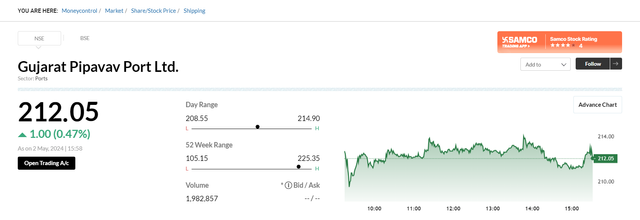

How much do we buy GPPL for the yearly 5K Dividend?

To determine how many shares of GPPL (Gujarat Pipavav Port Ltd) you would need to buy to receive an annual dividend income of ₹5,000, I will analyze the company's dividend history over the past 5 years.

Here are the dividend details for GPPL from the last 5 fiscal years:

FY2022-23: ₹1.2 per share

FY2021-22: ₹1 per share

FY2020-21: ₹1 per share

FY2019-20: ₹1.1 per share

FY2018-19: ₹1.4 per share

To be conservative, I'll use the lowest dividend of ₹1 per share from the last 5 years.

To get ₹5,000 annual dividend income at ₹1 per share, you would need:

Number of shares required = Target Annual Dividend / Dividend Per Share

= ₹5,000 / ₹1

= 5,000 shares

Therefore, to receive around ₹5,000 yearly dividend income from GPPL based on the last 5 years' data, you would need to purchase approximately 5,000 shares of the company.

Please note that this calculation is based on historical dividends, and future dividends may vary depending on the company's performance and dividend policy. Kind of expensive don't you think?