TIB: Today I Bought (and Sold) - An Investors Journal #434 - Europe Network Equipment, Corn, Euro, 56 Percent Club Update

Markets go a little saggy with soft US inflation data. Trade action in old dog, Nokia, Corn and the Euro. 56 Percent Club update for May reflects the sagging month of May with yields and puts storming to the top of the options charts.

Portfolio News

Market Rally

US markets make a second soft day as the worry shifts back to China

Biggest casualty of the China nerves were again semiconductor stocks. Oil price sags with a 2nd week of strong inventory stockpile data.

Yield markets also go soft on soft inflation data

The headlines are all over the place just like the market. One of these two markets is wrong. Either, bonds have overreacted with a down view or stock markets have overreacted with an up view. Both markets think the same, i.e., the Fed will cut rates, but they are pricing differently. The soft inflation data did not help the confusion.

No confusion in Europe - yields continue to fall with Euribor touching a new high at minus 40 basis points for December 2020 3 month futures. The words from Mario Draghi could not even hold a week (where the chart last dropped). Price is now higher than when he started talking (maybe those 4 red bars in a line were his gritted teeth).

Bought

Nokia Corporation (NOK): Europe Network Equipment. Completed setting up a call spread risk reversal by selling January 2021 strike 4 put options for $0.33 premium. This brings the net premium of the January 2021 5/7/4 call spread risk reversal down to $0.22 and ramps up the maximum profit potential from 263% to 809%. Price does have to move 37% to reach the sold call strike (7) in 19 months. Risk in the trade lies if price drops below $4 and I am forced to buy the stock at that level.

Quick update of the chart shows where that sold put lies. Price has not been there since August 2013 when price was going up and did not get as low as that in 2016.

The impact of the sold put is shown with dotted rays - most notably is the way the 100% profit line pulls to less than halfway up the last cycle. See TIB433 for the initial rationale.

I did watch an interview with Rupal Bhansali of Ariel Investments on Bloomberg TV this morning about some contrarian stock ideas called MANG stocks. Michelin, AmDocs, Nokia and Gilead = not the conventional stocks people think about = stocks that nobody wants to touch. What she liked about Nokia was high dividend yield, high service revenues and low price earnings. Good to see two stocks I am holding (GILD too).

Sold

Corn Futures (CORN): One contract hit profit target at top of trading range for $21.90 per contract profit (5.3%). I did write the other day in TIB432

Corn markets has been bouncing around in a range on 4 hour chart between $415 and $440 as the Mexico and China trade conversations ebb and flow.

This trade went from the bottom to the top of the range. The chart is showing signs that this time price may push above the top of the range.

I have moved one profit target beyond the range to $445 and the other contract has no target on it. I have some friends cycling in the Race Across America who are reporting temperatures over 50C as they reach into Arizona. If this is a pattern to add to the late rains on the plains, I doubt corn growing is going to work that well in 2020

56 Percent Club

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

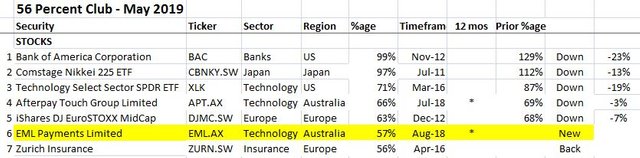

First is the table of stocks. I have also marked up whether they have gone up or down since last time. New entrants marked in yellow

What stands out?

- One newcomer in Australian payments provider, EML Payments (EML.AX) and return for Zurich Insurance (ZURN.SW) (7 vs 6)

- Bank of America (BAC) retains its top slot with a big big fall of 23%

- Biggest riser is EML Payments rising onto the list - everything else apart from Zurich Insurance fell.

- Japan and European Mid Caps still feature

- New entrant, EML Payments and Afterpay (APT.AX), an Australian payments provider, were bought in the last 12 months.

- One faller off the list in Japan, Wisdom Tree Japan Small Caps ETF (DFJ)

- Top 5 stocks are fallers in a weak stocks month.

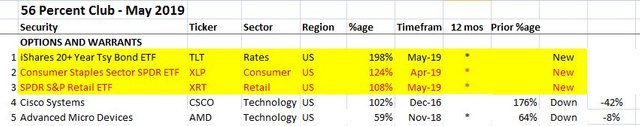

On the options side same deal with short positions marked in red.

