Akropolis - A DAO of Pension Infrastructure

Akropolis is a blockchain platform that organizes various pension funds, fund managers, and their respective clients. The project's concept is outlined in the context of a turbulent and chaotic situation in this field. As the economic landscape is currently getting reshaped by innovation, new technologies, job automation, Internet, work mobility, etc., the principles, that worked in the past and allowed workers to accumulate enough funds to guarantee their financial security after retirement, don't work anymore. People constantly change their jobs, work distantly, switching from project to project, moving to another gig and employer right after the previous assignment is finished. People move between countries and jurisdictions. In this heterogeneous environment, it's hard to implement a universal mechanism that would allow everybody to have a reliable retirement plan. Mostly it comes to the situation when people try to take the problem of pension savings in their own hands, putting aside money, making investments, and so on. Additionally, governmental social security mechanisms in most countries work as follows: pension funding is based on money, provided by the current generation of working people through taxes. This leads to the situation when demographic fluctuations between different generations cause this system to break down, now and again. For example, if the population has decreased, and, as a result, the current generation of taxpayers consists of fewer people, or their overall income is lower than it was in the past, then the funds, supposed to finance pensioners, won't be sufficient. To put it in the financial jargon, "retirement funds' assets won't be enough to cover their liabilities." Or, to be blunt, this accumulation of pension funds through taxes (given that the tax rate doesn't exceed a tolerable for taxpayers level) works mostly when the population and income levels are steadily growing. This leads some analytics to compare these social security mechanisms to a gigantic, state-level Ponzi scheme, where the dividends (pensions) of existing investors largely depend on the number of new participants, joining the scheme.

So, how blockchain technology can solve the current crisis in pension system? For example, it can bring some order in the chaotic array of various existing pension funds. There's a specific aspect of blockchain architecture that can prove to be useful, applied to this situation. Namely, blockchain is based on decentralized networks with potentially highly secure and balanced governance mechanisms. Those governance mechanisms are facilitated by Smart Contracts that guarantee that they will do exactly what's written in their code, and under no circumstances anything else. The code of Smart Contracts cannot be altered after they are submitted to the blockchain, and this guarantees a somewhat unbreakable system. Which is a good foundation for a platform, governed by a set of predefined rules written in code, in which any change in the rules has to be approved by the majority vote of its users. In other words, it's a system without a single point of control. Yes, I'm talking about Distributed Autonomous Organizations or DAOs. An important point here is that such a system guarantees an egalitarian principle of equal participation of all of its users in decisions regarding it. It means it doesn't matter that the platform may be founded and implemented by a certain organization and group of developers. Once the project is out in the wild, those founders and developers won't have any exclusive high level of control over the platform, which would put them above other platform's users. They won't be able to shut it down or change its algorithms without the consent of the majority of platform's participants. Technically, it's due to the fact that the entire blockchain project's code and data is distributed among multiple users' computers, rather than stored on a limited number of servers, controlled by the project's team. Plus, all the system's algorithms are written in Smart Contracts, which makes them a) transparent for everybody; every platform's user can see its algorithms, (and be sure that they don't contain any "Easter eggs" with financial consequences) and b) they are immutable. In other words, it's impossible to make any changes in the system, except through the special procedure when all the potential changes are put to a vote. If changes in the algorithms are approved by the majority vote they are implemented; otherwise, they are not.

