TIB: Today I Bought (and Sold) - An Investors Journal #394 - Italy, Ethereum, 56 Percent Club Update

Markets keep moving positively. Bitcoin and Ethereum keep finding buyers, me included. A profitable week for crypto bot trading. And I lose patience with Italy.

Portfolio News

Market Rally

US markets continue to push ahead into the weekend

Strong jobs report certainly helped sentiment. Time to start watching that wage inflation number. Treasury yields are not bothered by the inflation risk.

Sold

ComStage MSCI Italy TRN (CBITA.VX): Italy Index. 1.2% profit since July 2017. Ran out of patience with Italy - better places to deploy capital. With this ETN listed in Switzerland, exchange rate differentials to Australian Dollar added another 5.1% though it weakened 6.1% against the British Pound which affects some of the beneficiaries of the account.

The thesis for the investment was that Italy was trading at the lowest price to book valuation in developed Europe and if it closed the gap, this investment would produce better returns than Europe (see TIB 113 and 107). Truth is, Italy has not fixed its problems and it has not closed the gap. A quick chart to compare Italy (using iShares Italy ETF (EWI - black bars) to Vanguard Europe ETF (VGK - blue line) to SPDR S&P 500 ETF (SPY - red line) all in US Dollars).

Italy did outperform Europe in the front half of the period but ended up in the same place.

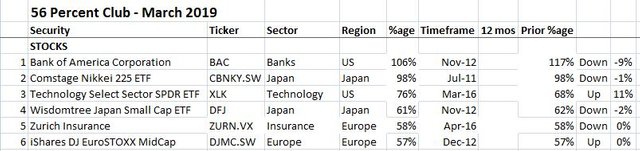

56 Percent Club

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have also marked up whether they have gone up or down since last time. What stands out?

- A shorter list by 3 with three falling off (6 vs 9)

- Bank of America (BAC) retains its top slot with a small drop in performance

- Biggest riser for the second month was Technology Sector ETF (XLK) continuing the rally from the selloff lows

- Japan and European Mid Caps still feature

- None of the stocks was bought in the last 12 months

- Three fallers off the list in marijuana, Aphria (APHA.TO), lithium (Global X Lithium ETF (LIT) and gold exploration, De Grey Mining (DEG.AX)

- While Aphria did fall off the list, there are averaged down holdings for two marijuana holdings above 56%, Aphria and Harvest One (HVT.V) = honourable mentions for both.

- 4 fallers and 2 risers.

On the options side same deal. I have highlighted ones that are new to the club in Yellow.

What stands out?

- There is the same leader in Consumer Staples ETF (XLP) which was the fastest riser on the prior list. This is an interesting move in a month when the growth stocks in the broader market rose - i.e., I would have expected XLP to lag

- New to the list is a new entry for European supermarket chain, Ahold Delhaize (AD.AS)

- List grows to 7 (was 3) with returns for offshore oil driller, Tidewater (TDW), Technology Select Sector ETF (XLK), and Swiss pharmaceutical stock, Novartis (NOVN.VX)

- 3 positions bought in the last 12 months.

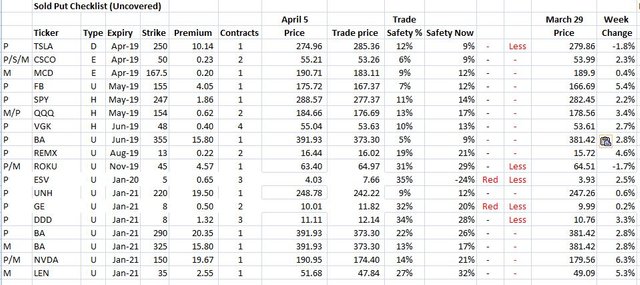

Naked Puts

Below is table for weekly review of naked puts. Two stocks are showing RED, both with a long run to expiry. Ensco (ESV) is something of a bother as it is planning a 1 for 3 split. This always disrupts options pricing.

I have put in a new column to compare the safety margin now versus the original trade time (column with RED Less markers). The closest expiry one is Tesla (TSLA). This short put is covered by a long put (same strike) with a later expiry. The others have time to run.

The biggest potential risk is Boeing (BA) exposure with 3 trades open. Its safety margin has improved. New to the list is Invesco Nadsdaq Trust (QQQ) = hedge trades opened some time ago

Cryptocurency

Bitcoin (BTCUSD): Price range for the week was $567 (11% of the open). Price moved strongly the day of my last report and then retraced for one day and held before making another run to the next resistance level up at $5547.

Ethereum (ETHUSD): Price range for the week was $23 (14% of the open). Price did indeed push to test the resistance at $177.80 (green line) and retraced to gather breath before having a go at breaking through making it on April 8 trading. The pink ray level is the next small test at $191.

