Steemit Crypto Academy Season 4 Week 6 [Advanced Course] | Investment through Private and Public Sales

Greetings friends, it's my pleasure to participate in this week's crypto academy lectures, more so I wish to appreciate professor @fredquantum for such an incredible lecture as this, below are my take on the following questions.

1 What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

Crypto investment has been one of the lucrative businesses in this 21st century although with a very high probability of risk but based on an investors risk management, profitability is inevitable.

On the contrary, investment in crypto can be in different forms. For instance, one may choose to invest through buying and holding and on the contrary becomes a holder or hodler of the coin.

Some other people may also invest through short term buying and selling to make profit within the shortest possible period.

Others may also invest through initial offerings, this is also an investment opportunity to some people on the contrary, whichever way that seems profitable to any one he can also invest.

Finally we should understand that investment in Crypto Assets shouldn't be without proper knowledge of the asset and medium one wishes to capitalize to invest.

To be able to proficiently and exquisitely utilize the different investment mediums, an investor should have, if not absolute but proper knowledge of the asset he/she wishes to invest on.

This incorporates the price of the asset when it will be traded in comparison to its current price, the exchanges where it will be traded, the time it will be listed on exchanges, the total minted supplies of the coin etc.

The investigation above can be carried out on different exchanges where most of them compile a list of assets that will soon be released and traded on their platforms. Through this medium, exchanges raise funds on behalf of the Coin inventors and investors on the contrary buy these coins at a cheaper rate This medium is called Initial Exchange Offering.

Nevertheless, an investor can also navigate through coinmarketcap.com

to discover all the initial coin offerings and their criteria

The coinmarketcap medium can also be used to ascertain the volume, market cap, price, total supplies etc of an existing asset which can also aid an investor in taking certain diplomatic steps in investing in an asset.

An investor can also use some other tools like crypto charts, that is the trend of an asset in making decisions on when to buy and exit the market.

Indicators on the other hand is also a good investment tool which can help in taking necessary buy and exit orders in the market be it long or short term buy or sell.

Finally the on-chain metrics is also a helpful medium, where an investor can utilize tools like sentiment in determining the possible trend of an asset especially for long term investors and other similar tools.

2 Talk extensively about the following. Also, highlight the benefits and risks associated with each.

i. Private Sale in Cryptocurrency.

ii. Presale in Cryptocurrency.

iii. Public Sale in Cryptocurrency.

PRIVATE SALE IN CRYPTOCURRENCY:

This is an early stage in the sale of a particular cryptocurrency. At this stage, investors buy the crypto currency in a reasonable quantity at the minutest price and have a larger control of the assets before it's being sold to the public.

This stage of sales is majorly to firms and corporate bodies who shows interest in the sales and as well well to do investors who can pump reasonable some of fund into the invention.

These investors could be viewed as whales in the said crypto asset. For instance in steemit we have heard about @tipu and @trafalgar and some major stakers in the steemit ecosystem.

BENEFIT OF PRIVATE SALE

HIGH VOLUME OF SALES:

At this stage, it is easier for inventors to have a greater part of their asset sold since the investor would be buying in a very large quantity due to reduced price.INCREASED PURCHASES

In this regard, investors are at advantage in buying a very large quantity of the asset since it was offered at a low rate.HIGH RETURNS

Investors who were able to grab the opportunity at this stage are entitled to higher returns once the crypto asset comes onboard

RISKS ASSOCIATED WITH PRIVATE SALES

- LOSS OF ASSET

Due to the uncertainty of events, where probably the inventor or inventors could not meet with certain demands and perhaps the project was dropped, it will result in possible loss of investors funds.

This kind of investment involves a very high risk and on the other hand, let's assume that the project's price was traded at a lower rate after being listed on exchanges, it will actually cause a great loss on the side of investors.

- VERY HIGH RISK INVOLVEMENT

Investors in this regard who could have possibly invested about 90% to 95% of their income or savings may lose

everything if the project probably fails.

PRESALE IN CRYPTOCURRENCY

This is carried out in cryptocurrencies before it's initial coin offering and at this level, the project currency is sold to interested investors at a certain rate although at a limited quantity which may not equal to the sales made to individuals at the private stage.

