A “Dirt Cheap” Investment Most People Don’t Know?

The best investment experts are discussing if shares are overvalued. If bonds are too expensive. If there is a bubble on these markets. The opinions, like always, are different, but no one says, shares or bonds are undervalued, or very cheap.

Forgotten investment is good

Almost nobody is saying anything about commodities. Nobody cares, only some hardcore experts. And that is a good sign, in my opinion. Forgotten investments at “dirt cheap” levels, with low valuations? Welcome, seems to be the best buy for me. Maybe the chance of a lifetime.

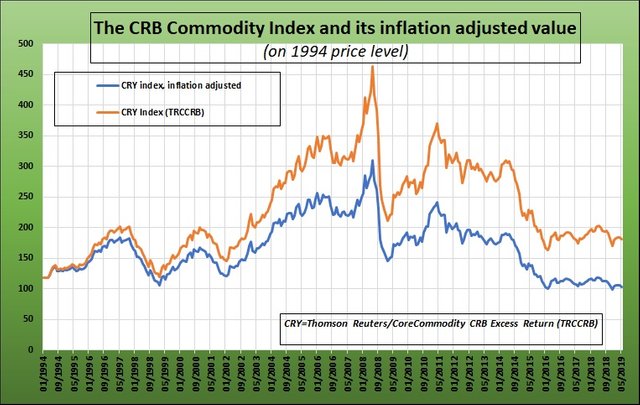

The crude oil was on many years low in February 2016. Platinum is very cheap (palladium isn’t), coffee is near many years lows, wheat and corn are, at least, not very expensive. Cacao was really cheap some years ago. In general, prices of most commodities are relatively low in the last months, years. That is showing us also the CRB Commodities Index (CRY), with its newer name, the “Thomson Reuters/CoreCommodity CRB Excess Return Index”.

17 years low

As you can see on the chart, the orange line, the index is moving in a downtrend, since June 2008, or April 2011. It was only lower in February 2016 (crude?), and before, in 2002. So, commodities are near 17-years low now!

But I was wondering how inflation can modify this picture. I searched for long term data and found the mentioned CRB Commodities index since January 1994. So I made an inflation-adjusted version of the index, I re-calculated practically the index value on the price level of 1994.

My surprise

Surprise! The CRB Index was at 118.5 points on the 31st of January 1994, and now, near 180 points. That is only 52 percent growth. But, the inflation of the US dollar (growth of consumer prices in the USA) was around 74.8 percent in 25 years. That means, commodities are cheaper than in 1994. The adjusted index value is only 103.2, 13 percent lower than in 1994.

How can this be if the resources of the Earth are depleting?

The fact is, after 1994, the commodities prices began to surge and we can observe two other uptrends from 1999 and 2002. The inflation adjusted commodities prices index, about 103 in this May, was only two times lover: In February 2016, and December 2018. That means: Commodities prices are on one of the lowest levels in more than 25 years, in real terms.

Is this a trap?

Or, that is what it seems to be. I’m cautious for two reasons. One is the famous contango. That means, longer commodities futures prices are higher than near-month settlements. That is good for short sellers, but bad for long buyers. And this can influence also the values of indexes.

With other words: The fall of the index can be in part a result of this contango. A “roll-over loss”, a technical issue. WTI type Crude was about 15 USD in January 1994, now, 56.50. Gold also tripled in 25 years. Some soft and agricultural prices are not so high. What is a reality?

More and more questions

The other reason why I’m cautious is, I don’t know if, in 1994, the prices of commodities were high or low. The CRB Index was invented allegedly in the ‘50s already, but I can’t find earlier data. Why are they publishing only the data from 1994? I must continue my research.

(Cover photo: German mines. Pixabay.com)

With all the flooding in the great plains, corn is not going to be planted, certainly not the hight yielding long season varieties, in much of the corn belt.. I am thinking the market will catch up soon to the idea that the crop this year is going to be low. Also a million calves were killed in flooding in Nebraska this spring. That is going leave a mark on next years beef prices.

Corn is skyrocketing already, 20-30 percent in 2-3 weeks...

https://www.investing.com/commodities/us-corn

It is the right way for sustainable development.nice presentation

The charts sure raise a few questions.

I look ahead in time and climate change aside, we are heading to a major problem in agriculture as farmers leave the land. The hard part is finding ways to invest in the sector at any scale and outside of the futures markets.

I suppose agricultural and mining technologies are continuously improving, productivity surges. Fewer farmers produce more. Or smaller areas are producing the same. But there can be a limit of this, resources of Earth can deplete.

Reduced farming area is such a high risk. If those areas suddenly hit by disaster food supply can fall dramatically.

Mining companies, agricultural producers?

Bayer-Monsanto is cheap now. :)

Most of the people don't even care.

Why?

They have no money to invest.

@deathcross purchased a 59.11% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com

You got a 73.20% upvote from @spydo courtesy of @deathcross! We offer 100% Payout and Curation.

Congratulations @deathcross!

Your post was mentioned in the Steem Hit Parade in the following category: