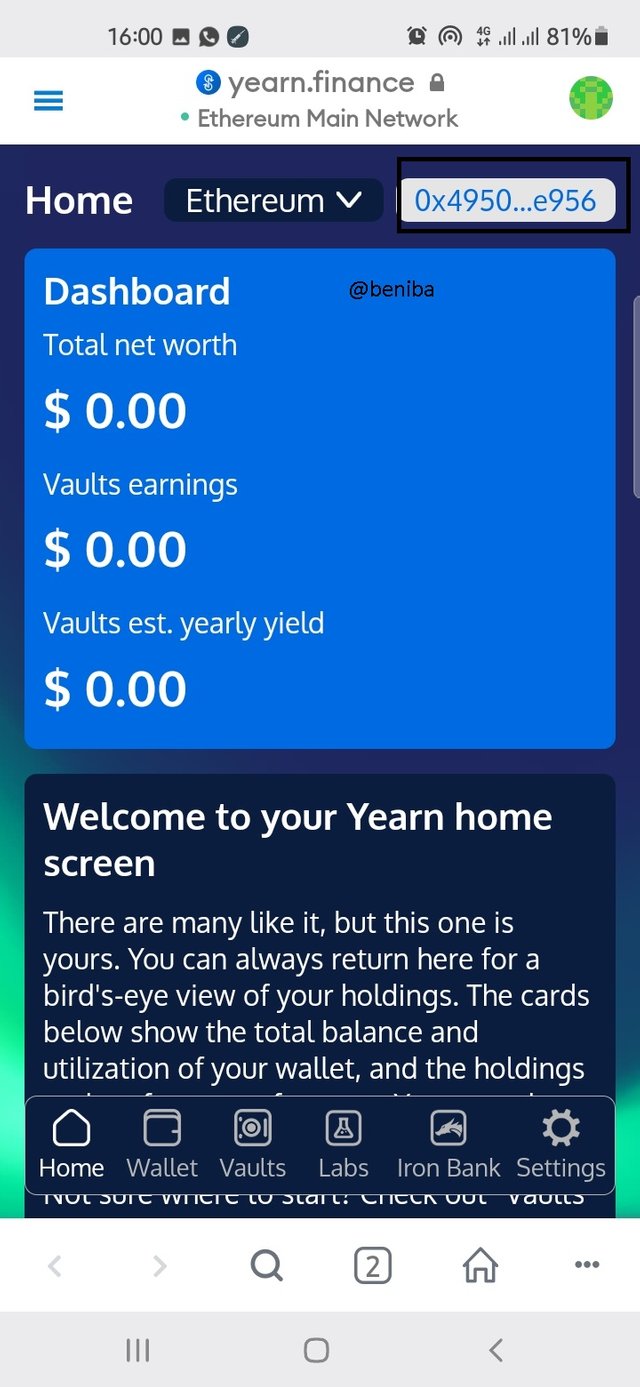

This is the page that welcomes you to the yearn finance platform. It summarizes your asset’s and displays them. In this feature a dashboard containing your total net worth, your vault earning and vaults est. yearly yield.

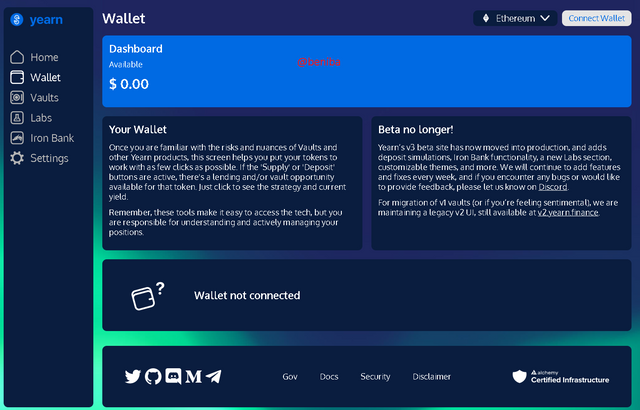

This feature on the yearn finance platform displays the worth of your assets that have not been locked up in yield farming. The amount is displayed in USD.

