Crypto Academy/season 3/week 6-home work post for @yohan2on/ Crypto Scams and how to avoid them

Good day steemians. I really enjoyed participating in this assignment by @yohan2on as I'm sure a lot of people looking to venture into the crypto space have either fallen victim of crypto scammers or have encountered them and luckily, didn't fall victim.

Now let's begin.

1. What are crypto scams (Make your research on any crypto currency scam.)?

As a result of the increasing popularity of crypto and since there's so much high prospects of making huge profits, people don't do proper research or know how to spot when something doesn't seem right, they fall easy prey to crypto scams.

Crypto scams are attempts made by frauds to swindle people of their money using crypto, leaving them high and dry. crypto transactions can't be reversed and it doesn't really have any legal backing, so many scammers opt to use this method to swindle people looking to invest and make profits.

Crypto scams could present itself in a number of ways;

Social media scams:

Sometimes, hackers attack social media accounts of people with large followers who look up to them and use their accounts to drop misleading crypto information that could rob the followers of their crypto assets. They could also create fake accounts and use it to lure people online into giving them crypto assets.

A popular case was the one that occurred last year, July 2020, where impostors hacked certain Twitter accounts, pretended to be certain influential people in the tech space and convinced people to send their Bitcoin to a certain wallet and it would be doubled as a charitable gesture. Among the people were Elon Musk, Warren Buffet, Bill Gates and other influential people.

Their followers immediately responded to those tweets and started sending in their Bitcoins within a few minutes of that tweet.

Investment scams:

This works typically like a ponzi scheme, where people are promised really high returns if they send a particular crypto asset to the company. Eventually, when a lot of people have gained a lot of trust in them, they close up and vanish without a trace. Since crypto transactions are irreversible, one can't get his asset back.

Email scams:

Sometimes, scammers could get people's emails through certain email lists gotten by hacking certain exchanges and wallets and by sometimes, getting access to user personal information. These scammers then message users as a particular service the user uses and could ask user to take certain actions which could make his account get compromised.

Fake exchanges:

Sometimes, scammers create fake exchanges which could pass off as a real one and set up such good prices that people are lured to use these exchanges. Everybody keeps searching for reduced rates so they could increase profit margin and could easily fall prey to transferring their tokens to these scam exchanges for different purposes.

An example of one such cases were the reports about BitKRX in 2017, a South Korean Bitcoin exchange, falsely claiming to be affiliated with the trading board of KRX, which was itself legitimate. Luckily, this scam exchange was discovered following the reports.

source :https://cointelegraph.com/news/south-korean-government-concerned-with-scams-in-bitcoin-market-fake-exchanges

Other examples includes use of phishing sites and ICO scams etc.

2. To what extent have crypto scams affected the crypto space?

With increased popularity of the crypto space, scammers keeping bringing up new and better ways to scam people and crypto scams have since been evolving and becoming more rampant.

According to Federal Trade Commission Data, crypto currency investment scams have increased over 1000% from October 2020. source

Clearly, last year during the pandemic saw a huge rise in crypto scams in parallel to the huge rise of interest in crypto. A lot of people used social media, including telegram, to chat unsuspecting people in different groups and promise them investment opportunities with huge returns when they were actually scammers.

