Powell disappointed the market, bitcoin once fell more than $4000

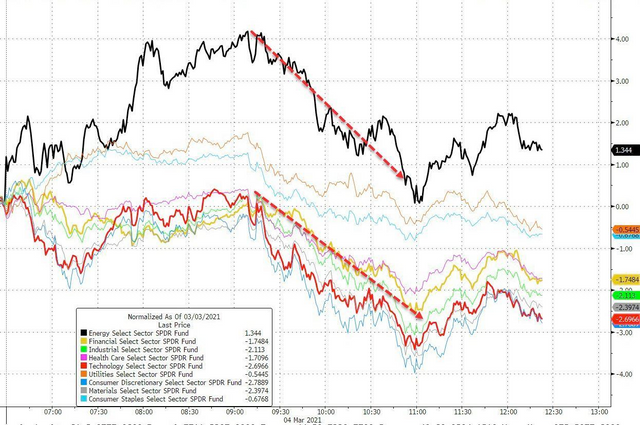

US Federal Reserve Chairman Colin Powell's speech did not show that he was worried about inflation and did not release the signal of possible action such as "operation twist". The yield of US debt soared in the intraday, and the US stocks accelerated the downward trend, continuing the killing trend dominated by technology stocks.Energy stocks led the way as crude oil surged as OPEC + unexpectedly didn't decide to increase production in April.

During the midday session of the US stock market, Powell mentioned that the recent fluctuation of the bond market attracted his attention. It is expected that the resumption of work may push up inflation, but it is a temporary recovery. He said that if the financial environment continues to tighten and threaten to achieve the inflation and employment targets of the Federal Reserve, he will be worried.According to the commentary, Powell did not give any hints as some investors expected to address the recent rise in interest rates.

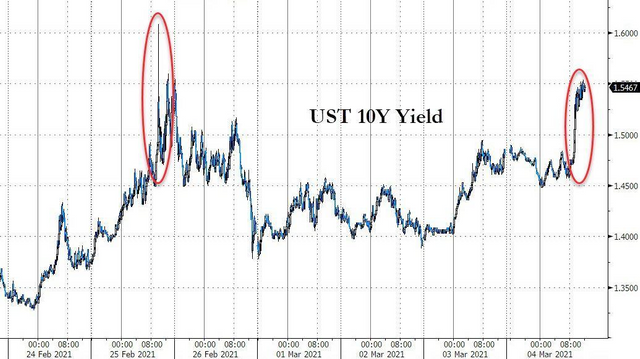

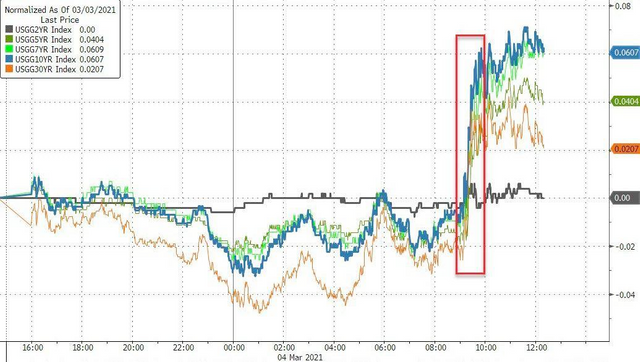

Powell's speech solidified the gains in the dollar and long-term US bond yields.During his speech, the three major U.S. stock indexes fell again, and the US dollar index jumped. The short-term yield of 10-year U.S. Treasury bonds rose by more than 8 basis points, breaking the daily high and breaking 1.50%. After his speech, the three US stock indexes continued to rise, and the U.S. stock market even rose to 1.56% after hours.

While the US dollar strengthened, cryptocurrencies such as bitcoin, industrial metals such as copper, and precious metals such as gold fell, in sharp contrast to another commodity, crude oil.European stocks were led by technology stocks and mining stocks dragged down by the fall in industrial metals, but European bond prices rebounded and yields fell.

Technology stocks continued to lead the decline, the US stock index once gave up all the gains of the year, while energy stocks continued to rise against the market

Mr. Powell's speech followed a flash crash in early trading on Friday.

The three major U.S. stock indexes opened higher on Friday, but all the gains and losses in early trading were quickly reversed. The Nasdaq composite index, which rose more than 0.5% at the beginning of the trading, fell more than 1.6% less than an hour after the opening.At the same time, the Dow Jones industrial average, which rose more than 180 points at the beginning of the day, fell more than 120 points, while the S & P 500 index, which rose nearly 0.5%, fell nearly 0.8%.The Dow and the S & P have since moved up quickly.