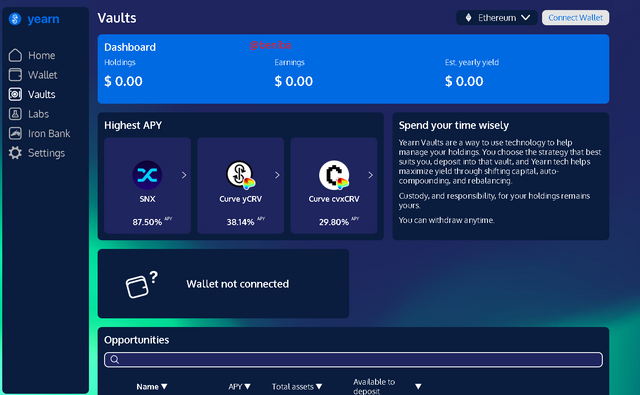

This is the feature on yearn finance that displays the amount of asset that you have used in investing into the yield farming. It also contains the interest or profit you have made from yield farming. This feature also contains a list of pools you can invest in. the opportunity list contains this list from the pools with the highest APY to the ones with the lowest APY.

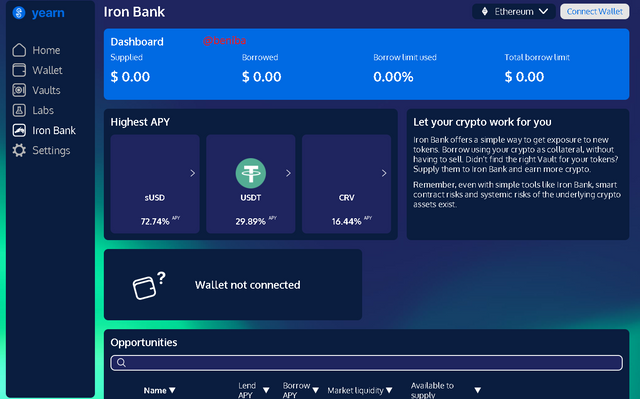

This is a feature on the platform that makes it possible for users to borrow on the platform using their crypto assets as collaterals. You can also supply your crypto out to be lended to people and you then earn interest from it.

