Litecoin Case Study – Understanding What, Who, Why, When, and How - Part 2 (What, Who, Why)

Hi everyone, I hope all of you had a great EASTER! Or as great it can be with all of this volatility in the digital asset market. Hard to believe that ETH is back in the $300 again. What is also starting is Litecoin’s about to touch levels last seen in December 7, 2017 ($104). Bitcoin isn’t spared but seems like its weathering a bit better. Who knows how this plays out. Its like catching a falling knife…..you know its coming down but do you stick your hand out to catch it?

As a reminder, in my posts, I try to do some research on the various digital assets that exist. I’m currently tackling Litecoin.

We continue with my case study on Litecoin, a sibling/cousin of Bitcoin. It seems that since Charles Lee sold his shares, Litecoin has really underperformed compared to Bitcoin and others. I think there are reasons for this decline but according to friends, this could be an interesting entry point. Whether or not, I agree to that assessment depends on if I buy into any foreseeable catalysts that might trigger a slew of buying. Today's discussion revolves around Lightning Labs.

What do we know about Litecoin? Here is what googling on the internet produced. Note, I’m sure most of you who have been watching CNBC, MSNC, Money, Coindesk, blockgeeks.com and all other media channels already know about Litecoin but to those that have been living under a rock, like myself (and those who are not in the know)….

Question: What is Litecoin (cont)?

Summary from last week:

• Litecoin’s creator is Charlie Lee, who is an ex-Google employee who had the idea to create a different version of Bitcoin, which he thought was innovative but too expensive for transactions and too slow for processing.

• The Litecoin Network went “live” on October 13, 2011.

• Think - If Bitcoin was “GOLD”, then Litecoin was “SILVER.” – Still valuable but a less store of value.

• So Bitcoin has a max mining of 24 million coins, while Litecoin has a max of 84 million coins.

• There are currently 55 million Litecoins mined so far.

• According to Charlie Lee, “The vision is always I wanted Litecoin to complement bitcoin—not compete….”

• Charles Lee sold all of his Litecoin to avoid any conflict of interest.

• Litecoin and Bitcoin are similar in certain ways but how they are different is in the way they are mined, where Bitcoin uses SHA-256 (parallel), while Litcoin uses S-crypt (serially) algorithm.

• Average block mining speed in Litecoin is 2.5 minutes when compared to bitcoin’s 10 minutes.

Creation of Lighting Labs

• Transacting on Bitcoin is very expensive and limited in volume, as a result transactions are slower and cumbersome. Some of this was offset by the creation of Bitcoin Cash (more volume blocks resulting in smaller average price) and Litecoin, however the transaction costs have not come down. As a result, some investors, including Cryptocurrency creators have begun investing in Lightning lab as a way to offset this.

• What is Lightning Labs? Lightning is an overlay network built on top of an existing blockchain protocol. Lightning creates an entirely new layer, offering instant, high-volume payments that are denominated in the blockchain’s native currency. Implementation, has been primarily developed for Bitcoin, and have also integrated Litecoin support.

• That last sentence is what I would focus on. LITECOIN.

• Whenever there is an opportunity to integrate a ICO into the mix, that can be viewed as a catalyst event.

• In March 2018, Lightning Labs raised $2.5M from several prominent investors, including Jack Dorsy (CEO of Twitter and Square), Charles Lee (creator of Litecoin), Square exec Jacqueline Reses, serial-founder-turned investor David Sacks, e.g. David was COO and Product leader for Paypal, Litecoin creator Charlie Lee, Eventbrite co-founder Kevin Hartz, BitGo CTO Ben Davenport and Robinhood co-founder Vlad Tenev, along with The Hive, Digital Currency Group and others. The investor mix is impressive.

• But for me the key player is Charles Lee. Why would Charles be involved with this if he sold Litecoin? I think he has a legacy issue where he wants to creation (Litecoin) to live on and be influential just like Bitcoin.

• Lightning Labs works off Lightning Network, a protocol that is like the second layer of bitcoin

• Lightning Labs wants to exponentially boost the number and speed of transactions of the bitcoin blockchain without increasing the size of blocks.

