STEEM Dollar Purge Update : The Bonfire has been lit!

Well that escalated quickly! It was less than a month ago when I wondered Have we reached the New Normal? and while I was sceptical about whether we had, there was at least some cautious optimism in my tone. However, we are now seeing some SBD destruction occurring at what I believe is at an unprecedented scale. More and more SBD HODLers seem to now be rushing the exits as some of my worst fears for the STEEM platform are in danger of being realised.

Source

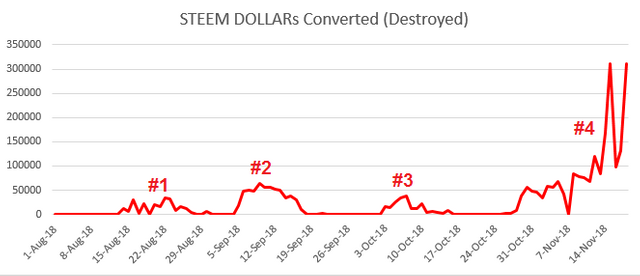

Of course, we haven’t been helped at all by the general downturn across the entire crypto market and we can point the finger there if you’re into finger pointing. I guess the damage is done on that front so I’m personally trying to focus on the future and what comes next. Before I go into that though, here is my updated chart showing the STEEM DOLLARs Converted per day since the start of August so that you can see what I'm talking about.

As you can see, the first couple of Purges that I previously labelled 1, 2 and 3 were both short in duration and size. They have been rendered almost irrelevant bumps compared to what has happened over recent weeks. The price of SBDs has lingered below the critical $1 USD level now since late October and the SBD Purge really has had a kick along since Nov 15 where the broader crypto market took a big hit and STEEM dropped from 80 US Cents to under 60 US Cents today. That’s a 25% drop in a short space of time and we have had a couple of days now where over 300,000 SBDs have been destroyed in a single day. With the SBD price still lingering around 95 US Cents it looks like there is still more fuel for this fire.

Source

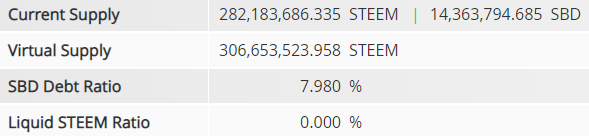

According to Steemworld.org the System Debt level is now pushing close to 8% so while we are still printing fresh SBDs, we are not very far now from the key threshold levels at 9% and 10%. There is not a lot of room to move from here and one of my big fears was that we would not be Purging SBDs at a fast enough rate to reduce the Debt level as the STEEM price continues dropping in a negative feedback loop. A lot of the SBDs converted into STEEM are ending up for sale on the Internal Market so if you want to buy STEEM during the Purge then this is the place to do it. You might be able to score a 1% or 2% discount on what you’d find on the external exchanges if you can buy with SBDs. Alternatively you might be better off converting your SBDs into STEEM yourself and powering up if the STEEM price can stabilise at this level.

Source

So what comes next? I wish I knew. My gut feel is that the Purge is going to continue for a while as all the SBD speculators who don’t understand the system are getting shaken out. I think it is now very likely that we will hit the 10% Debt threshold because we’re probably only 1 big sell-off away from that happening. When it does happen we will get another SBD printing halt (post rewards will be in liquid STEEM once again) and the market will realise SBDs are no longer going to be pegged at $1 USD so we might see a further downturn in sentiment. I really hope we don’t see SBDs breaking down into the 80s, but at this point I expect it to happen and I don’t think the STEEM DOLLAR will have much credibility left as a Stable Coin when it does. Sorry if that sounds pessimistic or harsh – I’m just calling it how I see it. Hopefully it won’t stay there and we will find some support in the market soon so that we can have some sort of recovery.

Hey, @buggedout.

I noticed the uptick in the percentage of SBD debt on steemworld, too, which I guess is confusing me, since as you say, there are quite a few of us who are taking the SBD and converting it to STEEM.

I know you explained it, but I'm still not getting why burning SBD would not make the debt ratio go down, rather than up. Besides, it's something I've been doing from the beginning, so I can power up the STEEM.

As of right now, too, STEEM is below $0.46 USD and SBD has fallen below $0.90.

Converting SBD reduces the outstanding debt total and if the STEEM price remains the same then the % debt is reduced. However, if the STEEM price drops, the market cap drops and the percentage of the market cap that the outstanding SBD adds up to goes up.

This is where the negative feedback loop comes in. SBD price drops, people convert to STEEM and sell STEEM, then STEEM price drops from the selling...debt as a percentage actually goes up. As long as the SBD price remains under conversion value (currently $1 USD - but not for much longer) this "Purge" of excess SBDs will keep going and arbitrage players will smash the STEEM price.

Okay. Got it. I probably should have figured that out on my own, though, so thanks, but sorry for making you walk through it again. I guess I wasn't tracking the fact that the percentage goes up if the price of STEEM goes down.

