Crypto Academy Week 10: Homework Post for @kouba01 | Cryptocurrency Contracts For Difference (CFDs) by @blue10

Hi lovely people, It was such a pleasure to participate in prof.@kuoba01 lecture on Cryptocurrency Contracts For Difference for cryptoacademy week 2. I learnt so much from his submission and i am happy to share mine as well.

What is a cryptocurrency CFD?

The term Contract for Difference (CFD) is an abbreviation for the expression Contract for Difference. Cryptocurrency Contracts for Difference simply refers to the practice of an investor entering a cryptocurrency investment based on contracts, which means that the assets exchanged by such a trader aren't his, but rather a broker's buy/sell contract. A trader and a broker enter into an arrangement called a contract.

Investing in CFDs has a number of advantages that have boosted the device's success in recent years. It's a contract-based investment and trading form. The trader decides whether to buy or sell a position. The trader has the option of basing the contract on the asset's bullish or bearish trend.

The trader would reach an agreement with the broker by placing a position, and at the end of the deal, profit or loss would be taken, depending on whether things went in the trader's favor or not.

Advantages Of Trading Cryptocurrency CFDs

1.An investor has a high chance of profiting during both positive and negative market cycles.

- Buying cryptocurrencies is easy, and you won't have to go through any complicated steps to get tokens into your account.

3.Investors have access to a larger market that they would not be able to access with their small initial investment.

Disadvantages Of Trading Cryptocurrency CFDs

- If margin trading effects are improperly handled, an investor may lose a significant portion of his investment.

How To Determine Whether A Cryptocurrency CFDs Suits Your Trading Strategy

Traders believe cryptocurrency CFDs are ideal for all of them because they enable you to benefit from highly volatile asset price shifts. To determine if trading CFDs with cryptocurrencies is appropriate for your trading strategy, consider the following factors:

You should also aim for both high and low cryptocurrency prices.

You should also find and pursue an investment to profit from minor price shifts right away.

You must keep in mind that purchasing cryptocurrencies is extremely costly.

After your research has shown a clear pattern, you must be determined to maximize your chances of profiting quickly from the crypto market.

Are CFDs Risky Financial Products?

Yes, CFDs are high-risk financial instruments. While CFD trading has its benefits, it also comes with a number of risks that are often ignored when it comes to the crypto market. The risk that is involved will be highlighted below;

Market fluctuations and changes in the price of the commodity you're trading on can have an impact on your position and cause you to lose capital.

If your entry status turns out to be incorrect at the end of the contract, you are responsible for the losses.

The cost of keeping your job when you're gone for an extended period of time is high.

Do all brokers offer cryptocurrency CFDs?

In this case, the response is that not all brokers offer cryptocurrency CFDs, but just a few do. I will highlight the few brokers who do below.

Swissquote : This is another broker that rose to prominence in the year 2000 and is currently an online bank based in Switzerland that provides access to most financial markets as well as cryptocurrency CFDs.

eToro : eToro is a trading site that allows users to trade stocks as well as cryptocurrency. They also sell cryptocurrency CFDs in addition to cryptocurrency trading. eToro was founded in 2006 and is headquartered in Tel Aviv-Yafo, Israel.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