• Lightning protocol essentially aims to let two or more people — and eventually machines — create instant, high-volume transactions that still use the underlying blockchain for security. Think SMART CONTRACTS for Bitcoin and Litecoin, so incorporating some Ethereum attributes to their process.

• The current average transaction price for transacting Bitcoin is around $50

• Lighting is looking to lower than transaction to less than $1.

• Are Lightning transactions Bitcoin transactions? “Lightning doesn't use its own token or currency, it only uses Bitcoin when on the Bitcoin blockchain. Lightning sends payments using the transaction format of the underlying blockchain. When running on Bitcoin, Lightning is actually exchanging native Bitcoin transactions—without the need to broadcast every transaction to the chain. This combined with a series of pre-signed contracts enables users on Lightning to send instant, low-fee payments, without having to trust central intermediaries.”

• The Lightning Lab’s network is composed of a diffuse network of many small nodes routing payments amongst each other, ensuring a decentralized platform.

• How can you use Lightning? Get a Lightning-enabled Bitcoin or Litecoin wallet. A Lightning wallet has all the same functionality as a regular wallet, but also allows one to instantly send/receive payments via Lightning. – I have not done this yet but I think its interesting as this might be the way of the future.

• Does Lightning work with other crypto? At the moment, they are primarily developing to support the Bitcoin blockchain, but contributors are also working to develop Lightning for other blockchains, such as Litecoin.

