AAVE/USDT Buy | S6T4 - Team Trading Post for Fredquantum-Kouba01 Traders Team

About The AAVE Token

Stani aimed to build a blockchain protocol where users could lend and borrow funds.

Making the AAVE the first Defi protocol to be built that permits its users to borrow and lend funds. The AAVE works more like how yield-farming works. The lender's asset would be locked in the liquidity pool till the preferred time and earn some partial income.

Interest would be given to lenders for locking their assets in the liquidity pool. The borrower would be allowed to borrow some funds but the borrower needs to deposit some funds to be used as collateral in case there’s any problem with the lender’s money, the collateral would be used to intervene.

Before 2018, The AAVE protocol was known as the ETHlend. As I said earlier, the AAVE provides some discount to the liquidity providers or the lenders. The AAVE is built on the Ethereum blockchain technology that’s why is currently using the proof of stake consensus algorithm. Users stake their assets to earn income.

The AAVE token was built to be used for transaction gas fees on the AAVE platform. However, due to how outstanding the project is performing, the AAVE token has attracted more investors to invest. Now the AAVE token is among the highest price cryptocurrencies.

In 2020, in the cause of the defi craze, the AAVE recorded the highest project regarding the highest value of asset stakes in its liquidity pool. This is one of the biggest achievements of the AAVE Defi protocol.

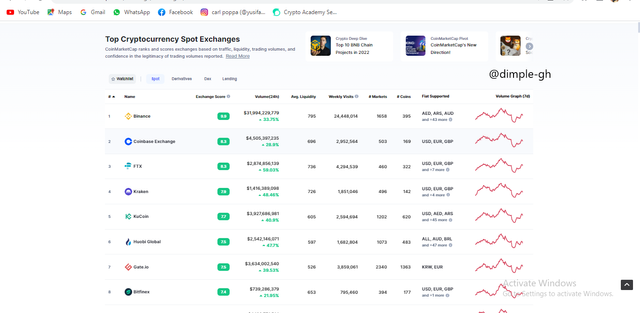

The AAVE token can be traded on many exchange platforms. Including the topmost exchange platforms we have.

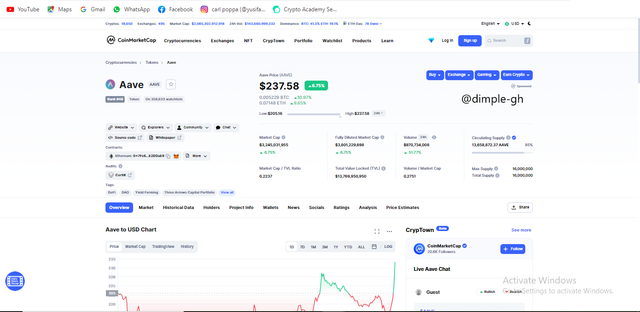

price data of AAVE token

According to the Chart above, the AAVE token is ranked #48 among the current altcoin rankings.

The current price at the time of the assignment is $237.58

The current market capitalization is $3,245,031,955

The Fully Diluted Market Cap is $3,801,229,698

The total supply of the AAVE token is 16,000,000

Technical analysis about AAVE Token

I would make technical analyses on both longer and shorter timeframes. It is always advisable to make a complete analysis before you enter into trade.

Analysis on 1-day timeframe

From the chart above, the momentum is bearish. The price is making a series of lower lows and lower highs. However, the price has broken above the resistance trendline which suggests a bullish trend reversal.

The price is currently above the 100 moving average which also suggests a bullish trend. Usually, when the price falls above the 100 or 200 moving average, we consider the whole trend to be bullish.

The breakout occurred just at the point where the trendline and the 100 moving average met.

Analysis with 4-hour timeframe

The 4-hour timeframe is showing something exquisite here. All the key levels and the resistance levels are been broken.

Initially, the price broke above the first key level. When the price reached the first resistance the price retraced back to the key level and broke above the first resistance again. This is to show that, indeed the price is in a strong bullish momentum. All key levels are been broken.