After Powell's speech, the three major stock indexes broke their daily lows. The decline of the Na index was more than 3.4%, and the decline of Dow Jones index was more than 720 points, and that of S & P was more than 2%. The largest decline of S & P was more than 2.5%.

At the end of the day, the decline of the three major stock indexes narrowed, and finally closed down for the third consecutive day.The Dow fell 345.95 points, or 1.11%, to 30924.14, the lowest close since February 3.The S & P 500 closed 1.34% lower at 3768.47, its lowest close since January 29.The Nasdaq composite index closed 2.11% lower at 12723.47, the second consecutive day of closing low since January 6, nearly wiping out all the gains since the beginning of the year.

Small cap stocks underperformed the broader market, with Russell 2000, a value oriented small cap index, down 2.76%, more than the three major indexes.

On Thursday, the NASDAQ fell below the 100 day moving average into an adjusted range, and the S & P also flattened all gains in the year.

Of the 11 S & P 500 sectors, only two closed higher on Thursday, with energy rising by more than 2%, far ahead, and telecommunications services up 0.03%.Among the declining sectors, information technology fell by more than 2.2%, materials and non essential consumer goods also fell by more than 2%, industry, health care and finance fell by more than 1%, followed by public utilities which fell by nearly 0.2% and essential consumer goods by more than 0.5%.

Among the six major technology stocks of faanmg, Google's parent company alphabet, which only rose more than 1% and Facebook, which rose nearly 0.9%, closed higher. Apple and Nye fell more than 1%, Amazon fell more than 0.9%, and Microsoft fell nearly 0.4%.

Chip stocks fell across the board, with the Philadelphia Semiconductor Index and semiconductor sector ETF soxx falling more than 4%. western data fell by more than 8%. TSMC, micron and NXP fell 5%.New energy vehicle stocks fell collectively, with Weilai auto down more than 5%, Tesla, which fell more than 5% in the session, closed down more than 4%, Xiaopeng auto fell by more than 2%, and ideal automobile fell by more than 1%.

Arkk, the fund that wagers Tesla's "bull Queen" Cathie wood, has fallen more than 5%, wiping out all gains this year, down 28% from its February high.

Ron Baron, a longtime Tesla shareholder and billionaire, said on Friday that his company had sold 1.8 million Tesla shares because it was too large in its portfolio and that selling could "mitigate the risk to customers.".Baron said he did not move on Tesla's more than 1.1 million shares and was still bullish on Tesla's shares to $2000.

Among the cyclical stocks, banks, airlines and tourism stocks also fell collectively, while most energy stocks rose. Brent crude oil fund rose by more than 4% and PetroChina rose 2%.

Popular zhonggai lost the market, with ETF cqqq falling more than 5% and kweb falling more than 4%.Interesting headlines fell by 25%, litchi by 24%, BiliBili by 8%, pinduoduo by 6%, baidu by 5%, Tencent ADR and Jingdong by 3%.

The pan European stock index ended three consecutive positive days on Friday, falling more than a week's high, led by mining stocks falling more than 4% in basic resources and technology sector falling by more than 3%. Oil and gas sector rose by more than 1% and led the market.

- European debt rebounded and 10-year US bond yields rose 10 basis points at one time

European bond prices rebounded and yields fell.The yield on the benchmark 10-year Treasury bond in the UK fell 5 basis points to 0.731%, while that of Germany fell 2 basis points to - 0.31% in the same period.

During Powell's speech, the yield of us 10-year benchmark treasury bonds rose by more than 8 basis points in a short-term to 1.50%. After Powell's speech, the yield once rose above 1.55%, about 10 basis points higher than the intraday low, about 1.54% at the end of the day, and rose 6 basis points within the day, reappearing the trend of a week ago. The US stock market broke through 1.56% and moved forward to the one-year high set by 1.6% on Thursday.

However, the short-term yield response was flat, with two-year yields almost flat at the end of Wednesday.