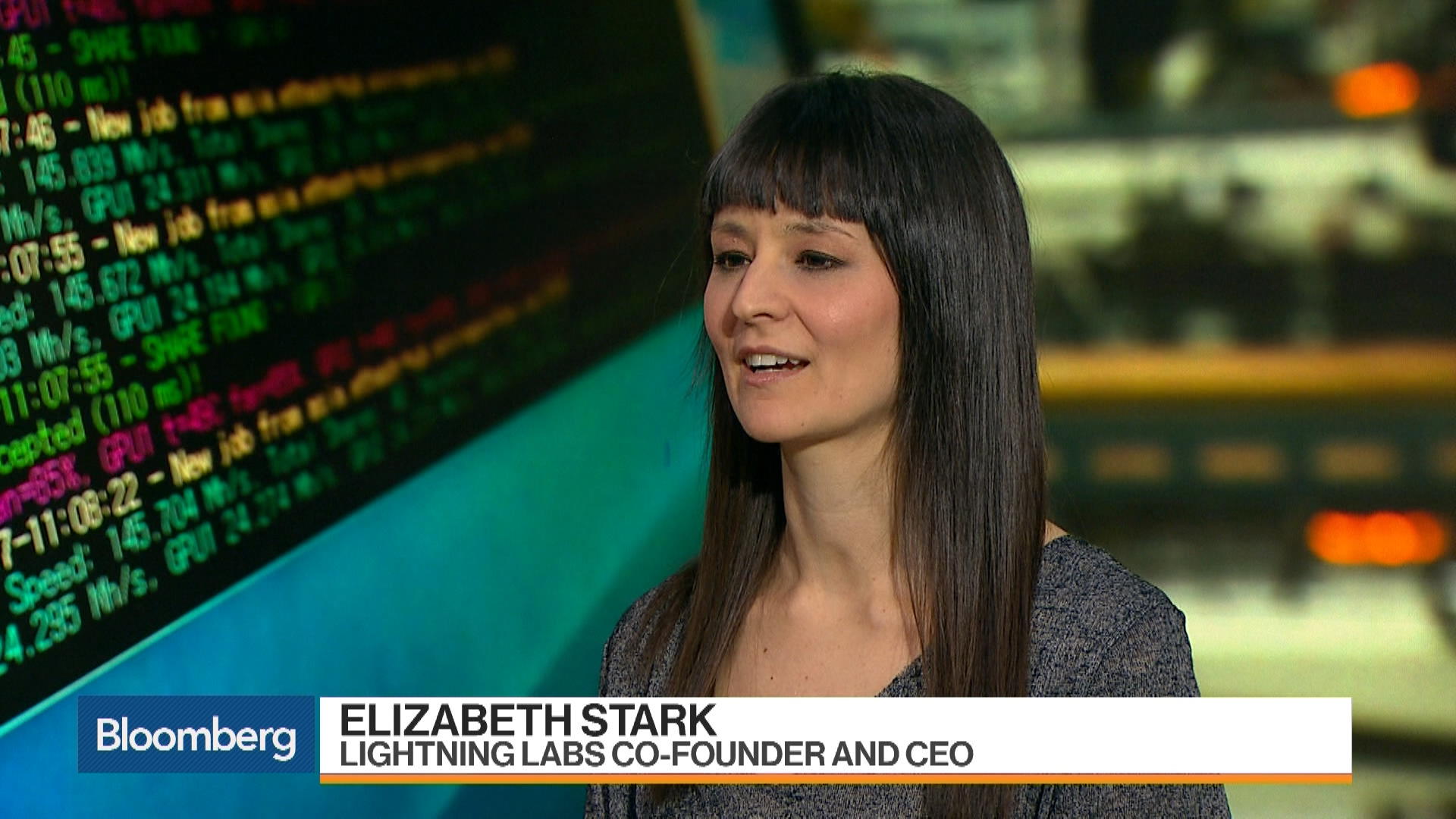

• Who started Lightning Labs? Some ex Google employees and various Bitcoin enthusiast. The two co-founders of Lightning Labs is Elizabeth Stark, CEO (ex Stanford and Yale prof) and Olaoluwa Osuntokun (CTO, ex Google summer intern)

• One of the key advisors is Bram Cohen, the founder of BitTorrent

• Lightning allows the ability to transact Litecoin for Bitcoin and vice versa, without it going to an exchange. This is really key, as your allowing “offline transactions of two different digital assets.”

Key Takeaways:

• Lightning Labs is creating a new and revolutionary way to transact Bitcoin and Litecoin.

• They are offering the chance to lower transaction fees as well as increase volume at faster rates

• They are using SMART Contracts to make this happen on a protocol/second layer network that sits on top of Bitcoin

• Lightning is essentially allowing more users and players to transact Bitcoin and Litecoin, which means that it is advocating for wider adoption by the larger masses.

• Lightning is already an Wallet enabled adoption

• SQUARE’s CEO, Jack Dorsey is an early investor and looking to use this technology to allow SQUARE to implement BTC and LTC to transact on Square, which is game changer if these currencies take off

David Sacks is also an impressive investor (COO and product leader for Paypal) that should have some indication of potential

• The founders of Lightning Labs are NOT impressive (in my humble opinion) but I think their advisor (founder of BitTorrent) is legit and real.

• I think Lightning’s early investors are very impressive, but the dollars deployed so far are not meaningful for these billionaires and millionaires (Jack Dorsey is networth at $3.7B but he only added like a few hundred thousands) and the total raise was $2.5M from other investors.

• I think Lightning has something there but it remains to be seen if it’s the key driver of mass adoption of BTC and LTC.

• I do think this is all positive for LTC.

• I think if LTC hits <$100, might be worth it to buy and stick it out.

Follow Me @epan35

Reply (with a good comment) and Upvote and I'll return the favor! I need Feedback!

i am a fan of LTC. I like your article . lets see what will happent to entire crypto market because at the moment the situation is not very good .

Thanks for the feedback!

I am a litecoin fan. I read anything that says LTC. :-D.I see the market fluctuating between their current levels as they are. I do not see any huge dump in the near future. And once it has stabilized it will pick up. From what I have read in your article, Lightning currently is much more workable for BTC, but LTC should consider it only if their transactions slow down to that level as 10 mins. Currently they seem to do fine. But surely this is an interesting technology, which the more newer coins can use to boost their Market Cap.

Thanks for the feedback. Yeah, I think there are lots of moving parts at the moment and Litecoin is definitely not spared. Keep the faith! it will be rewarded...hopefully soon!

very good written article about LTC i am a fan of LTC as well, you put in good amount of work here. i like your writing style i am going to follow you as well

thanks again and look forward to more of your amazing posts and videos

Sorry for the delay. I've been busy with work and haven't had a chance to reply. Thanks for the feedback!

Yeah you right the dollars are not meaningful but in any case they are still better than the others

Very informative post! Keep informing the community with content like this!

Coins mentioned in post: