Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread by @chinto1

Greetings @awesononso,

Welcome back from the break, I'm highly delighted to be part season 4 of the steemit crypto academy and nice to have you back as well.

Thanks to steemit team for retaining you prof @awesononso.

The Bid-Ask Spread.

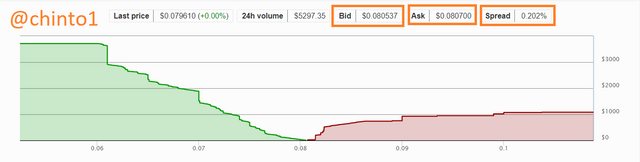

The bid-ask spread is one of the fundamental concepts when it comes to economic investment and businesses terms. I will briefly explain the two economic terms used together(the bid price and the ask price). The bid price is the highest price a a buyer is willing to pay for an asset. On the other hand, the ask price is the lowest price in which a owner or retailer is willing to sell his commodity.

The bid-ask spread is defined as the difference between the bid price and the ask price. We can simply represent it with an equation

The Bid-ask spread = The Ask price - The Bid price

In simple economic terms we say, For an asset, the bid is the demand and the ask price is the supply. It determine the liquidity of the price of assets in the market.

screenshot of BId price, ask price and spread.

One of the major importance of the Bid-Ask price id that;

The spread represent the transaction cost of asset, The bid is the demand and the ask represent the supply. The buyer sell at the bid price and buy at the ask price, in the case of the market maker, assets are bought at the bid price and sold at the ask price.

With regards to this, the markets liquidity of assets is determine by the spread.

Another importance of the Bid-ask spread is that, it helps us to understand more about financial matters in order to negotiate a good price for a buyer to purchase a commodity. for example, if the price of a stock is trading at $30, a market maker can place an offer at $30.5 and a bid at $28.9. He will a market call of $28.9/30.5. The trading point of $30 is called "mid-market price".

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a.)The general for calculating Bid-Ask spread is,

spread = Ask price - Bid price

Bid-Ask spread = $5.20 - $5

Bid-Ask spread = $0.2

therefore crypto X will have a Bid-Ask spread of $0.2

b.) calculating the Bid-Ask spread in percentage,

%Bid-Ask spread = (Bid-Ask spread/Ask price)100

%Bid-Ask spread = ($0.2/$5.20)100

%Bid-Ask spread = 3.85

therefore crypto X will have a %Bid-Ask spread of

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a.)To calculate the Bid-Ask Spread we use the general formula,

Spread = Ask price - Bid price

Bid-Ask Spread = $8.8 - $8.4

Bid-Ask Spread = $0.4

therefore the crypto Y will have a Bid-Ask spread of $0.4

b.) To calculate the percentage Bid-Ask spread we use the formula,

%Bid-Ask Spread = (Spread/Ask Price) x 100

%Bid-Ask Spread = ($0.4/$8,80) x 100

%Bid-Ask Spread = 4.54

therefore the crypto Y will have a percentage Bid-Ask spread of 4.54

In one statement, which of the assets above has the higher liquidity and why?

Crypto X has the higher liquidity. This is because, crypto X has the smaller spread, crypto with smaller spread will have high liquidity. This is because their buying and selling price are closer to each other, it is easy to enter and leave the market, so it generates more trade.

Slippage simply means failure to meet expectations or standard. Same way in crypto, slippage mark the gap between the expected price of assets and real price of commodities at which it is executed. slippage is more common among assets with lower liquidity due to the wide nature of Bid-Ask spread of commodities.

Price of cryptocurrencies can at any second which means they are highly volatile commodities. Due to this unstable nature of the price changes, price change between the period of the market order is placed and when it executed.

Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

Crypto traders who are involved in the world of cryptocurrency are mostly at an advantage because of this positive slippage.

When one wants to buy steem in the internal market, when he wants it instantly he uses the market price to buy the coin.

After placing the order when the price adjust slightly and the ask price of steem to sbd fall the amount of steem the trader would get will increase.

This is what is referred to as positive slippage because here the trader is at an advantage and he gains more steem.

If incase the trader places a sell order for steem to buy some sbd and then the price changes slightly the amount of sbd the trader will get will be more making a positive advantage.

Negative slippage.

As the positive slippage the negative slippage is the vice-versa of positive slippage.

Negative slippage is when a trader places an order using the lowest buy price which is the market order and the the price adjust slightly and then the amount of steem the trader will get will decrease which means it is a negative slippage.

Which means let's say your were supposed to get 1 sbd for selling 12 steem and the price changes slightly, the trader will get 0.9 sbd instead of the initial 1 sbd.

For the buy order the trader will get less steem for the sbd he executes to buy.

Here the trader execute the buy steem order at a particular price and he would have gotten a higher steem and the price adjust he will get less steem for the sbd he wanted to sell.

This is negative slippage as the trader will be at a disadvantage.

Conclusion.

With this topic I have learnt a lot about price change of commodities and more about slippage. This topic has enlighten me that, slippage is volatile in the crypto market and can happen at any time in any second.

With the Bid-Ask spread I have done much research with regards to the bid price and ask price and with the help of my little knowledge in economics I'm able to stand firm with the research and produce such wonderful answers to the questions.

My regards to @awesononso

Hi @chinto1

Please use only specif tags which given to the specific homework tasks so that unnecessary the task will not list in the other homework tasks.

With the help of a specific tag, the professors can able to count the total accurate task submitted in a specific Homework task at the end of the week.

Thank You.

Hello my friend, could you please remove the tags that do not correspond to the class of the teacher @awesononso, as they affect the statistics of the other teachers.

Thanks