Just how much of an effect are we having on the STEEM blockchain when we convert our earnings from SBD to STEEM? Because, we would all be holding STEEM, right, or does the nature of it change when we power up like I've been doing. In other words, if I were to keep it all out as STEEM (aside from it obviously affecting what I can earn with the lower SP), would that help the debt ratio any? And not just me but thousands of us?

If you mean that everyone selects 100% SP as a post reward instead of 50/50% then - YES, the system will stop producing SBDs and that will assist in the debt level management.

Considering SBD is currently trading at about 0.90 USD it is probably a smart move to be doing this and powering down instead to get some liquidity if you need to spend.

What if by reaching 10% SBD debt ratio instead of implementing thehaircut we start to convert SBD not to Steem, but to Steem Power ( but with 100% ratio, no haircut ) ?

So for those who are powering up there'll be a clear intensity to keep on buying and converting SBD all the way down ?

This is an interesting idea but I think it's still open to exploitation by big players. If they are converting less than 1/13th of the value of their SP they can just power down to turn it into liquid STEEM. We'd just be slowing them down by 1 week - but that may have some value in itself.

Well it looks like this exact situation is sort of playing out. I feel like this happened in late 2016 as well.

Im pretty sure the SBD printing halt is happening now bro. 😭 . So spot on as usual.

Thanks Arly. I think we crossed through the 9% and 10% thresholds in the space of about 24 hours. So that means the printing halt and the haircut are now in play.

Hairy stuff :(

Any advice on how to get SBD aside from selling Steem?

You can buy it on Bittrex for about 0.84 at the moment, but I would not recommend holding SBD while this is playing out. It is no longer a safe place now that 10% has been hit and I'm not sure the market realises the full impact of what the haircut on conversions means for the peg.

They should never have changed the debt ratio from 5 to 10% in HF20. Now we just have a much bigger run on steem on our hands. 300k SBD is 500k of steem being dumped on the market every day at the moment. This could get a lot worse before it stabilises.

Prophetic words.

It's about another 25% drop in the last 24 hours and we have over 600K SBD currently in the conversion process. If that lands on the market there is another 1.2 million STEEM of selling pressure just this week from the SBD Purge. It's the stuff of nightmares.

Yes it is a blood bath. I would be interested in your comments on my post about it here as most people have no idea what is happening https://steempeak.com/steem/@intrepidphotos/3jjuph-doom-and-gloom

Have done so. Be a good mate and throw me an upvote on my post?

Sorry I thought I had not upvoted it.

All good. Thanks :)

The change in the debt ratio had almost no effect. If you look back at the supply on May 29 (a more or less random date long before HF20 I found on the coinmarketcap chart), SBD supply was already 14m, about the same as now. Since the price was still above par and many people were still holding on to their SBD in hopes of a new pump, its supply never significantly decreased.

Some new SBD was printed post-HF20, but this also had the effect of bringing the price down and encouraging more conversions along the way (see previous "purges" in the post), so it is difficult to say whether the overall debt ratio is higher or lower than without HF20. It is clear though, that it isn't much different either way (+/- a few percent).

The large (relative to current market cap) supply of SBD didn't come from post-HF20 printing, all or nearly all of it came from the SBD pump, which led to the build up of supply since it shut down the natural 'drain' of conversions for a long time, while printing (even under the previous limits) continued.

I warned of the SBD pump causing a boom and bust cycle at the time, and we are now paying the price with a bust (though, hopefully, this too will pass). But at the time a lot of people didn't want to hear it, and didn't want to do anything to improve the peg and stop the pump. They were just happy to pocket greater rewards, future be damned. How many of those people are even still here?

Since 26-Sep-2018 (HF20) we have printed approx 870,000 fresh SBDs and we purged about 200,000 SBDs in Purge 3 - the only one post HF20 before this latest carnage began.

So considering the purges were already underway I think it is a stretch to claim that we didn't make things worse (more unstable) with HF20.

I agree though that most of the damage was done during the unchecked SBD Pumps and there were plenty of senior witnesses and whales who didn't want to do anything about it. They still don't.

Somewhat true but in fact the change in HF20 was an incremental measure to help reduce these pumps, supported by witnesses and whales so it is false to say that they don't want to do anything about it. It is true that, especially at that time (late 2017-early 2018), there was a great deal of resistance as many people were enjoying a lot of 'free' money. That probably included resistance from witnesses and whales and are part of the reason nothing at all was done until HF20.

Reverse conversions might be better, but what happens when you reverse convert right up to whatever limit is set (say 5% or 10%) and SBD is still pumped?

Really? What would the SBD ratio be right now without the added 870K (we can even ignore the 300K that were converted down, although I don't think we can categorically say that HF20 didn't play a positive role in those happening)? It would still be at or near 10% and I argue this is not significantly worse. It may be marginally worse, but its really ultimately the same thing. Now consider the effect of a supply shut off during a pump because of low soft limit (say 2-5%) being hit, meaning there is nothing to push the price back down and reduce supply. No, I don't agree that overall a supply shut off makes things better. At least it is not clear at all that it does.

