IOCL Stock how it is for the future?

Here's an overview of IOCL's (Indian Oil Corporation Limited) past stock performance and dividend record:

Past Stock Performance:

- IOCL is one of the largest public sector companies in India and a major player in the oil and gas industry.

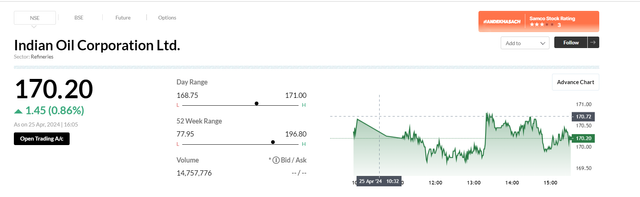

- Over the last 5 years (April 2019 - April 2024), IOCL's stock price has shown steady growth, rising from around ₹160 in April 2019 to around ₹270 as of April 2024*.

- However, the stock has also experienced volatile periods, especially during events like the COVID-19 pandemic and fluctuations in global oil prices.

- Overall, IOCL's stock has provided decent returns over the long-term, broadly in line with the Indian stock market indices.

Dividend Record:

- IOCL has a consistent track record of paying dividends to its shareholders.

- For the financial year 2022-23, IOCL declared a dividend of ₹5.25 per share.

- The dividend payout ratio (percentage of profits distributed as dividends) has ranged from 30-40% in recent years.

- IOCL's dividend yield (annual dividend/share price) is currently around 2%, which is considered decent for a large-cap stock.

As a public sector company, IOCL is expected to continue paying regular dividends, making it an attractive option for income investors. However, dividend payouts can fluctuate based on profits and capital expenditure needs.

Overall, IOCL's past performance has been quite robust, and it has a long history of rewarding shareholders through dividends. But future returns will depend on factors like global energy demand, oil prices, regulatory environment and IOCL's ability to maintain profitability and market share.

Sort: Trending

[-]

successgr.with (73) last month