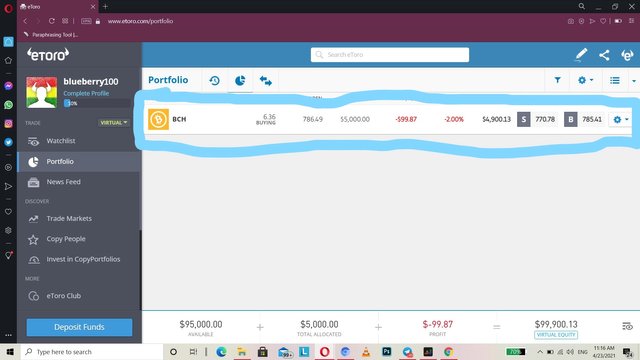

Visit the website etoro.com

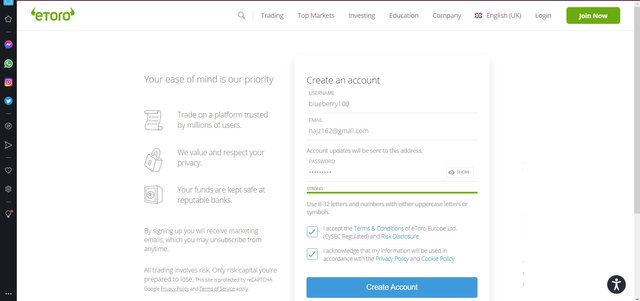

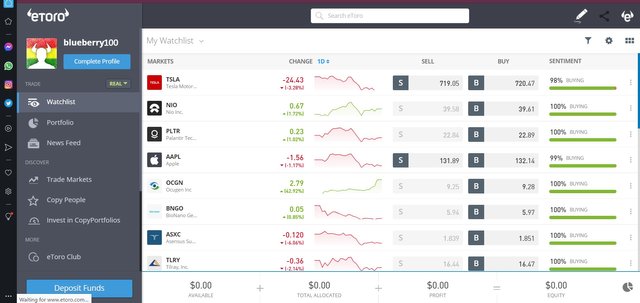

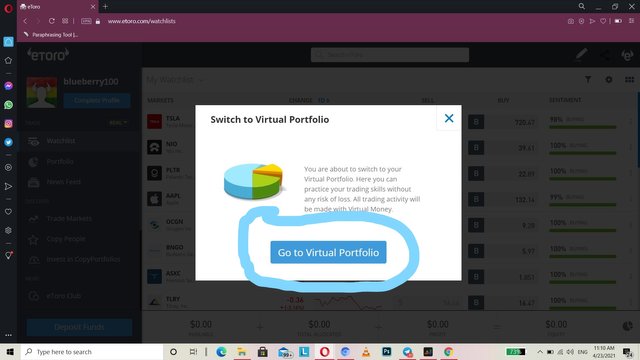

I created an account first before proceeding to switch from real portfolio to virtual portfolio

Completed setting up my profile by visiting the profile page

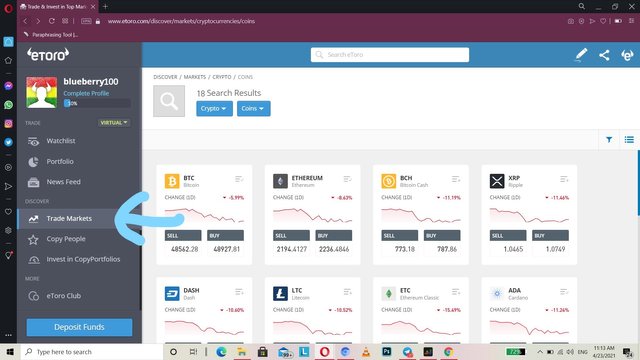

Go to trade markets

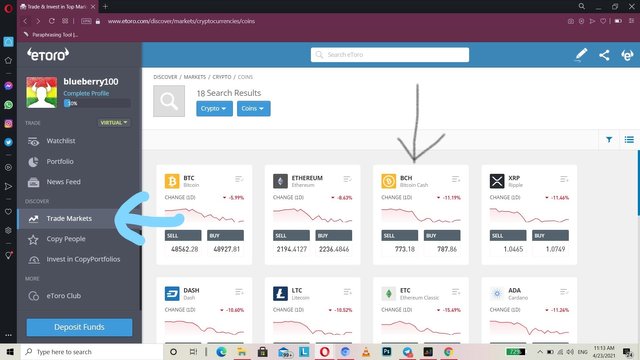

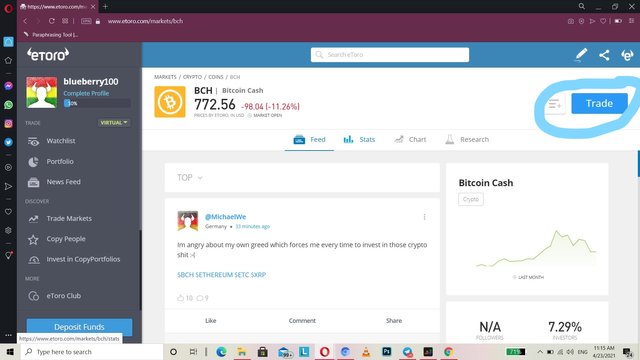

In this i used BCH .

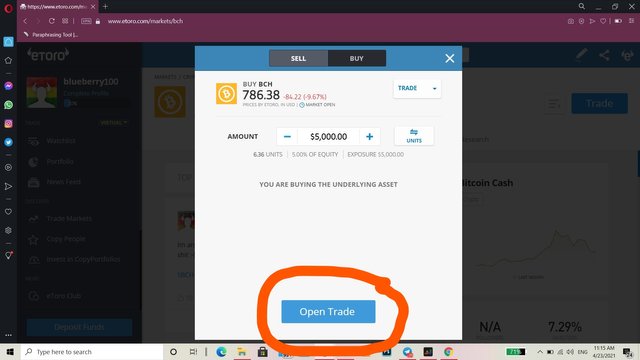

After which I opened a trade of $ 5,000.00.

The steps above in pictures

CONCLUSION

Thank you professor @kouba01 for this great lecture. I really enjoyed it and getting to know more about cryptocurrency CFDs through lectures and also my research makes it understanding to me.

I am looking forward to learning more @kuoba01 because I really admire your lectures.

Thank you for your attention.

Hi @blue10

Thanks for your participation in the Steemit Crypto Academy

Feedback

This is just average work done. Kindly put more effort into your work.

Homework task

5