Tales Of The Crypt #1: Is John Mcafee Gonna Have To Eat His D***?

Tales Of The Crypt #1:

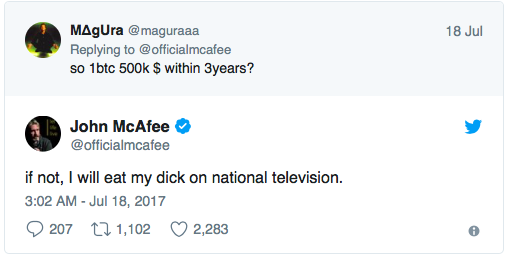

If you haven't been living under a rock for the past three months you've probably heard of the bet that John Mcafee has on bitcoin hitting $500,000 by 2020.

In July John said in a tweet that he would eat his dick on national television if it doesn’t.

So what are the Odds that Mr. Mcafee is gonna have to chow down on his ding dong?

As of writing this the current price of bitcoin according to coinmarketcap.com is 7468 dollars with a market cap of roughly 125 billion and a circulating supply of about 16.67 million.

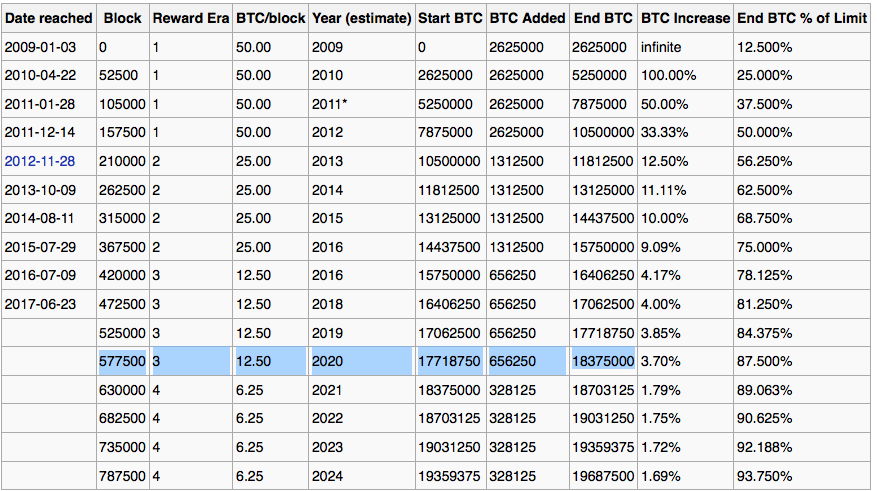

The last block of 2020 should be around 629999 and have a circulating supply of about 18,375,000 coins.

So if we take the 18,375,000 coins X 500,000 dollars = the market cap should be around $9,187,500,000,000.

So ya, things aren't looking good for John but there are a couple scenarios that could play out in his favor.

2018 Stock Market Crash?

If you look at the chart above you can see that price is moving far from the 200 and 100 period moving averages which could signal a correction is on the horizon.

The MACD is also indicating that the markets are extremely overbought.

Recently Harry Dent, the man who predicted the Housing Bust, the dot-com bubble and the economic collapse of Japan, Was Quoted Saying:

The world markets are about to face an economic recession that will be far worse than what we faced in 2008. A once in a Lifetime Reset.

He also Said that:

Gold, which is considered a safe haven asset during times of volatility, will collapse to $700 in the coming years.

If Mr. Dent is correct again that could mean Billions possibly even Trillions of dollars flowing into cryptocurrencies. If Stocks, Real Estate and Gold are bad buys then the asset class that I see most of that money going into is cryptos.

Dollar Collapse?

If you look at the chart above you can see that the lifespan of a world reserve currency is anywhere from 80 - 110 years or an average of about 95 yrs.

Currently The USD has been the World Reserve Currency for the past 90 years or so which means its WRC status is just about over.

Recently Venezeula Dropped the Petro Dollar instead wanting to be paid in Yuan. Click Here To Read

And Russia has dropped the dollar at all of its ports wanting to be paid in Rubles. Click Here To Read

Things aren't looking good for the dollar. If another oil producing country like Iran, or Saudi Arabia drops the PD it could send the dollar crashing down with inflation we have never seen before.

If that happens a $500,000 bitcoin is very possible since 500,000 dollars won't be worth that much anymore.

img credz: pixabay.com

Nice, you got a 21.0% @peaceandlove upgoat, thanks to @cookiekush

Want a boost? Minnowbooster's got your back!

The @OriginalWorks bot has determined this post by @cookiekush to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Your post was resteem by Whale ResteemService @booster007

Keep it up!

All the best!

First Follow for 3 hours | Send a minimum transaction 0.100 steem/SBD with post URL in memo | Your post gets resteemed | A post can only be resteemed once!

We can be certain that the days of the US$ as the world's reserve currency are numbered. Its price will plummet. In fact, all fiat currencies will drop to their true value of zero.

You summed it up perfectly in your final sentence, as "dollars won't be worth that much anymore." Consequently, precious metals and cryptos will most likely be worth much more.

Hopefully he’ll sauce it properly... with a STIFF drink to follow... We’ll see.

Let The Dick Puns Begin

No... just a little cocky

The question you need to ask is not what Bitcoin can do for you. The question you need to ask is what can alt-coins do that Bitcoin cannot.

For an example just compare what Dash can do compared to Bitcoin. Cryptos may even have a combined net worth over 100 Trillion USD. But it won't be just Bitcoin. The utility and scalability is very low for Bitcoin even though the usability have improved mainly because of the networking effect.

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

The @reblogger's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

The world reserve currency graph is very interesting in many ways. Very nice analogy although I think its someone else that will eat John Mc's ding dong.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cookiekush from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews/crimsonclad, and netuoso. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

This post has received a 0.63 % upvote from @drotto thanks to: @banjo.

Whatever @resteembot resteems, I resteem too!

I am a new, simple to use and cheap resteeming bot

I will automatically resteem posts resteemed by @resteembot until 2017-12-26 00:00:01 +00:00

If you want to read more about me, read my introduction post.