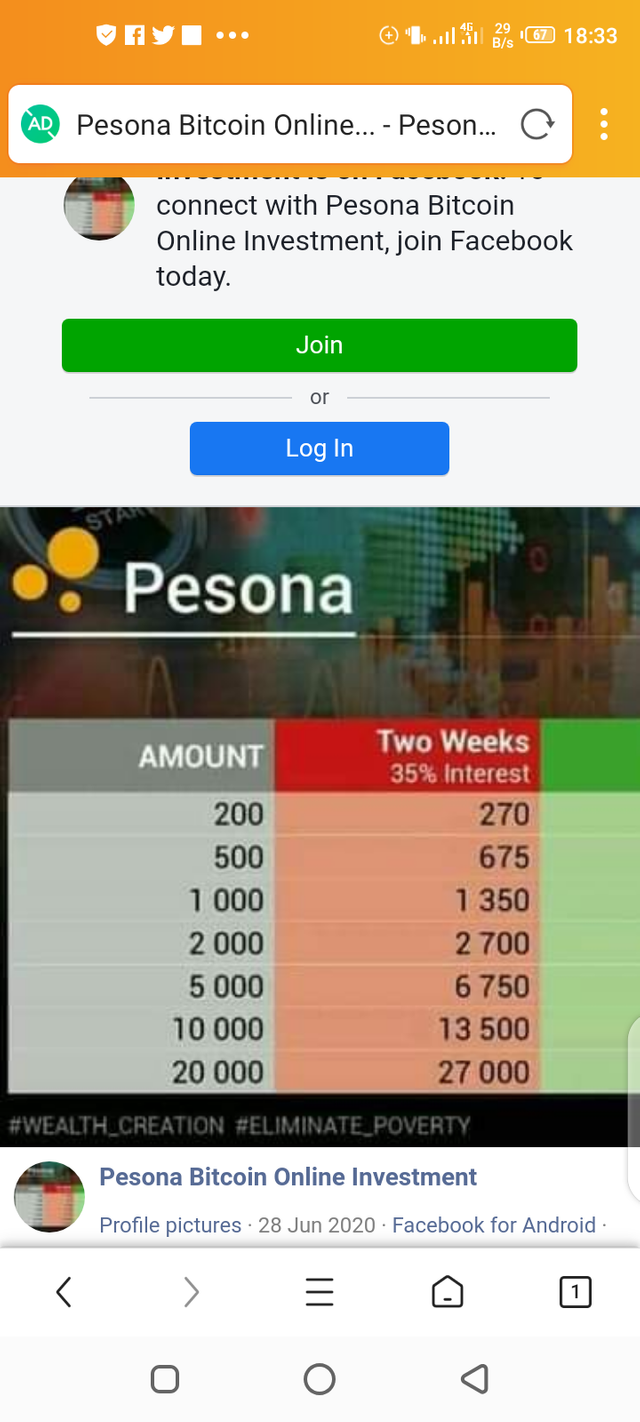

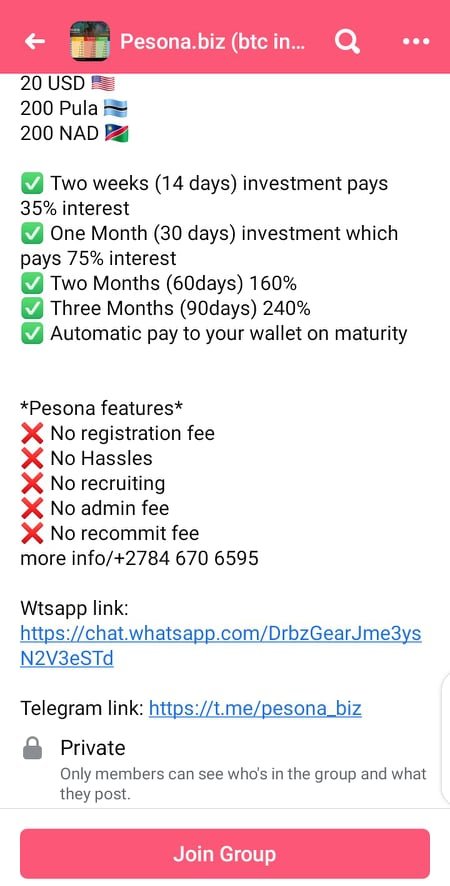

I was unfortunately a victim of a crypto investment scam back in June, 2020. There was this particular company then, Pesona, which claimed to be giving about 35% profits to their investors.

A lot of people kept talking about it and I grew curious. They said they were an investment company, and they used people's Bitcoin to trade, make huge profits and give a percentage of that profit to their investors. Once you put in your Bitcoin, you couldn't monitor how it was going till your 2 weeks is up and you can then withdraw your 35% ROI.