At this stage therefore, investors can also use a portion of the available crypto in their wallet while using a specified network in purchase of the new crypto before it's full operation in exchanges.

BENEFITS OF PRESALE

The following are the benefit of presale but not restricted to:

- LOW AND AFFORDABLE PRICE

The price at this stage is very low so as to encourage investors to buy the limited quantity of the asset.

Investor in this regard buys the asset as much as they could based on meeting with the criteria for purchasing the crypto

- ENCOURAGING RETURNS

After the launch of the crypto and it was able to sell profitably on exchanges, the investors on the other hand will enjoy a good and encouraging profit from the investment.

On the other hand, the investors will also enjoy quick profit or returns as the crypto sells profitably.

RISKS OF PRESALE

The following could be considered as the risks associated with presale.

- LIMITED SALES

This stage is associated with limited sales as compared to what could be obtained from the private sales. Since the inventors want the asset to be distributed at a wider range they would prefer to sell limited quantities of the crypto to investors at this stage after the private investors have taken a larger quantity of the assets.

- DELAY AND UNCERTAINTY

There is always uncertainty in the launching of a new coin or token, therefore let's assume that the token could not meet certain demands in it's launching, probably technologically or otherwise, this will cause a delay in the expectation of investors as they may lose confidence in the token for lack of competency on the side of the owners.

PUBLIC SALE IN CRYPTOCURRENCY

This type of sales in cryptocurrency is carried out when a token was not able to reach the demand of its market capitalisation at the presale stage.

Public sales also occur after I token has been listed in an Exchange and are at various customers disposal but is shut off their Intended market capitalisation.

- BENEFITS OF PUBLIC SALES

The following are the benefits of public sales of cryptocurrency but which are not limited to:

- IT HELPS IN REALIZING MARKET CAPITALISATION

This helps token honours to easily realize their market capitalisation after their intended capital was not able to be met.

So on the side of taking honours it helps them in generating their full market capitalization.

- LITTLE OR LOW RISK INVOLVED

There Is very little involvement of risk at this stage of sales because this is after the coin has been listed on exchanges.

At this stage, an investor may choose to buy if the token is profitable, so if the token is actually profitable, he may choose to buy as much as he/she could.

- RISK OF PUBLIC SALES

DUMPING OF THE ASSET

In the scenario where the token that was launched has a discouraging value or traded below expectation, it will lead to the dump of such token by impatient investors.

- HIGHER PRICES

Investors who would want to invest into the said token at this stage may not purchase it at the same rate the presale and the private sale stage investors were able to afford it, in other words the price may have increased

3 What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

The different mediums used in private, pre and public sale of crypto currency are expantiated below.

EXCHANGES

Most exchanges has a medium for supporting new coins through IEO where the about to be launched token and it's criteria for purchases are given for public view and participation for instance most exchanges like Huobi and Binance has the new coins on their Launchpad.WEBSITES

Many websites are used as a medium in the sale of different crypto currencies, as they make publication on the criteria necessary for the purchase of the crypto asset.SOCIAL MEDIAS

Most times, social medias like telegram, WhatsApp etc are used for directing the public especially for the purchase of a cryptocurrency.PERSONAL CONTACT

Many coin offerings are sold by just meeting interested and able investors in person and explaining to them the possible benefits derivable from investing in the coin.

4 Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

This is a DeFi project which uses a deflationary utility token and it also operates as a BEP20 token on the BSC network.

This token was developed by John Karony and some other notable personalities like:

Hank Wyatt (CTO), Thomas Smith (CBO), Charles Karony (executive assistant), Jack Haines (COO) and Jacob Smith (web developer). and the project was launched on 8th of march 2021 with some good features like smart contract static reward, manual burn, automatic liquidity pool and safe earn.

The safe moon protocol as I earlier said uses the BEP-20 protocol and also BSC network. It has a transaction fee of 10% of your asset while it distributes 5% of the fees to holders of the safe moon token; this actually creates a good incentive for holders of this coin.

The remaining 5% of the transaction fee is divided into two while ½ is shared to BNB and hence added to pancake swap and the final half is sold as smart contract to BNB token.