WALLET CONNECTION

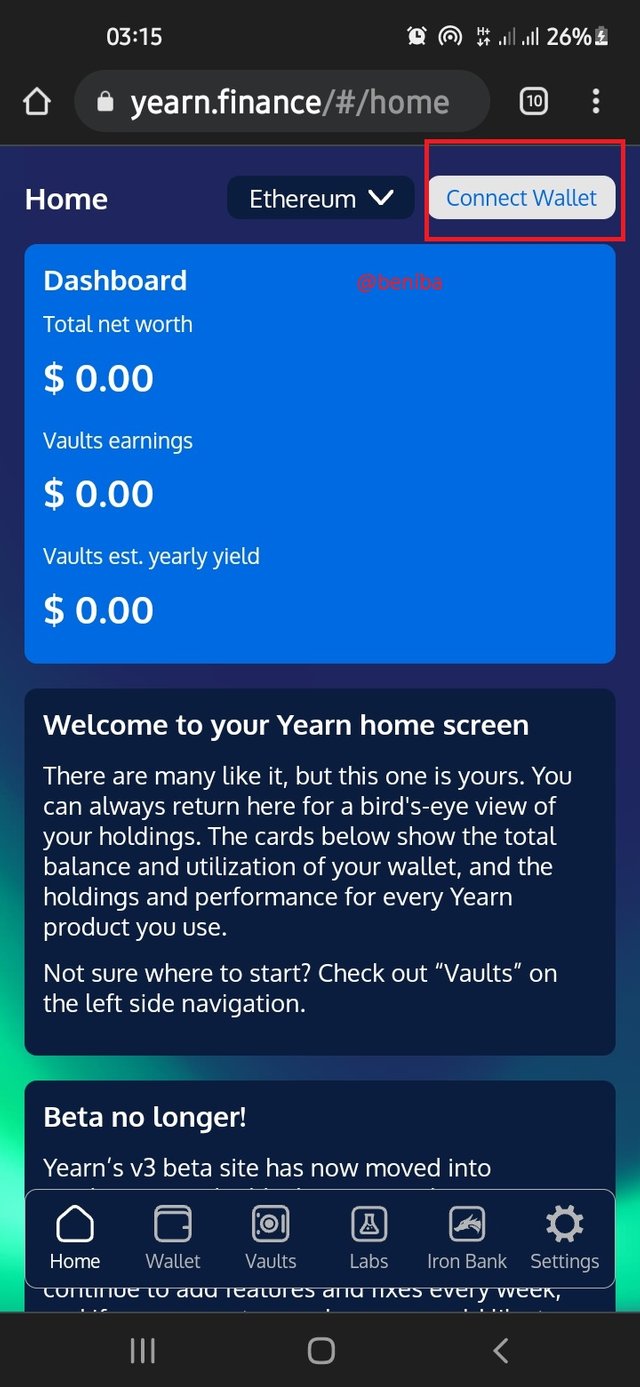

- from the top right corner click on connect wallet.

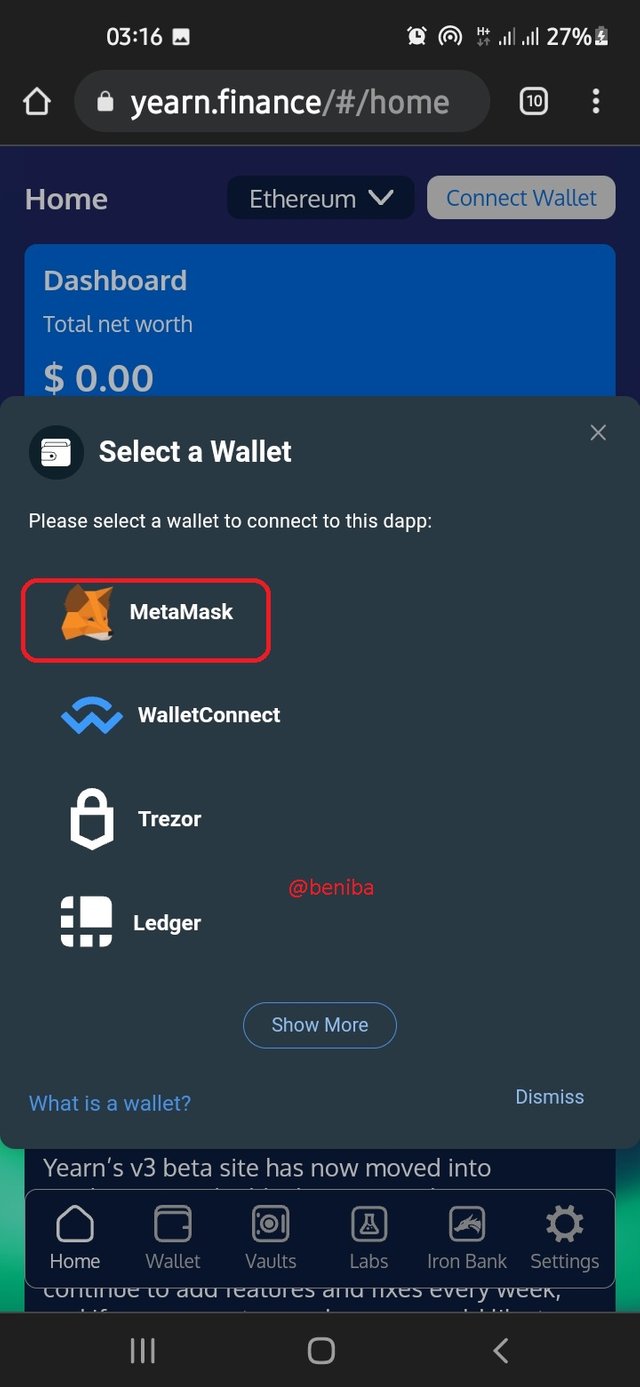

Choose the type of wallet you want to connect. i will choose MetaMask.