As they were paying back, we trusted them more and were willing to invest higher and get higher returns. At some point, the server just stopped paying. Nobody even knew the face behind the project and they were untraceable. Gone with large amount of Bitcoins people had invested. I was devastated as I had put all my savings into it. Below are screenshots of their page.

Images from source

Compounder Finance DeFi rug pull: This started as a result of increasing popularity of DeFi platforms. Investors pool their more stable tokens and sometimes lock them in a smart contract. These scammers then find a way to make away with these investors tokens.

An example of this was in December 2020, when scammers made away with $750 000 worth of Wrapped Bitcoin, WBTC, $4.8 million ether, $5 million and some other crypto currencies on a DeFi platform, Compounder Finance.

Investors were supposed to get huge interests for depositing their crypto into a time locked smart contract. It was said that developers built a back door and carted their crypto before the contract expired. source

Let's not also forget the Twitter scam by malicious people mentioned earlier which also occurred in 2020.

Despite this, it still hasn't seemed to faze out the growing interest of people in the crypto space, especially with the glossy future prospect it presents and the it's volatility which gives people a chance to explore markets and make huge profits, except they're now more hesitant to jump on ideas.

I guess this could be attributed to the greed of individuals and the need to make huge profits and also, fear of missing out in what seems like the present day gold mine, which is the crypto space.

If anything, people are getting more aware of crypto scams, and as all things evolve, more and more people have taken it upon themselves to educate the public on the existence of crypto scams and how to avoid them. People in the crypto space with increasing awareness of these scams, now have these at the back of their minds before making decisions even though this has not stopped people from falling prey to different tactics by the day.

One would say that in a way it exposes the vulnerabilities of the crypto space and while they work on new ways to haly these vulnerabilities, people have an open choice to choose to venture into the crypto space while being aware of it's vulnerabilities. source

3. Will regulations in crypto add value to the crypto space?

I do believe that regulations in crypto would add value to the crypto space.

As the crypto space keeps growing, a lot of big companies are looking to explore on the possibilities of incorporating crypto into their finance system,one way or the other but the lack of regulations in the crypto space makes them skeptical as there could be a lot to loose.

Even governments are scared of the advantages crypto currencies could offer fraudsters, like purchasing illegal things and money laundering hence they move to ban them in their countries.

Clearly, some sort of regulations might be needed to let this big players accept crypto currencies without so much skepticism.

Also, when there are crypto currency regulations, it could help protect investors, as they might be less prone to incurring huge losses due to so much diversity of the space and the fact that a lot of people still don't know too much about crypto.

When companies in the crypto space are forced to be more transparent with information regarding their operation, investors would have a better idea of what they're getting themselves involved in. People would be more comfortable investing in things like ICOs knowing there are suitable rules guiding the launch of one.

People are generally more trusting when they find out there are rules involved.

Regulations would definitely cause a lot of changes in the crypto currency space as a lot of advantages which it boasts of and which makes it a go to option for a different calibre of people and could cause an initial reduction of trading volume but I believe with continuous evolution and suitable regulations, that is regulations that are not so much that it ruins the beauty of crypto currency, it would eventually become much more valuable with increased acceptance worldwide.

The crypto space, though it has so much prospects, a lot of things are still unclear. Sometimes, when an opportunity seems too good to be true, it is. A lot of us are eager to key into the seeming profitability in the crypto space and then get scammed. Crypto scams come in different ways and if one is not careful, could easily fall victim.

People are advised to conduct proper research before making any decision and not just jump to whatever decisions we wish to take as these scams seem to be on the increase following increased popularity of the crypto space.

Thanks

CC @yohan2on

Hi @ebiis

Thanks for participating in the Steemit Crypto Academy

Feedback

This second image is a copy-right image. Avoid using Cointelegraph images in your articles.