Steemit Crypto Academy Season 2: Learn About Cryptocurrency

Created for: @eward2930

Hello friends of Steemit, I hope you are well .. Today I will take the teaching of our teacher @levycore I hope you like it, greetings!

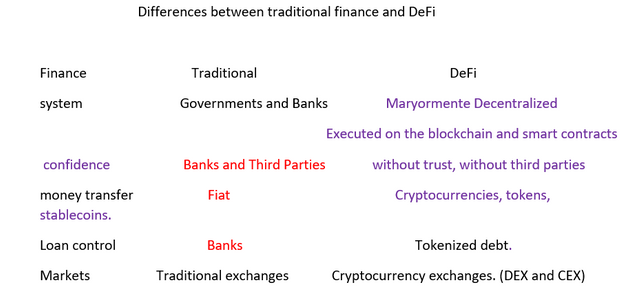

1 . What is the fundamental difference between cryptocurrencies and conventional financial systems?

Taking into account that both are currencies, we must clarify that there are relevant differences between them. It is notable that both have a value as a generic exchange for services or other goods, that is, both are represented by an exchange character. But there are also important differences that each of them has. Those of traditional coins are characterized by referring to the nature of the coins that have been traditionally used over the years to acquire products and services. The most used in commerce have been the euro, the dollar and the peso. Digital currencies represent money in digital form that is used over the Internet. It also allows you to carry out various types of transactions, such as transferring or exchanging it for another currency, paying for services in physical stores or online stores. Currently, almost all the money that is used in the world is virtual. It could be said that approximately 8% is traded in cash. Since most of the transactions carried out are through card or mobile payments, this thanks to NFC technology.

• On the other hand, cryptocurrencies are a medium of exchange that represent a decentralized digital asset that is not controlled by the governments of the countries. It is considered trustworthy because they are subject to cryptography and on the blockchain, that is, they are encrypted, making them impossible to be hacked. It is also important to mention that cryptocurrencies are not regulated by conventional financial systems, therefore, they cannot be traced. Once a transaction has been made, the transaction cannot be undone. Being unregulated and anonymous, they are vulnerable to use for illegal purposes.

2 : Why is a decentralized system needed?

Let's imagine a world where anyone can interact freely, carry out transparent, fair and efficient financial transactions, without the need for intermediaries, such as banks, lenders or insurance companies. Performing transactions in a decentralized system eliminates the problem of negotiating exchanges or negotiations with people who are miles away or continent from the world. This would avoid inconveniences that arise in conventional financial systems, such as when some type of tension occurs between two countries.

3 What affects the value of cryptocurrencies?

The value of cryptocurrencies will depend particularly on the number of users it has. Users who invest in cryptocurrencies will have a place in promoting the price or value of cryptocurrencies. But cryptocurrency users who do not have investors to invest in them will keep their prices falling.

Some factors that affect the value of cryptocurrencies

Volatility, many people question the stability of bitcoin daily. This occurs in any market or financial asset, each action must be analyzed before making an investment.

Most of the users who invest in cryptocurrencies are young, they take over most of the movements, apparently, they prefer virtual currencies over more traditional values. You could say that cryptocurrencies are becoming a 2.0 source. for investors. Some, with little experience, start investing in bitcoin or ether with small capital investments, because they cannot risk having large losses, generating that when a sudden movement occurs in the market, they sell quickly for fear of losses. This happens when the market goes down, so the coin is discharged at the first reflected danger signal, accelerating dips and sudden movements. The volatility of cryptocurrencies is always high. There is no stability in these virtual currencies.

What affects the value of cryptocurrencies?

The value of cryptocurrencies will depend particularly on the number of users it has. Users who invest in cryptocurrencies will have a place in promoting the price or value of cryptocurrencies. But cryptocurrency users who do not have investors to invest in them will keep their prices falling.

Some factors that affect the value of cryptocurrencies:

Volatility, many people question the stability of bitcoin daily. This occurs in any market or financial asset, each action must be analyzed before making an investment.

Most of the users who invest in cryptocurrencies are young, they take over most of the movements, apparently, they prefer virtual currencies over more traditional values. You could say that cryptocurrencies are becoming a 2.0 source. for investors. Some, with little experience, start investing in bitcoin or ether with small capital investments, because they cannot risk having large losses, generating that when a sudden movement occurs in the market, they sell quickly for fear of losses. This happens when the market goes down, so the coin is discharged at the first reflected danger signal, accelerating dips and sudden movements. The volatility of cryptocurrencies is always high. There is no stability in these virtual currencies.

4 Why can't everyone be a miner?

The mining process is a complex process that uses computers that allow solving complicated mathematical problems known as hashes through their high computational capacity. Said has is unique for each transaction. One of the main characteristics of mining is the demand for the necessary resources to be carried out. That is, it requires a large amount of computing power to meet its needs and requirements for mining. Also, it allows the users of the mining network to reach a consensus on the effectiveness and precision of the blockchain. However, it is vitally important to have a mining machine with computing power and to ensure a stable electrical power grid.

For mining, specific software is required that allows the resolution of mathematical problems and the verification of the correct transaction that confirms or validates that a block is a block. Which are added to the public ledger (blockchain) in an approximate period of every 10 minutes. After the software manages to resolve the transaction, the user will get their reward from digital currencies. The faster the miner's hardware works, the more accurately it can process these math problems. For this reason, we must bear in mind that mining requires very high-cost equipment, high-power computers, high-performance GPU (graphics card), ASIC (a computer dedicated to extracting a certain currency). That makes it a problem for most of you who want to mine. Computers consume a large amount of energy. Different hardware may be required for each type of coin to be mined. If you don't use proper hardware you will only lose money.

Why can cryptocurrency transactions be called more transparent?

Because it is a decentralized public ledger, all transactions that are carried out through the Blockchain are public. The blockchain records a file that is stored on a network on multiple computers. This allows the storage to be publicly viewed by all users, making it a reliable and transparent medium, impossible to tamper with. Since it is a blockchain, and each block is represented by an information storage unit. Transactions are carried out distributed in the system after being validated, which in turn form independent nodes. The transactions that are registered cannot be modified or eliminated in the future.

5 Explain how cryptocurrency developed in your country:

In Venezuela, the cryptocurrency market has been adapted more to a growing need to obtain crypto quickly and efficiently. The use and adoption of cryptocurrencies in Venezuela originates approximately from the year 2012, although the first steps were clandestinely with BTC. The main causes of the adoption of cryptocurrencies are due to the protection against inflation that the country has suffered from the firm exchange control imposed by the government since the beginning of the 21st century. Currently, in the midst of the coronavirus pandemic (COVID-19), stablecoins represent an option for Venezuelans to protect themselves from inflation.

On the other hand, in Venezuela a cryptocurrency was created (still under discussion) known as The Petro project, which is nothing more than another CBDC (Central Bank Digital Currency, or central bank digital currency), with the endorsement that it was proposed for be valued as a digital representation of the country's natural resources.

The Petro is a currency of Venezuela. A CBDC issued by the central bank and that apparently uses some Blockchain technology processes. The Venezuelan government maintains that its value is supported by the oil wealth and the nation's precious minerals, such as gold, iron, diamonds, coltan and gas.

. Petro Name (PTR)

. PoS and PoW Consensus Protocol

. X11 Mining Algorithm

. Private Blockchain

. Transaction confirmation 5 blocks

. Block emission time 60 seconds

. Creating a 5000 PTR Masternode

. Block explorer https://explorador.petro.gob.ve/

. Pre-mined 100,000,000 PTR

. Masternode Reward 0.001%

. RPC Port Reserved

. Staking 85/15

. Block size 4 MB

. Minimum unit mPR (0.000001) = 1 meme.

Conclution:

To conclude, it can be said that people have found in cryptocurrencies an ideal place to carry out secure, efficient and more profitable transactions, which allows them to have control over their own money. Cryptocurrencies are represented by a virtual currency and digital money, while the same cannot be said for conventional financial systems. Because there are differences between these two types of currency, when talking about digital money, it means the types of currencies that are used in the world, traditional currencies such as the euro, the peso or the dollar, and when talking about currency Virtual refers to cryptocurrency, such as Litecoin, Bitcoin, Davies, Ripple, Dash, Monero, etc.

CC;

@levycore

Hi @eward2930, Thanks for submitting your homework

Feedback: You have completed every point and you have understood the basics of cryptocurrency

Rating: 5