Dollar Cost Averaging - What and How It Works?

You may be wondering what I'm going to bring up this week. It's the dollar cost average strategy. It may not really imply a steady meaning using the name as there's more to it. Dollar cost average works on the principle of investing consistently.

It's an investment strategy used by most traders to earn profits in their investments no matter how bad the market is. It's more like going to the market to buy Commodities on a monthly basis. You know very well it's not at the same price you'll make these purchases as they'll be some fluctuations in price .

This applies same to dollar cost averaging where you'll have to invest a speculated amount of money on a regular either monthly or weekly. This trading strategy helps reduce the impact of fluctuations on your investments.

The term dollar cost refers to a fixed amount of money you can invest regularly while averaging means spreading your investments over time to achieve an average cost instead of trying to make these investments when prices are completely low. So combining it gives you the definition I gave at the onset.

This is a trading strategy used in the market by crypto traders and they are bastardly earning from this method. You may want to know how it works. It's simple. It works on several principles which includes consistent investments, using a fixed capital to invest and doing so regularly irrespective of the market conditions which seems irrelevant.

How DCA works |

|---|

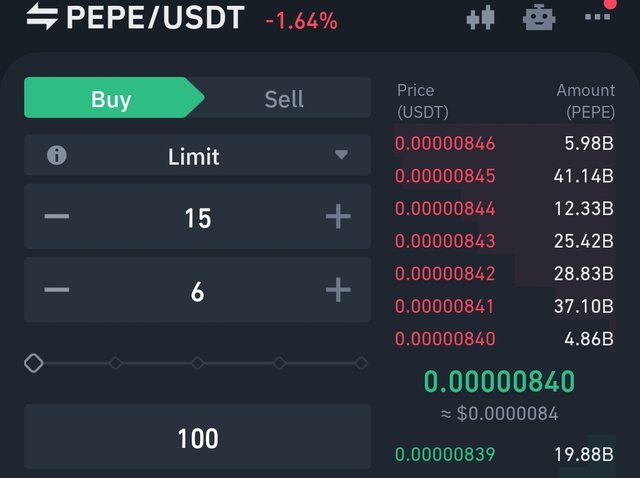

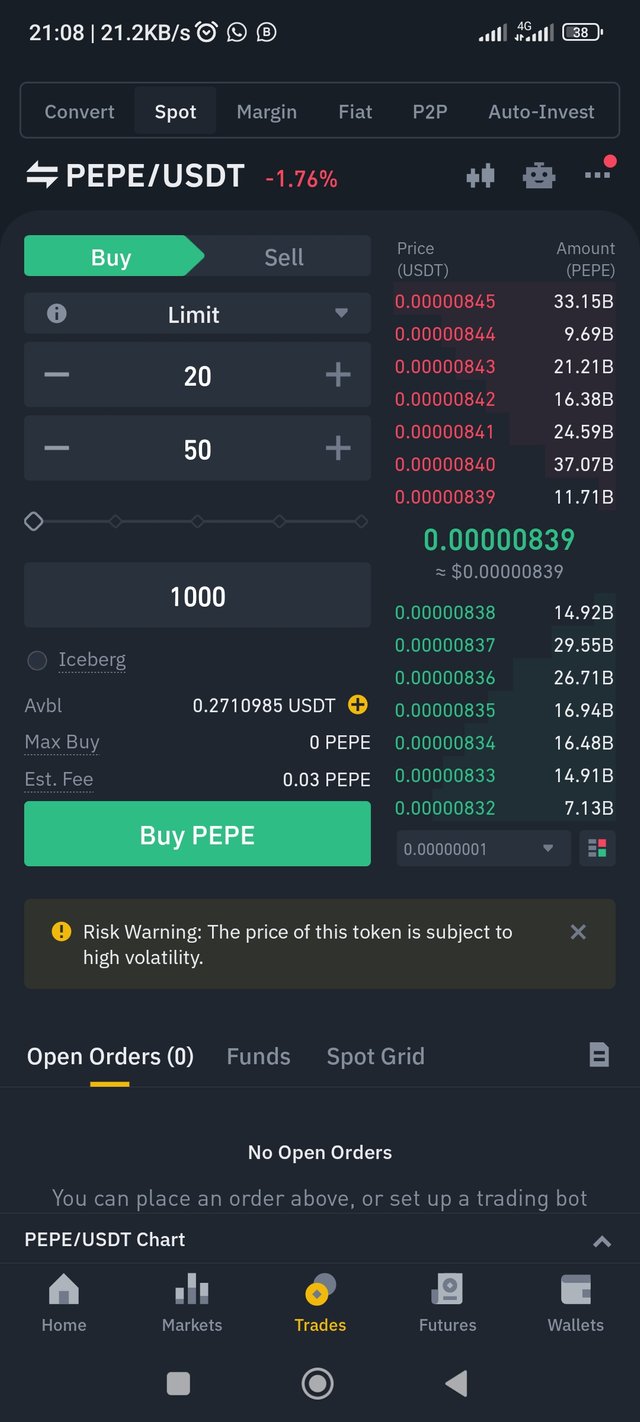

I'll illustrate with this to show how it works.....

Let's say you want to buy Pepe with $1000. Instead of using the entire $1000 to invest in $pepe, you strategize using the dollar cost averaging by investing $100 every month for ten months. How is this beneficial? Let's see

January: Let's say you invest $100 on Pepe this month and the price of this asset is $20. With this, you'll buy 5 of the coin.

February: You invest another $100 and let's say the price drops to $15 per the coin, you'll be getting a total of 6 coin

March: You take another $100 to invest in the asset and this time, you guys at a higher price of $22 per asset, giving you a total of 4 coins

Same till the other month, an increase an a dump. As the asset price fluctuate, the dollar cost average ensures you buy more assets when prices are lower and fewer assets when the prices are higher as shown in the illustration. This averaging reduces the overall cost per asset over time.

It's more advantageous than using $1000 to buy at once which would probably give you 50 of the asset at once. If the price drops, the value of the 50 drops. The beauty of this dollar cost averaging is that it helps you spread your investments and also mitigate the risk of investing a large amount of money at a wrong time in the market.

If you invested the $1000 when the price of the asset was high, you would have gotten fewer assets but with DCA, you csn spread your investments and even get more than what you would have gotten with $1000 at once.

This dollar cost averaging helps you reduce the impact of volatility in the market and increases your outcomes in the long run, minimising your risks. Does this come with any other benefits.? Yes.

Benefits of DCA |

|---|

- This dollar cost average gives you a disciplined approach towards investments in the sense that it helps you commit yourself into investing a fixed amount of money on an asset at regular intervals. By doing this, you help build your own portfolio and also benefit yourself when the market goes run and there exist fluctuations in the market.

- Dollar cost averaging reduces the stress that comes with predicting market trends and reduces the possibilities of making mistakes that are costly based on timing. So this averaging helps reduce that risk.

- This averaging help maintain emotions as it focus on a long term investment. It helps mitigate risks involved in investments and allows you buy assets at different prices.

In summary, this dollar cost averaging can help you invest wisely as spreading of your income is solely involved. It also helps reduce the impact of volatility in the market.

All screenshots are from my binance

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1789028198962868365?t=GTF0qiR3Vgdy1NW7G_F1Bw&s=19

Note:- ✅

Regards,

@theentertainer