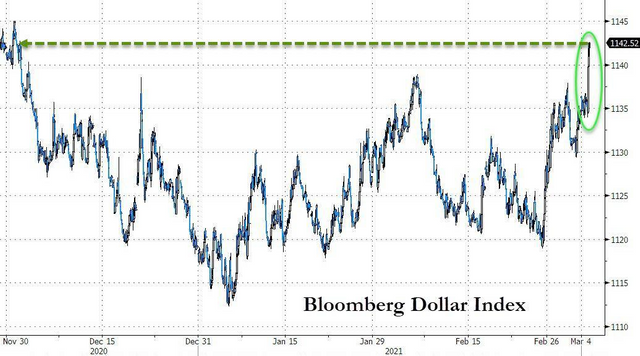

The dollar index hit a four month high, and bitcoin fell more than $4000 at one point

During Powell's speech, the ice dollar index (DXY), which tracks the exchange rates of a basket of six major US dollar currencies, rose above 91.50, a one month high. After the speech, it rose to 91.67, the highest intraday high since December 1 last year, and rose nearly 0.8% within the day.

By the end of Thursday's U.S. stock market, the dollar index was above 91.60, up more than 0.7% in the day. the US dollar spot index was up 0.7%, both up for two consecutive days.

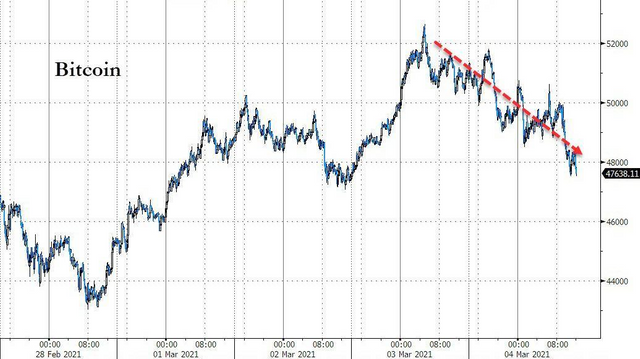

Most of the mainstream cryptocurrencies fell on Thursday. Bitcoin (BTC) fell to US $47500 in midday trading, a new day low, about US $4300 lower than the intraday high in Asian markets. US stocks closed above US $48100 and fell more than 5% in 24 hours.By the end of the U.S. stock market, only XRP was up in the last 24 hours, according to coinmarketcap.

- Crude oil rose more than 4%, the largest closing gain in two months, and the US oil hit a new high in nearly two years

In early trading on Thursday, the media quoted OPEC + representatives as saying that Saudi Arabia is prepared to continue to voluntarily reduce oil production in April and may, among which the scale of production reduction in April is still 1 million barrels / day. OPEC + is close to reaching a consensus and may maintain the oil production policy unchanged in April and will not reduce the scale of production reduction.

After the news, international crude oil futures rose rapidly.WTI crude oil in the United States broke through the $63 and $64 levels in a short period of time and returned to the high level since January last year. Brent crude oil broke through 66 and 67 US dollars successively, close to the high level since January last year.

After the meeting on Thursday, OPEC + announced that it would maintain the current oil production level and allow Russia and Kazakhstan to slightly increase production by 130000 B / D and 200000 B / D respectively. It is planned to hold a meeting again in early April to evaluate the policy.The Saudi energy minister also said that Saudi Arabia agreed to maintain the policy of voluntary additional production reduction of 1 million barrels / day in April, the same as in February and March, and that Saudi Arabia is not in a hurry to restore supply.

International crude oil continued to rise.In midday trading of US stocks, Brent crude oil once rose above 67.70 US dollars, up more than 5.7% within the day. WTI was close to 64.90 and rose more than 5.8% within the day.

In the end, WTI's April crude oil futures closed up $2.55, or 4.16%, to $63.83/barrel, the highest monthly contract closing record since April 30, 2019, and the largest closing gain since January 5, this year.Brent's may crude oil futures closed up $2.67, or 4.17%, to $66.74/barrel, the highest monthly contract closing record since February 25 last year, and the largest increase since January 5, this year, just like American oil.

- Gold hit a new 9-month low, while copper hit a two-week low. Lunni fell more than $1200 for two consecutive days, reaching a four month low

New York gold, silver and platinum futures fell for a second day in a row.COMEX gold futures in April fell more than 1.6% and closed 0.9% lower at 1700.70 U.S. dollars / ounce, a new low since June 5 last year, a new low in the same month after last Friday, Monday and Wednesday, and a new low since the 8th of the same month on Wednesday.

London base metal futures continued to fall collectively on Thursday, with the exception of lunni falling for two consecutive days.Luntong closed close to $8900, a two-week low, Lunzi a three-week low and lunpb a new low of about one and a half months.Lunni fell for three consecutive days, closing down 1284 US dollars. For the second consecutive day, it fell more than $1200, a new low since December 3 last year.