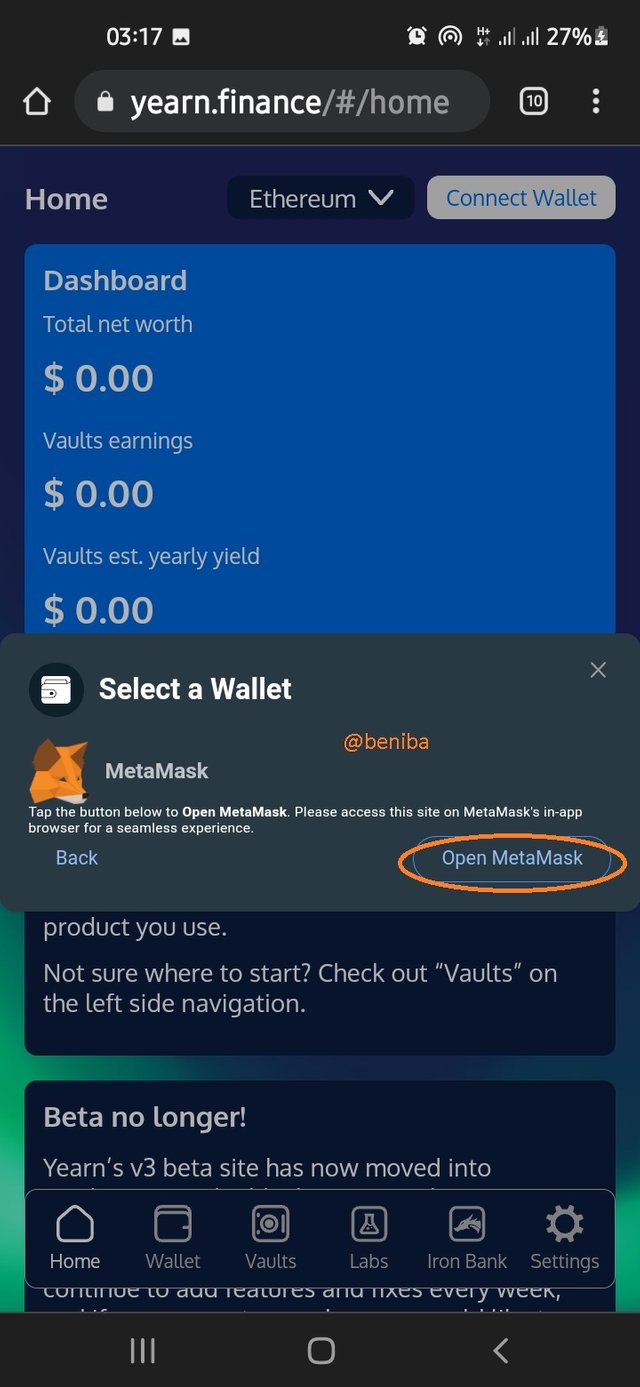

proceed by clicking on open MetaMask.

