How is IRB stock in last 5 years in india? And how it is performing in context of the dividend and the growth?

Based on the search results provided, IRB Infrastructure Developers Ltd.'s stock performance in India over the last 5 years has been strong, with significant returns compared to both the Nifty 100 and Nifty Infrastructure indices. Here are some key points about IRB Infrastructure Developer's stock performance and dividend growth:

- Over the past 3 years, IRB Infrastructure Developers Ltd. generated a return of 548.14%, significantly outperforming the Nifty 100, which returned only 54.06% over the same period.

- The company's stock also performed well against the Nifty Infrastructure index, generating a return of 548.14% versus the index's return of 107.99% over the past 3 years.

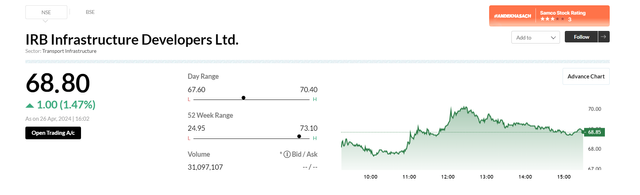

- IRB Infrastructure Developers Ltd.'s stock price moved up by 1.48% from its previous close of Rs 67.80 to Rs 68.80 on April 26, 2024.

- However, the company's dividend growth rate has been volatile over the past 3 years, with a highest 3-year average dividends per share growth rate of 81.70% per year and a lowest of -26.30% per year. The median dividends per share growth rate was 26.00% per year.

- The company's PE ratio is currently at 74.62, indicating that the stock may be slightly overvalued relative to its earnings. Its PB ratio stands at 3.05, suggesting that the stock is fairly valued based on book value.

- The company's dividend yield is currently at 0.30%, meaning that shareholders receive a relatively small cash payout relative to their investment.

Overall, IRB Infrastructure Developers Ltd.'s stock performance has been impressive over the past 3 years, although the company's dividend growth rate has been somewhat inconsistent. Potential investors should consider conducting additional research or consulting a financial advisor before making any investment decisions.

Sort: Trending

[-]

successgr.with (73) last month