Safe Moon as a token also goes through the process of burning in order to appreciate its price and demand in the market.

Some exchanges that accept the safemoon token includes:

Gate.io, Pancake swap, Bank, Bitbns.

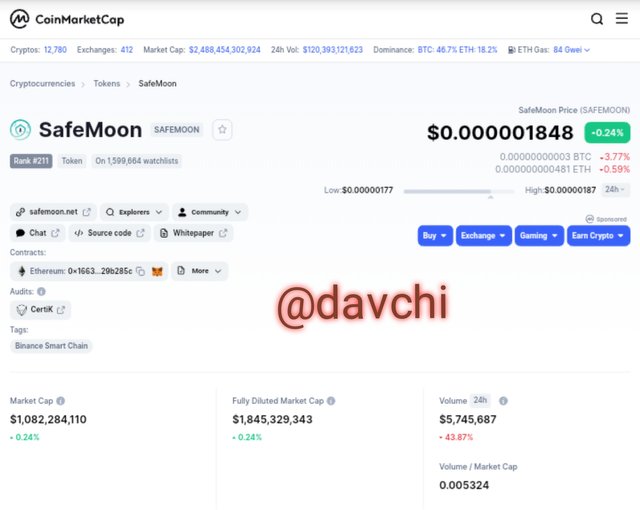

Finally at the time of writing this post, the current price of safemoon is $0.000001867, a trading volume of $5.8m, circulating supply of 585,536.37b safemoon and a market cap of $1b

We can also see its current chart and market analysis below.

5 Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

Dav Token:

The Dav Token is a deflationary DeFi crypto currency that is built on the TRC20 network

This project was invented by Dacvhi as the CEO with some other dignitaries like; tipu as SA, ngoenyi as PA, talktofaith as Blockchain Technologist, focusnow web-developer.

The token will be launched in Nigeria in no distant time using the TRC20 network, after meeting with the private, presale and the public sale hopefully on the 30th of March, 2022.

It will be used as a medium for raising funds and earnings through staking on Huobi, JustSwap and Binance Exchange and also for trades on futures, margin options and Spot trades specifically.

To improve in the tokens price mechanism, Dav Token will always be burned periodically to maintain a good price scale in the market while maintaining smart contracts.

Nevertheless, the finance team has come up with a summed proposal of $900m to cater for the project and hence we have decided to give it out as an initial coin offering ICO in the following regard.

We made a total supply of Dav token at 200m at the price of $0.5 each, which we have also given 90m of it to Binance, Huobi and JustSwap on equal bases for sales as IEO and also for public sales on their platforms.

We were able to sell the remnant which is 110m pieces of it in the following order to private, pre and public sales as an ICO;

PRIVATE SALES CONTRACT

Dangote group of companies showed interest as the white paper of the project was given to them and they agreed on purchasing a 30m token on the 20th of November 2021.

They also agreed never to dump the coin as they are major stakers in this invention.

OUK group of companies has also shown interest as a private memo was sent to them indicating more of the profitability associated with the project.

In this regard, they purchased 30m Dav token on the agreed date being 5th of October 2021.

Although these two investors were the people we decided to sell the coins to on the private sales level.

OUR PRE-SALE CONTRACT

The technical team of our Blockchain token contract were able to purchase 100% of the remaining Dav token which is 50m pieces of it since a public offering was made through the exchange medium to reach the masses.

Our technical team agreed on minting more token based on the demand of our token in the nearest future.

When all sales would have been realized, we will be having a market capitalization of $100m from the sales and price at $0.5

That is, MKT Cap ÷ T. Supply.

It is agreed that every sale by any investor will be charged at 8% sales charge

And in these charges, 3% will go to investors that are the holders of the coin, 3% will be shared among the three exchanges, and the remaining 2% go to TRC20 as a smart contract.

The Dav token is to be purchased with $0.5 worth of any TRC-20 token.

Details:

Token name: Dav Token

Founder:. Davchi

Launching Date: 30/03/2022

Total supply: 200,000,000

Price: $0.5

Website: www.Davtoken.net

Company: Mainstream group of companies.