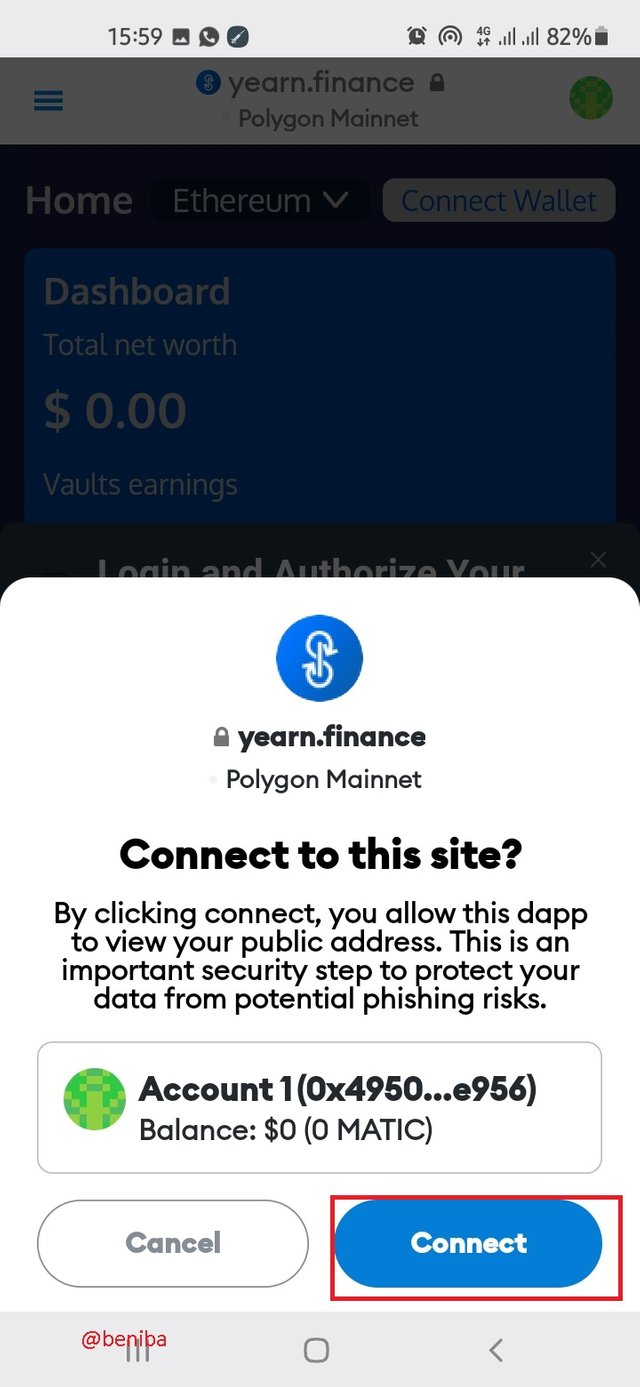

click on connect to connect.

your wallet has been connected successfully.

QUESTION 3

What is collateralization in Yield Farming? What is function?

Collateralization in our traditional banking system refers the act of giving or putting out a valuable asset in order to gain or receive a loan facility. In yield farming it is almost the same as the traditional banking mechanism. Collateralization in yield farming involves two parties which are the lender and the borrower. Collaterazation in yield farming refers to the situation where a borrower deposits an asset into account in order to receive a different asset without selling what he already has. The lender then receives some interest from the asset borrowed and when the borrower defaults in payment his collateral is used in liquidation and the interest goes to the lender’s account.

QUESTION 4

At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

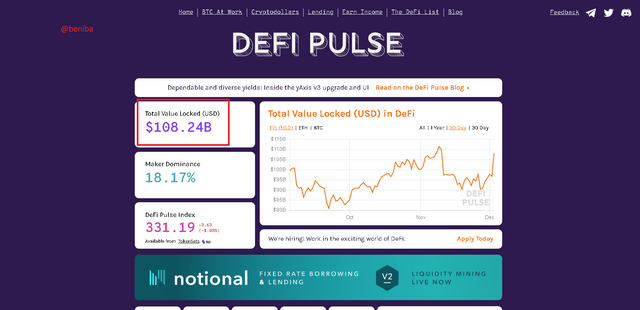

- in order to get access to the TVL of the DeFi ecosystem you will need to open the DeFi pulse using this link

As of the time I was writing this assignment the TVL of the DeFi ecosystem was 108.24B usd.

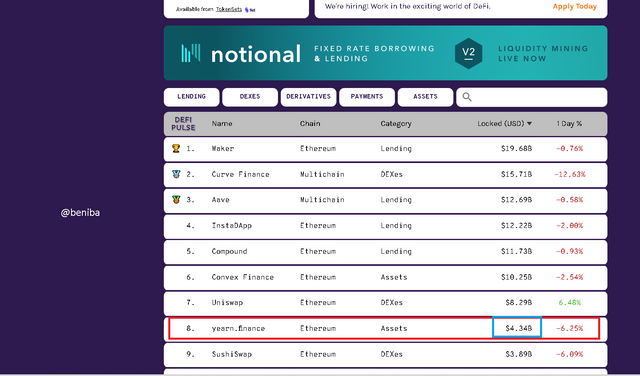

To view the TVL of yearn Finance you will have to scroll down to where the defi platforms are ranked you will find Yearn Finance placed at 8th with a TVL of $4.34B.

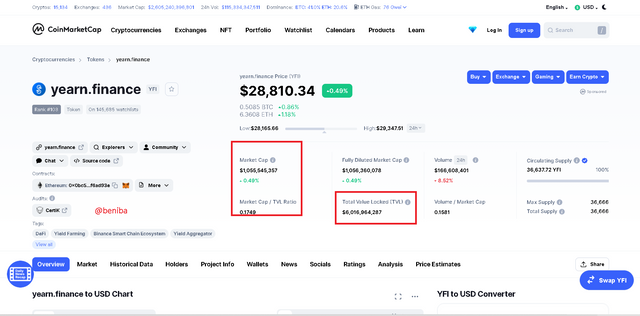

the YFI token is the native token of the yearn finance platform. In order to find the market cap/TVL ratio I will have to open the coinmarketcap platform to get this information.