I added one new long trade on a confirmed reversal on the 4 hour chart in my IG Markets account. I have put in stop loss (below $155) and take profit target ($195 - below next round number)

CryptoBots

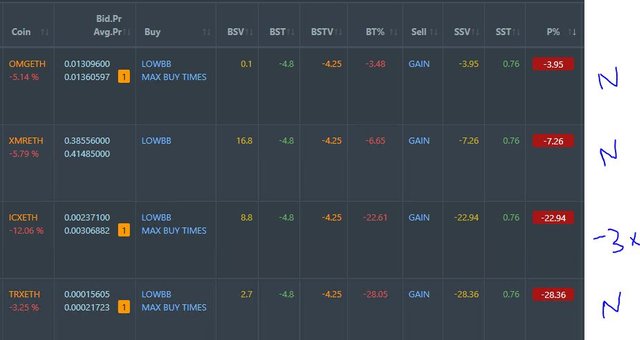

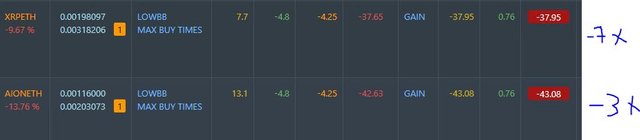

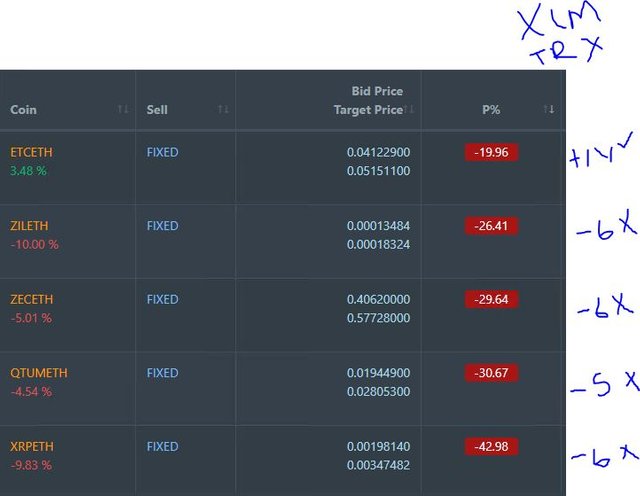

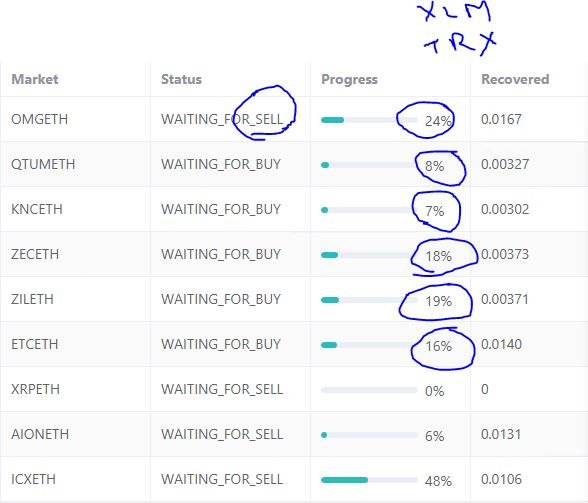

Profit Trailer Bot Fourteen normal closed trades and one PT Defender trade closed (average 2.22% profit) bringing the position on the account to 7.82% profit (was 7.33%) (not accounting for open trades). Trades closed on QTUM, XLM (2), KNC, ZEC, ADA (2), IOTA, ZIL, TRX, ZEC, ETC, ZRX, LTC, OMG

Dollar Cost Average (DCA) list stretches to 6 coins with TRX, OMG, XMR joining. Altcoins suffer when Bitcoin and Ethereum run.

Pending list drops to 9 coins with XLM and TRX completing PT Defender defences. Of the rest 1 coin (ETC) improving, 1 coin trading flat and 7 worse.

PT Defender now defending 9 coins. Something was not right in completion of TRX trade as coin went back onto DCA list on completion without opening a new trade (average cost problem fixed now). Defence trades made on OMG, QTUM, KNC, ZEC, ZIL and ETC.

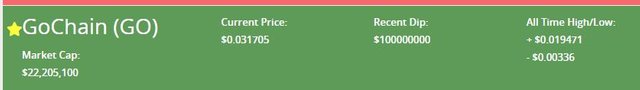

New Trading Bot Trading out using Crypto Prophecy. No closed trades. New trade opened on GO - not quite passed the stochastic RSI signal (lower window)

but appeared on Crypto Prophecy screen.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade on NZDJPY for 0.03% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

April 3-5, 2019

A printing Fed that seems to be promoting risky assets will probably gives the cryptocurrency run higher more legs! Will be interesting to see how many follow as investors have probably learned that they are not all created equal.

Posted using Partiko iOS

The FOMO mob are coming back to crypto but not like last time. AND it is not only in crypto.

wonderful investing sir,i really admire your works sir @carrinm

Thanks