6 What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

The criteria for listing any token on Coinmarketcap includes the following

The token must have a leverage cryptography, it must possess consensus algorithm, it must have a defined clear distributed ledger, for it to also function as a store of value it should also possess smart contracts before being listed in coinmarketcap

the Token must also have a functional or operational block explorer and website.

the Token must be actively traded on at least one exchange before it will be listed on coinmarketcap

the token owners must provide a representative through which communication can be established as to reach out to the token owners with regards to any clarification.

With regards to listing of assets on exchanges, it is believable that many exchanges had their criteria for or before assets could be listed on their Exchange.

Source

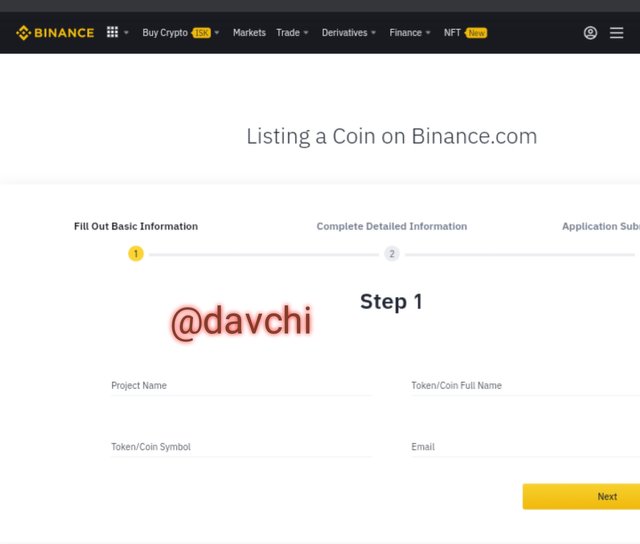

Nevertheless, I will be making use of the Binance Exchange in illustrating this.

First there are two means of listing assets on Binance.

First is through direct online application form and the Launchpad Launchpad or pool. Through these two mediums for instance, one can get his asset listed on Binance.

Let's see the First parameter applicable in the enlistment of assets on Binance.

First you have to provide well detailed information about the asset or token in question you wish to be listed on Binance.

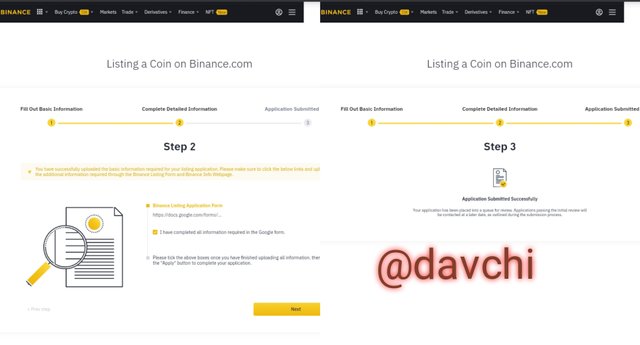

Next is to fill an online form which consists of the asset name, your mail and some other information about the asset.

And the final stage is the submission of the form you already filled then you wait for Binance response which may take also take time

Some other tips includes:

The provision of every possible information that could be communicated to Binance and also the filling of form by the project founder that is the CEO which may or may not be responded to as soon as possible as this is a Norm in Binance

Next is to constantly update the progress of the Project which could be weekly or monthly as this is highly valued by binance. And if your assets rank high after being listed, it is an indication of growing a good user base.

Next you have to incorporate or raised BNB or BUSD during your fundraising phase or process.

Next is to support BNB in your community

Don't ask for a contact person and don't also shill coins to CZ,

Don't send your white paper to CZ, don't also pressurize binance in listing your assets on their platform.

Finally, there is no fixed fee that is payable by any one; rather you can deposit some coins which you are also comfortable with and willing to pay to Binance which Binance on the other hand directs to Binance charity.

CONCLUSION

Crypto investment is actually a good means which helps in raising funds to both inventors and investors simultaneously.

But proper analysis must be carried out into any coin that one wishes to invest on and more so the utilization of proper tools that can aid profitability on the side of the investor is highly encouraged. Thanks for patiently going through.

Cc : @fredquantum