Philippines' New Tax Law: Calculation of Withholding Tax

Tax Reform for Acceleration and INclution (TRAIN) Law

Last December 19, 2017, our President Rodrigo R. Duterte has signed the TRAIN (Tax Reform for Acceleration and Inclusion) bill into law now known as Republic Act No. 10963. This law, which seeks to make the tax system simpler, fairer and more efficient in accordance to collection, became effective on January 1, 2018.

In this new law, the rich will have a bigger contribution, apparently, and the poor will benefit more from the government’s services.

This new law aims to:

- Lower the Personal Income Tax (PIT)

- Simplify the Estate and Donor’s Tax

- Expand the Value-Added Tax (VAT) Base

- Increase the Excise Tax of Petroleum Products

- Increasing the Excise Tax of Automobiles, and

- Increase the Tax of Sugar-Sweetened Beverages

Says the Philippine Government Department of Finance. However in this blog, I will only discuss how to calculate the lowering of the personal income tax.

Lowering Personal Income Tax (PIT)

One of the greatest good news to Filipino taxpayers with an annual income less than P250,000 is they are now exempted from paying the PIT. Let me repeat that again, they are EXEMPTED! It’s indeed a good news, isn’t it? In addition to this, the first 90,000 of the 13th month pay and other bonuses will also be excepted from the income tax.

Eventually, for a person who has a taxable income of P500,000 and above will be taxed from 32% previously down to 25% this year and will be brought down to 20% after five years.

Tax Schedule Effective January 1, 2018

For the first five years (2018-2022) the Personal Income Tax will go like these.

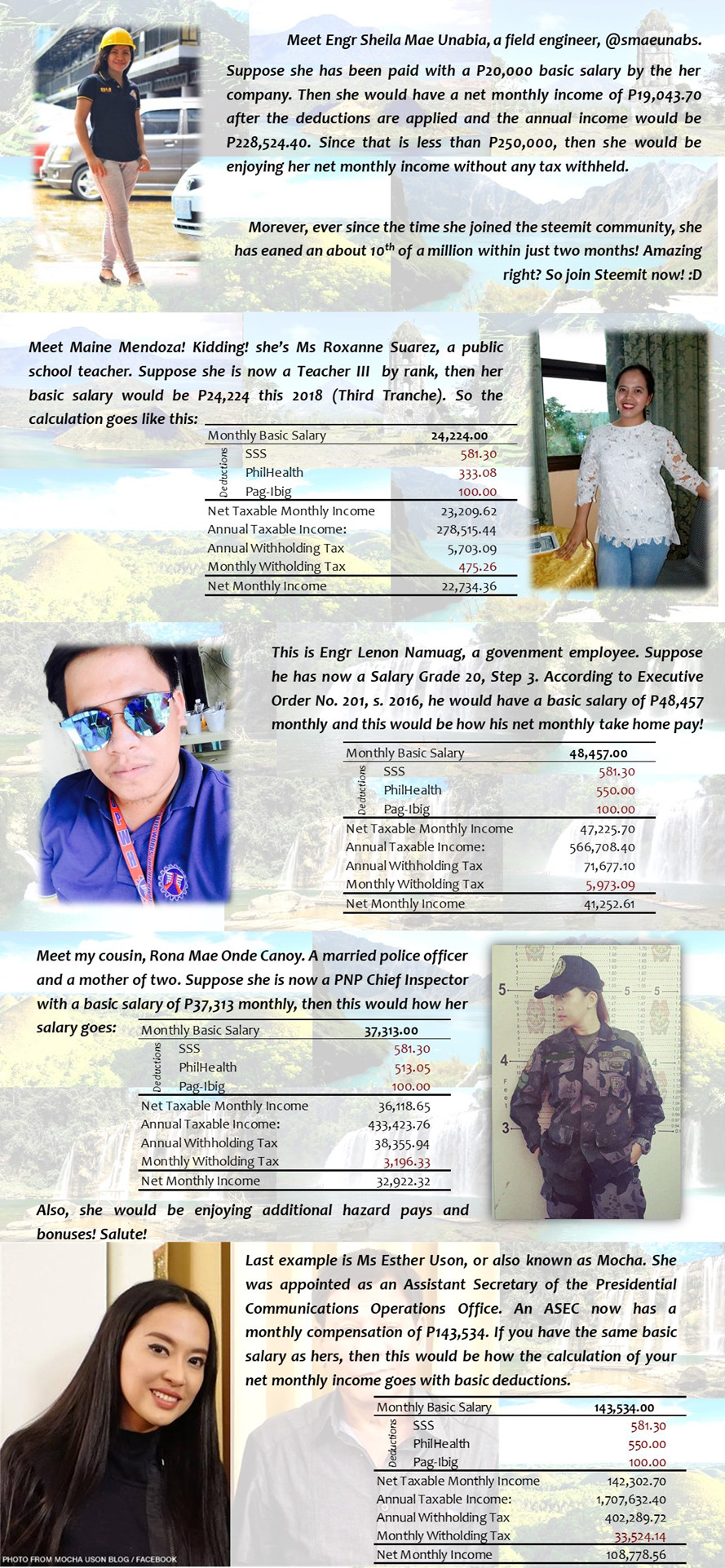

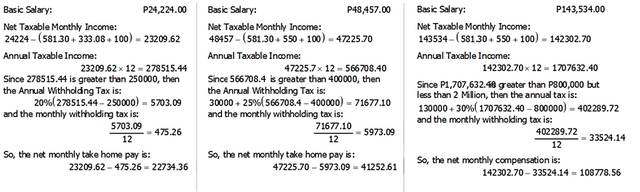

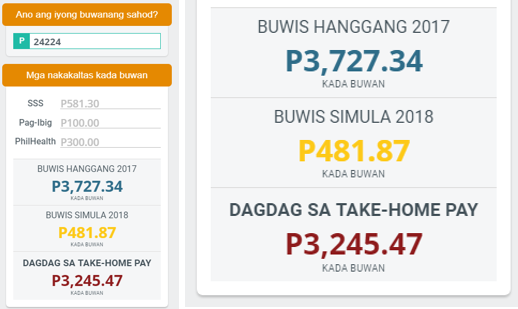

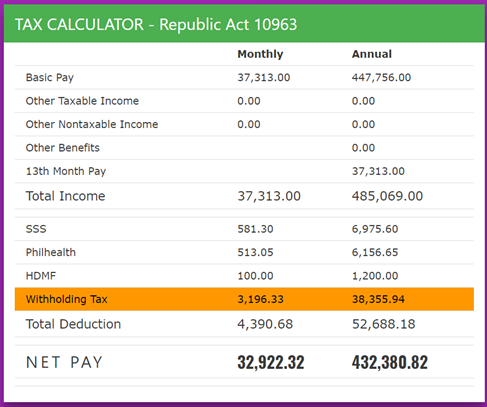

Sample Calculations

Maybe some of you can relate to these sample tax calculations with different incomes and different jobs. Take note: The compensations used in the following are just assumptions, not really the exact.

Detailed caculations

The detailed calculations of some the examples above are these:

Tax Calculators

There are various tax calculator websites in the internet that are already in accordance to new tax reform law. These calculators show the difference between the withheld taxes the previous years and for the current.

Abs-cbn’s Pinoy Tax Calculator

Aside from the difference of the taxes from last years and now, this also shows the additional take-Home Pay.

BIR’s New Tax Calculator

What I would recommend for everybody is this website. This is more accurate, more detailed and is updated in accordance to SSS and Philhealth contributions for 2018.

Department of Finance

The Department of Finance does have their own calculator but is now under maintenance, I suppose. Click here to check.

To know more about the new tax reform law, go the Department of Finance website http://www.dof.gov.ph/taxreform/index.php/train/.

Other links:

http://www.dof.gov.ph/taxreform/index.php/pit/

The Executive Order No. 201, s. 2016 link:

http://www.officialgazette.gov.ph/2016/02/19/executive-order-no-201-s-2016/

RA 10963 or TRAIN Law links:

http://www.officialgazette.gov.ph/2017/12/27/republic-act-no-10963/

http://www.officialgazette.gov.ph/downloads/2017/12dec/20171219-RA-10963-RRD.pdf

SSS Website PhilHealth Website Pag-Ibig Website

Hopefully this blog helps a lot.

Very informative post for those who have questions about the new tax law :)

thanks :)

Wow! A very helpful article for us Filipinos! Thanks for this ser!

Weeeeeh wala nakoy tax! Hahahah

na notice jd nako ang ka sexy nmu manager haha 💕😘

Hahahaha hanggang throwback picture nalang ang pgka sexy

kaayu hahaha.

hahahaha mag gym naka she?

ta, mag gym ta ninyu hahaha

ta ta ta! gym na ta

pag gym namu kay gusto biya mo mag beach nya mag two pc hahahha

hilig mn jd mig two pc sir. two pc chicken lang nuon hahha

hahahaha. na example jd ba. pero grabi kaayug income sa steemit..hahaha

Ayaaaat kauna da. Hahahah basin mas dako pa imo puhon ser ayee

hahahaha, kung pariho palang ko nimu ka banggiitan hahaha

Yaaaay di na imposible ser hahahaha

This is really helpful @fojrance. Cheers to TAX-FREE INCOME! hahaha

Hooray! A better take home pay for us. :)

Part @fojrance nya ako part 366 ra nya kuhaon pajug tax wan a negative na haha 😂😂

sure part uy hahahha

Your post is the second pick for the latest edition of Top 20 Commented Posts using the #philippines tag

Your post has been upvoted at 98% VP = $1.77, and you will be featured on the next edition. Congratulations.

wow, thank you very much! :)

wow, thank you very much! :)

truly@fojrance

Your case is the same as that of Ms. Esther Uson, am I right lodi @fojrance ?

HAHAHAHAHAHAHAHHAHAHA mas dako pa jhon

ahahahah grabiha pud ana jhon uy hahaha

@originalworks

The @OriginalWorks bot has determined this post by @fojrance to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!