STEEM: Buy Low, Sell High on OpenLedger

Crypto markets are like the wild wild west of finance these days. The Bitshares OpenLedger trading platform is a great place to start, especially if you’re the kind of person who likes wide margins, a priori fixed rules, and are favorably disposed to algorithmic trading.

We recently described one type of trade in Trading with Bitshares: Profiting from Margin Calls, where traders can take advantage of system-forced margin selloffs to earn 10% above exchange rate for the “smartcoins” unique to Bitshares.

Now we’ll walk through how you can exploit relative illiquidity and wide margins on OpenLedger to trade STEEM. We’ve used it to buy STEEM below exchange rate and sell it above, sometimes for trading and other times because it’s just a convenient way to buy STEEM for less than other exchanges.

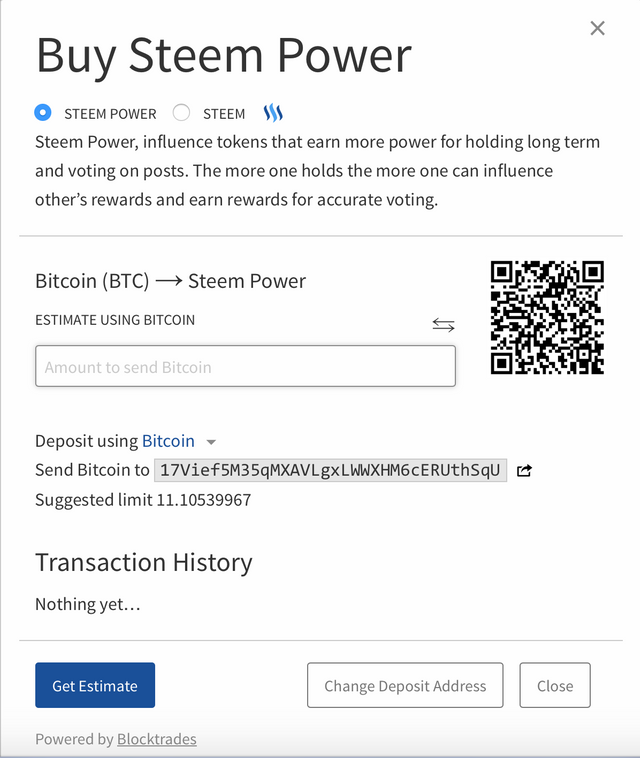

First off, how do you know what a “fair” market price is for STEEM? There’s really no answer, but there are two data points that can help. First, check out the current exchange rate on Steemit’s build-in wallet. Go to your wallet and click the drop down arrow on either your STEEM or STEEM POWER amounts, then click Deposit.

Here you can choose to buy STEEM with either BTC, BTS, or ETH. In this example we’re going to look at buying STEEM with BTS, so you can get your estimate in this window for your first baseline. FYI, this quote is pulled from blocktrades, which is an awesome crypto startup we highly recommend for privately trading a variety of cryptocurrency pairs.

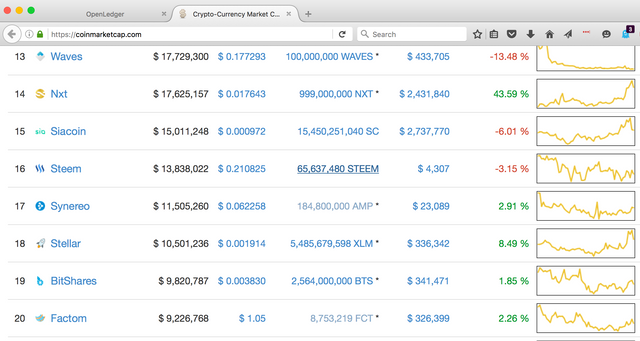

The second way to figure out a general exchange rate is to go to the king of cryptocurrency pricing sites: Coinmarketcap.com, scroll down to where you get a USD quote for STEEM and a USD quote for BTS, then divide the former by the latter to get the BTS/STEEM exchange:

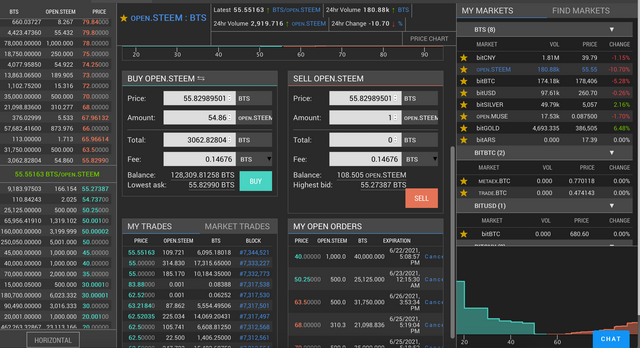

Now you have two market prices and can check out the order book on OpenLedger to see what’s going on. The market we’re working with today is the OPEN.STEEM:BTS market and here’s what it looked like earlier today when we bought some STEEM below the baseline price:

Our baseline price from the coinmarketcap method was 56.4613 BTS/STEEM and we see we had recently purchased about 600 STEEM in the 55-55.55 range. Nothing to brag about, but just one example of how you can exploit variable exchange rates on different exchanges.

The OpenLedger market fluctuates quite a bit over time depending on the marginal buyers and sellers trying to push orders through a relatively illiquid decentralized exchange. We’ve been able to both buy and sell STEEM for about +/- 10% of the exchange rate obtainable directly within the Steemit wallet.

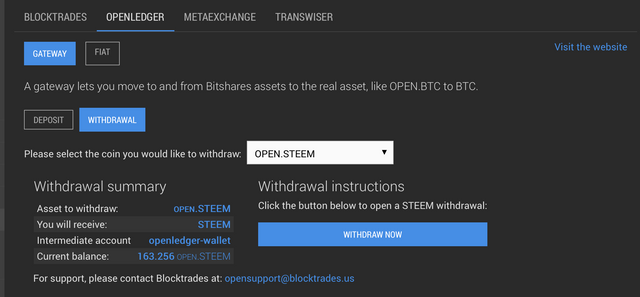

Note, the OPEN.STEEM token you’re buying in this market are synthetic STEEM contracts denominated in BTS. What gives them value on par with actual STEEM is that they are redeemable instantaneously on demand by simply withdrawing them from OpenLedger to your Steemit wallet:

In your OpenLedger Home page, click on the Deposit/Withdraw link on the left panel. In the OpenLedger tab click on Withdrawal, select OPEN.STEEM in the dropdown menu, click Withdraw Now, and simply enter the amount you want to withdraw and your Steemit wallet name:

Upvoted you

Just placing orders in the gap on OpenLedger is getting orders filled. I think OpenLedger bots will fill orders once they are placed, or maybe it's real people excited about paying a little less. Offer them a closer margin and still make 10%, pretty good times right now on the BTS:STEEM pair.

i agree and a big thank you to those running bots filling the spread. they're adding a good amount of liquidity and giving us some decent profit opportunities...

it's high time i get my own bot going on some of the OpenLedger markets. i've been trading manually for too long.

Why not buy high & sell low?

... its the winning strategy for those that want to get out of trading :)

Is there any how to videos for something like this. Thanks.

I appreciate the feedback on enjoying the material. We're not really geared up to do video production at this point, but that's something we'll definitely keep in mind going forward.

Good points in this post. I was about to post a similair thread. Buy low, sell high, it seems so simple but most investors still don't seem to get it :-) I was wondering if anyone of you uses: https://www.coincheckup.com Supposingly they researched every crypto coin in the scene based on: the team, the product, advisors, community, the business and the business model. They even score the coins stengths. Check: https://www.coincheckup.com/coins/Steem#analysis To see the: Steem Investment and research analysis.