What stands out?

- Quite a lot of change with holdings in Axa SA (CS.PA) and Qualcomm (QCOM) sold for good profits.

- Falling off the list are oil giant, Royal Dutch Shell (RDSA.AS), cybersecurity provider, Symantec (SYMC) and offshore oil driller, Tidewater (TDW)

- New entrant and new leader is iShares 20 year Treasury ETF (TLT)

- Other new entrants are short positions (i.e., puts) in US Retail (XRT) and US Consumer Staples (XLP)

- Only two survivors from last month both fall.

- Two fallers and 4 risers

- 4 positions bought in the last 12 months. TLT puts bought in May.

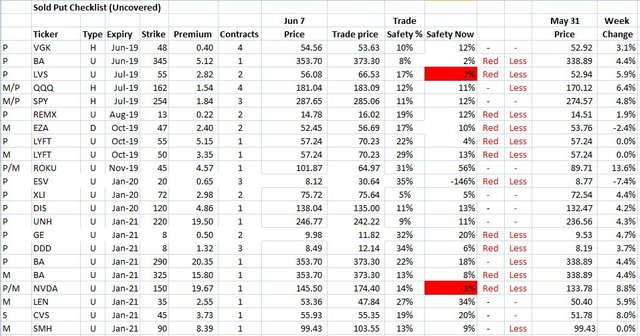

Uncovered Puts

Weekly review of Uncovered Puts (based on Friday last prices). Table shows naked puts in expiry order. Safety Now is the column to focus on focusing on minus signs and small safety margins. Risk trades are highlighted RED and in red.

- Action taken to roll down and out in time Las Vegas Sands (LVS). Price has stayed above the new sold put strike (55)

- Boeing (BA) has stayed above its new sold put strike (345). I will be pleased to see this one past expiry as June was a bit tight for them to fix their problems.

- Ensco (ESV) remains of concern especially with low oil prices prevailing but a lot changes in 7 months. The value at risk is small.

- Nvidia (NVDA) is caught up in the China trade story which I am guessing (hoping, maybe) will have been resolved by expiry in 2021

- Problem child from a few reports back , Van Eck Rare Earths/Strategic Metals ETF (REMX) has come out of the danger zone on the back of improving rare earths and molybdenum performance.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $445 (5.7% of the low). Price pushes away from support zone around $7761 and reaches well over $8000 making a new high for the last week's trading.

Ethereum (ETHUSD): Price range for the day was $20 (8% of the low). I wrote yesterday "Not quite time to extend that pink ray - maybe tomorrow". Price pushed right off of that short term support level and also made a new high for the week. Next test is of the twice rejected $277 resistance.

CryptoBots

Profit Trailer Bot No closed trades

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Euro (EURJPY): The article in the headlines about which market was wrong had me intrigued. The key words in it are "forex markets are complacent". I like it when they are as implied volatility is low and options trades start looking good. The article writers said they were shorting EURJPY as their way to play this. Flight to safe haven of Yen (their words) and European Central Bank painted into a corner on rates (my words). I set up a bear put spread with 12 months to expiry = bought strike 122.50 put option and sold a 109 strike put option. Let's look at the chart which shows the bought put (122.50) and 100% profit as red rays and the sold put (109) as a blue ray with the expiry date the dotted green line on the right margin

I picked the 109 strike as the sold put as that is the low price reached in 2016. 100% profit mark is above the 2017 lows and around the level the Euro dropped to on the Brexit vote. Price is in a clear downtrend like the one in 2014 (left hand red arrow). Get a repeat of that and this trade will comfortably reach the maximum potential.

The risk in the trade is Japan succeeds in weakening the Yen and Europe starts to grow more strongly than it has been and rates stop being negative. Here is the link to the article I used

Outsourced MAM account Actions to Wealth closed out 3 trades on GBPUSD, AUDUSD and AUDNZD for 0.18% profits for the day. Trades open on EURUSD, EURGBP and AUDCAD (0.11% positive). The AUD shorts are helping now.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 12, 2019

Hi, @carrinm!

You just got a 0.4% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.