Yes, it is only marginally worse - but it's still worse and its possibly only marginal because this market dump occurred less than 2 months since the change. We could have been printing for a lot longer and made things a lot worse before judgement day arrived.

Here are some of my current calculations :-

Expected Feed Price : 0.40533

Current STEEM Supply : 283092063.286

Current SBD Supply : 13929289.792

Debt Ratio : 10.825%

Expected SBD Conversion Rate : 0.915

Now I know this is oversimplifying things a bit but if you knock 800,000 SBD off that Supply then you get a Debt Ratio of 10.267% with a SBD Conversion Rate of 0.971

I don't think thats insignificant. The difference between 0.915 and 0.971 is massive for maintaining the credibility of a Stable Coin.

How much would the STEEM price have to decline to go back form 0.971 to 0.915? I'm pretty sure the answer is a tiny, almost insignificant amount (relative to typical volatility). (EDIT: I guess the answer is pretty obvious since SBD is effectively pegged to STEEM once the ratio goes above 10%: about 6%, well within the range of one day volatility.)

Ultimately it is price changes which account for the vast majority of all of these considerations.

And because of that, and the inherent volatility of the underlying asset, I don't believe it is possible to avoid all sorts of possible 'failures' of a stable value coin, including having the price go up (potentially a lot) because you cut off supply. The tradeoffs that Steem makes are pretty reasonable IMO.

Indeed, I would simply redefine failures as 'residual volatility' of any given design, and the look to minimize rather than eliminate volatility (as well as preferring smooth/gradual to catastrophic failures, which the current 10% rule does quite well). From what I have seen of Steem, big pumps are more of a concern to me than some excursions above 10% where the peg target drops below $1 (including, for the reason that the big pumps probably make the >10% excursions more likely). When SBD is $10 that means you can (and likely will) lose 90% of you money. It would be hard (though not impossible) to lose 90% from the haircut. It would require STEEM to decline another 90% plus not having conversions along the way to reduce SBD supply.

If you are holding SBD that you bought or received when valued at $1 then certainly 91 cents on the dollar sucks, and ideally $1 will be recovered relatively soon. But it is still a hell of a lot more stable (and will continue to be so even if it declines some more) than STEEM or most other cryptos. We need to define success (or at least progress) in relative terms.

As I noted elsewhere the print rate is simply tiny. Whether you print at 100% or not only makes about 2.9% per year difference. That's about a quarter of one day's price volatility!

There is simply no hope for the decision whether to print or not to have much effect at all. That will never work. IMO you might as well just leave the printer on all the time (which probably helps in some sense by removing a variable from market expectations) and let conversions adjust for the difference between that and what is needed. The latter can possibly adjust fast enough to cope with volatility and is really the only hope. (I'm also open to reverse conversion models.)

You have to remember that the print rate limit was not part of the original design and was thrown in by the devs with little real review or analysis. Nobody considered these sorts of numerical factors in whether it was a useful approach, nor that stopping printing of SBD doesn't actually mean stopping printing, it means printing more STEEM, which likely has an immediate negative effect on the STEEM price/market (and therefore possibly the SBD ratio). Some of the same devs who originally implemented the 2-5% range not only agreed with the 9-10% model but actually proposed a 9.9%-10% model. In fact, from a numerical perspective none of this likely matters.

I just came across your post, and since we have already crossed the 10% mark so the SBD is no longer pegged to $1?

That is correct. We need the STEEM price to recover and/or more SBDs to be destroyed to bring the debt level back under 10% so that the peg to $1 USD is restored.

Steem has been getting seriously wrecked lately when the heck are SMT coming out ?

Not this year I'd wager.

March 24th with a testnet live on Jan 15

Perhaps they're converting to Steem not just because they don't think SBD will spike, but they think Steem is a better bet at this level.

I see SBD at 94¢ and know I can get a nice convert to steem. Since my goal is spending steem on bid bots to promote our dApp dlux I find near immediate returns on the cost of advertising.

Doesnt converting sbd to steem burn the sbds and thus reduce the debt? So the bonfire would be hurting steems price more than anything. Buy sbd for 95c, convert to steem for $1 sell steem. Buy sbd again for 95c rinse, repeat.

Posted using Partiko Android

Yes but if is dropping faster than 5% every 3 days you can’t even buy your SBD back with the steem you get . And the flow of Steem onto the market from conversion seems to be making sure this is the case .

You're both right.

!tip

Thanks :)

Holding out for steem to recover is starting to feel like waiting for betamax to make a comeback.

There will be a bottom when the market finally capitulates. The question is where and when that happens.

That could be happening now, but as we learnt during the SBD pump earlier this year - the market can remain irrational for quite a while.

🎁 Hi @buggedout! You have received 0.1 STEEM tip from @daily.readings!

@daily.readings wrote lately about: Meet Vera, The Most Powerful Fastest Recruiter Headhunter In The World Feel free to follow @daily.readings if you like it :)

Sending tips with @tipU - how to guide :)