Finally, the price has been rejected again by the second resistance which is an indication that the price could break above the second resistance in the bullish run. Price is expected to break above the second resistance as seen in the chart above.

The MACD is also bullish and it’s above to crossover for a signal.

Analysis with 45-mins timeframe

All the confluences above have given a clear bullish signal. However, it’s very advisable to know the right time to enter the market.

The price is forming a bullish market structure at the moment. Hence, the price is expected to break above the previous higher high before its retraces back to the trendline. Hence, we would trade on the breakout.

The ultimate oscillator is currently reading 61.7 which also indicates a buying opportunity. It’s always advisable to trade with good risk management.

we place our stop loss just below the long bullish candlestick and set a reasonable take profit.

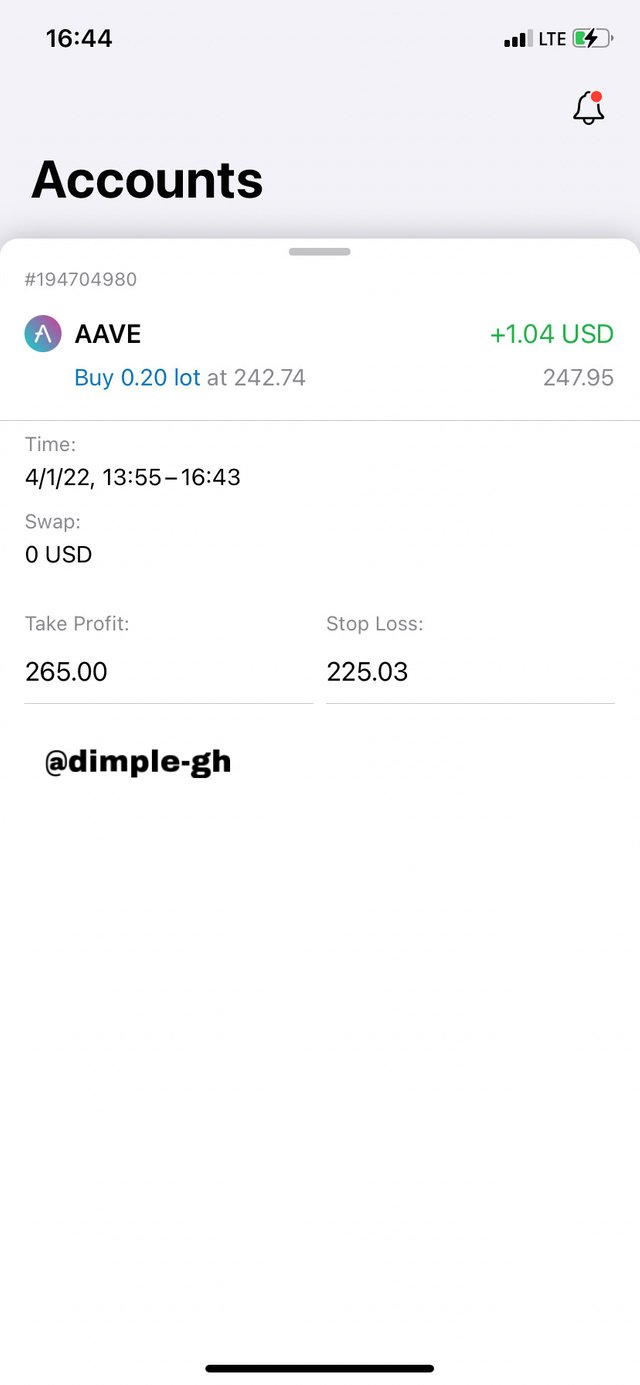

Trade placed in my Exness Broker account

- Today I was not able to make more profits due to the widespread of the token on my broker account.

Conclusions

Today, I made some good profits. I closed the trade at 20 pips profits this is because I used good risk management. Talking from price movements, I could have made more profits if I had waited for take-profit.

However, the price could have retraced back to probably stop loss. That’s why is very good to take partial profits when necessary.