Myro/USDT Daily and Weekly Analysis – A Look at Supply and demand and Consolidation 10% beneficiary to puss.coin

Today I will do an analysis of Myro/USDT on daily and weekly time frame, where we are seeing quite interesting price action between demand and supply zones. We will look at three different charts, which show us possible market scenarios and will help us understand where the price could go next.

Weekly Time Frame Analysis:

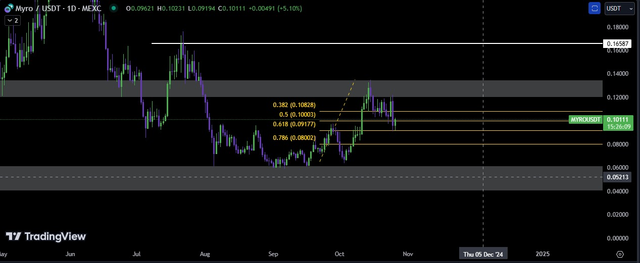

Look at the weekly chart. Here we see that the price is near the demand zone, which is acting as a strong support zone. The upward resistance zone is at $0.16587, which is the first important hurdle. If the price breaks this resistance, we can see a major trend reversal . But if the price fails to break it, the price can move back towards the demand zone.

Daily Time Frame And Fibonacci Levels:

Now look at the daily time frame. Here we see the price near an important 0.618 Fibonacci level . This level is a strong support and often signals a trend reversal. If the price respects this level, we may see bullish momentum and the price may again move towards the resistance zone.

Consolidation Break Or Support

Look at Consolidation Break or support Here we see a breakout of price after a consolidation phase . This consolidation phase developed above the demand zone and the price successfully broke the consolidation and moved above. But the price came back after hitting the resistance at $0.16587 and is now making the consolidation zone as support. Along with this, there is also the 0.618 Fibonacci level , which is a good sign for bullish trend continuation.

Overall, if the price finds support at the 0.618 Fibonacci level and the consolidation zone, we can expect a bullish move that can take the price back to the resistance at $0.16587. But if the price breaks this level, we can see a bearish move downwards that can take it to the demand zone.

Additional Scenario While the most likely outcome is a bullish pump, if this scenario fails and the price breaks the 0.618 Fibonacci support, the price could fall back to the lower demand zone potentially targeting levels around $0.05213 or lower. This would indicate a further decline, suggesting that sellers are dominating the market.

https://x.com/ShyraNet_/status/1850104188002324959

Wow thank you for giving us this perfect analysis. Seems like we might be experiencing a further decline

Thank you for your feedback, @adese! 😊 You’re right there’s definitely a possibility of further decline if the price fails to hold the support levels, especially around the 0.618 Fibonacci. But as always, the market can be unpredictable, so I’m closely watching for any strong price reaction around the demand zone. Let’s hope the buyers step in soon and we get that bullish momentum! 🚀

Note:- The quality of your post is not satisfactory, please give a more detailed explanation to your analysis

KINDLY JOIN PUSSFI DISCORD SERVER FOR MORE DETAILS!

Regards,

@jueco