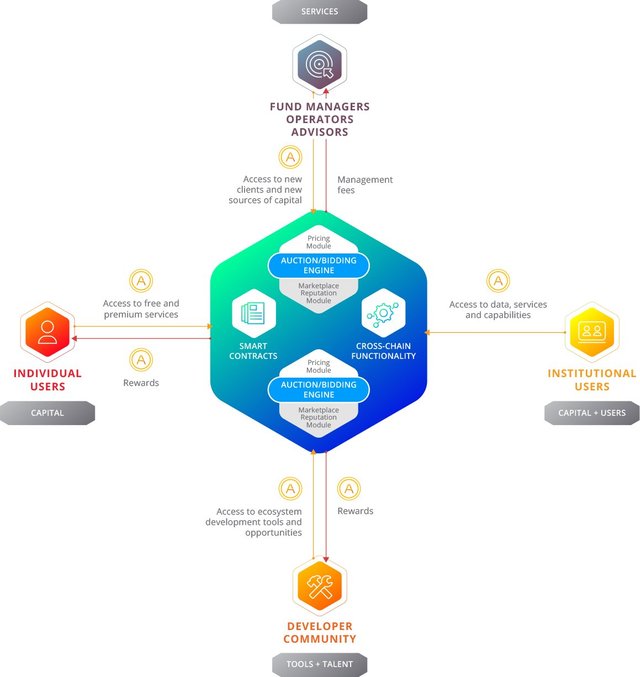

So, speaking of the Akropolis project, determined to improve the situation with pension systems and funds. The platform's underlying paradigm is a system that would create an atmosphere of financial transparency and accountability of all of its members. The platform includes the following categories of users: Pension Funds (PFs), Fund Managers (FMs), Asset Tokenizers, and Developers. Pension Funds, joining the platform go through the vetting process and further need to present regular reports on how they operate their resources. Adding some quirky plot twist, the platform also includes actors who financially benefit from exposing flaws, inconsistencies, and misinformation in Pension Fund reports. It's interesting how the Akropolis project explores this DAOs paradigm, exposing various potentially important aspects of such system. Probably one of the most important things is that DAO platform needs to be balanced. To break it down: a blockchain platform normally includes various categories of participants with different interests. There's no guarantee that some of them won't try to game the system. Since DAO system doesn't have any "moderators" who could stop any disruptive and subversive actions, the system needs to have "check and balances." In case of DAO "check and balances" are going to have a strictly economic nature. Here it's worth mentioning, there's a stark difference between blockchain style governance and, for example, the governance of Nation-States. Nation-States are essentially ruled by individuals who presumably have the nation's best interests at heart. Although, it's not always the case in practice, it's a key assumption, allowing this system to be viable in the first place. In other words, it’s not a Democracy in a true Platonic sense, when all the decisions are confirmed by the majority vote. Which is maybe for the better, considering Plato's warnings regarding such form of governance as essentially "the rule of the mob," that can be extremely dangerous. Ok, now here's an interesting thing. The blockchain governance is actually a Democracy in a Platonic sense, namely, it’s a system where all the decisions are made through the voting process. Such system doesn't have a central government of any kind, neither any group of people who have some extra. To draw an analogy, if DAO was a State, then Smart Contracts are this State's Constitution and laws. The executive power is represented by the blockchain itself because nothing can stop blockchain from executing something that, well, has to be done. And Legislative power is represented by the quorum of platform's users, and here's where the things start to get interesting.