After opening the coinmarketcap I will search for the YFI using the search buttom. I found the following information.

| PRICE | $28,810.34 |

|---|---|

| Market cap | $ 1,055,545,357. |

| TOTAL VALUED LOCKED | $6,016,964,287 |

| Market cap /TVL Ratio | 0.1749. |

QUESTION 4.1

The YFI token, is it overvalued or undervalued? State the reasons.

For a token to be considered undervalued or overvalued we take into consideration the market cap/ TVL ratio. If the ratio is a value less than 1 we conclude that the token is undervalued. From the market cap/ TVL ratio I had from the coinmarket cap / TVL ratio to be 0.1749 which is clearly less than 1 so that note I will conclude that the the YFI token is undervalued.

QUESTION 5

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

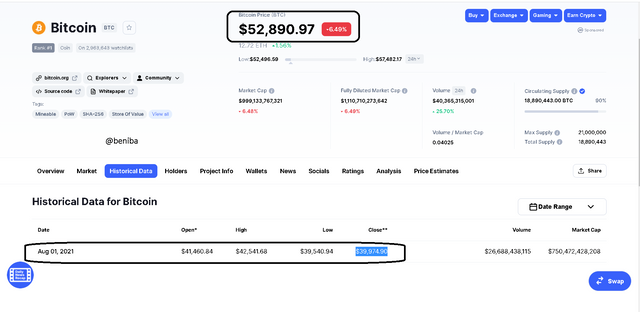

From the coinmarketcap platform Bitcoin closed at a price of $39,974.90

This means that $500 on 1st august will have bought 0.01251 BTC.

Currently the price of Bitcoin is $52,890.97.

This will mean that I can sell my 0.01251 BTC at a price of $661.67.

Return on BTC investment will be $661.67 - $500 = $161.67

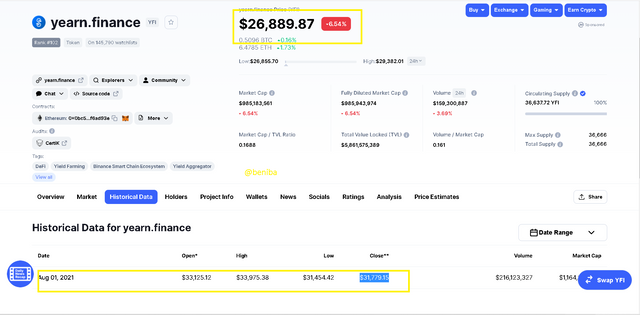

From the coinmarketcap platform YFI token closed at a price of $31,779.15

This means that $500 on 1st august will have bought 0.015734 YFI.

Currently the price of YFI is $26889.87.

This will mean that I can sell my 0.015734 at a price of $ 423.09.

Return on YFI investment will be $423.09 - $500 = $-76.91.

Total returns on my investment will be Returns on BTC + returns on YFI

$161.67 + (-76.91)= $84.76

The return on my investment will be $84.76.

QUESTION 6

In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

There are lot of risks involved in yield farming and below are some of them I will try to explain.

- Prone to attack: yield farming is run using smart contracts and are decentralized. In a case where this smart contracts are short of perfection, it makes it very possible for cyber criminals to attack the system and rob off investors of their hard earned assets.

- Prone to scammer: with yield farming being a decentralized system, the developers of these projects are anonymous this makes it possible for scammers to create fake projects and at the end take away the assets of unsuspecting investors.

- Impermanent loss: this is a risk that all liquidity providers face in the crypto market. This occurs when there is decrease in value of the asset after an investor deposits his assets. This leads to impermanent loss when at the time of withdrawal there is a decrease in value.

CONCLUSION

With the growth experienced in the crypto world it has become a very trusted place to invest and expect some returns. Yield farming is one of the many ways we can invest and make some profit. Just like any other investment it comes with its own risks factors. Thanks to professor @imagen for this wonderful lecture.