How is SJVN india performance for dividend stocks? How many stocks do I need for 5000 Rs a year dividend?

Based on cutoff of 2021-09, SJVN is a public sector undertaking involved in hydropower generation and transmission in India. For example, in fiscal year 2020, SJVN announced a final dividend of ₹1.60 per equity share, resulting in a total dividend payment of ₹1,615 million.

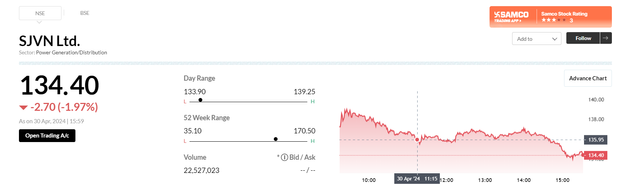

To determine how many shares of SJVN you would need to own to generate a dividend income of ₹5,000 per year, you would first need to know the current market price of the stock and the latest annual dividend per share. Assuming the current market price of SJVN is around ₹135 per share and the most recent annual dividend per share is ₹1.60, you would need to divide your desired annual dividend by the dividend per share to arrive at the required number of shares.

Required Number of Shares = Desired Annual Dividend / Dividend Per Share

In this case, assuming no change in the dividend amount, you would need to own approximately 3,125 shares of SJVN to generate a dividend income of ₹5,000 per year (i.e., ₹5,000 / ₹1.60). Please note that this is just an estimate and actual numbers may vary due to changing market conditions, corporate actions, and other factors.

As with any investment decision, it is important to thoroughly evaluate the potential risks and rewards of investing in SJVN and seek advice from a qualified financial professional if necessary. Additionally, keep in mind that relying solely on dividend payments as a source of income may not be sufficient and it is generally advisable to have a diversified portfolio spread across different asset classes and sectors.