Ok, so we have a system with no central authority and with various groups of participants driven by their self-interest. It's somewhat like a generalization of principles of market economy. It can actually be perceived as a model, in which an idea of the system, controlled by the balance of its participants' self-interest, is applied to all spheres of governance. The key thing here is to establish the rules that would give the participants an incentive to act in a certain way. In blockchain startups, implementing any sort of DAO model, it's usually called "applying game-theory principles." Game theory essentially studies how underlying motives and actions of individuals affect the functioning of a system with a defined set of rules. If actions of system's users are fundamentally defined by their self-interest that the most obvious approach to making such system stable is to introduce the rules that would align self-interest of various groups of individuals in a way that their self-interest driven actions would also benefit other groups of participants and the system as a whole. With a bit of a stretch, it can be said that this is an underlying mechanism of free-market economy. In the case of Akropolis this concept is applied, for instance, in a form of platform's "self-policing" of pension funds working on the platform. Basically it means that there's a group of users who have an economic incentive to reveal and expose any problems with pension funds' reports. This incentive is written in Smart Contracts that define the rules of the system from the beginning. More generally, the platform monetarily rewards honest behavior and punishes attempts to trick other users, or game the system in some way. Speaking of this, there is a remarkable principle generally known as a "staking mechanism," and it's widely used to motivate the participants of self-governing platforms to be honest and make responsible decisions. So how does it work? The method utilizes a specific class of "reputation tokens." When users take part in some decision making process, which outcome has to be determined by the majority vote, they stake those tokens on their votes. To draw an analogy, if I go to, say, a Presidential election, and I have to stake on my vote some points in the score, defining my reputation. Let's assume that my reputation score is public and visible to everybody. My reputation defines many aspects of my life, including jobs I can get or people who would be willing to communicate with me, etc. So if my reputations score decreases, it would have obvious negative consequences for me. So I don't want to lose my reputation points. According to the "staking mechanism" principle, if I go to the Presidential elections and vote for somebody, and the majority of people votes for somebody else, I lose "reputation tokens" I've put on my vote. In other words, my reputation would decrease if I vote wrongly, which makes me wonder when I enter the election booth "what the opinion of the majority would be?" To make this analogy more accurate, there are no election polls or any other statistics that would allow me to gauge public opinion. Which is good, because otherwise it would be a "bandwagon" system. When I cannot guess how other people are going to vote, the only remaining option I have is to assume that, since people are smart and rational beings, they are going to make the most smart and rational choice. Then I try to decide what would be the most smart and rational choice and cast my vote accordingly. Also, another important moment: reputation tokens don't have any clearly defined market value, even more so, they are not tradable. Which is also important, because it prevents the situation when those with higher pile of reputation tokens would also have more influence in a decision making process. According to the Plato's classification, this system would essentially be an Oligarchy, where citizens with more wealth automatically have more political power. Ok, getting back to the actual implementation of staking mechanism in the blockchain autonomous governance. Well, this system proved to be workable and currently is a de-facto standard component of blockchain voting models. It's worth mentioning that user's reputation score (reputation tokens), though technically not having a monetary value, plays a significant role on blockchain platforms, since it programmatically determines user's privileges and limitations, ability to earn money, etc.

I won't get in all the gritty technical details of the Akropolis project; suffice to say that it's a thoroughly thought-through concept of a self-governing system. While Akropolis aims to use it to bring order to the pension infrastructure, this concept and its underlying technological and organizational principles can, in fact, be used in many different ways. The most interesting aspect of this startup is its technical implementation of Distributed Autonomous Organization.

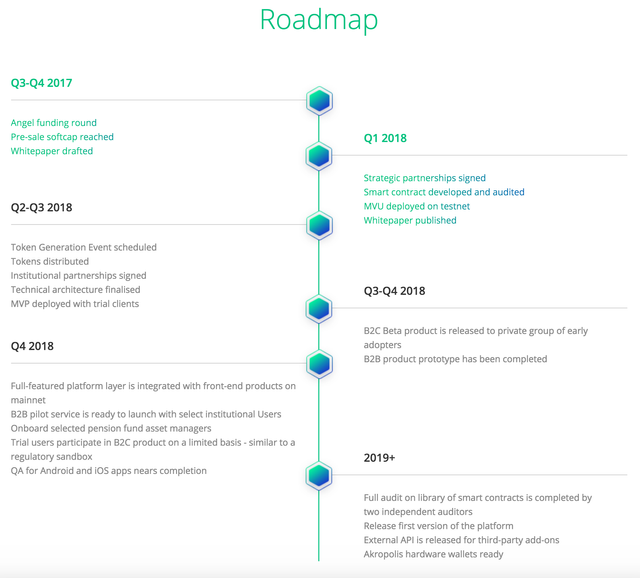

In June 2018, Akropolis will conduct a token sale, aiming to distribute 40% of its total supply of 900,000,000 tokens. The hard cap of the sale is $25,000,000.

Useful links

Website | Whitepaper | Telegram | Facebook | Twitter | Medium | LinkedIn | Github

This post was resteemed by @steemvote and received a 45.93% Upvote. Send 0.5 SBD or STEEM to @steemvote

This is my @originalworks

This post has received a 0.18 % upvote from @drotto thanks to: @cryptotaofficial.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by popeye from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.