Akropolis aims to decentralize the pension system. (Huobi Prime 4)

OECD countries are aging.

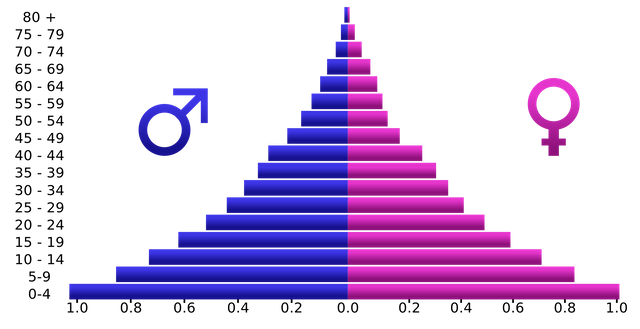

While the world population is growing at a rapid pace, the vast portion of developed countries have a low fertility rate. Subsequently, for the first time in these countries histories, the population pyramid has become inverted. Throughout history, the population pyramid has been heavier on the bottom (more young people) and shallow on the top (few old people).

With advancements in medicine, life expectancies have reached a record high figure; meanwhile, as life has become busier than ever, birth rates have dropped. This shift in the population pyramid is going to pose many challenges, but one of the most striking ones will be the sustenance of social security and pension programs.

Cracks in the System

Pensions systems across the world rely on the supposition that the number of aged (retired) people in a country will always be equal to or less than the number of young people in the workforce. Fees are claimed from young members of the workforce and funneled towards the aged; the assertion is that once the young reach their retirement age, a new generation will be providing their pension, and so the cycle will continue.

Things are about to change.

As the number of young people in the workforce across OECD countries has decreased, retirement ages have been pushed higher. This, however, is just the beginning of the problem.

Population pyraminds no longer look like this in OECD countries.

As the discrepancy between the number of young workers needed to sustain pension funds and the number actually in the workforce increases, pension funds will head towards a point of unsustainability. Many economists already believe that the pension system will soon collapse and the young workforce that has fed funds to today’s pension systems won’t see a dime of it once they reach their retirement age.

There’s a dire need for alternatives to present pension systems, and a blockchain startup named Akropolis aims to leverage the benefits of decentralization to enable a new form of retirement safety nets.

A Decentralized Network of Fund Managers and Savers

Pension funds are typically managed by highly skilled financial analysts. At present, the analysts involved with pension funds help centralized, government-controlled funds handle people’s pensions. Given the fragility of the current pension system, Akropolis aims to deliver a decentralized system in which people can offer their funds to fund managers to manage their pension savings without relying on the centralized, government-controlled pensions.

Through the aid of smart contract-enabled escrows, funds remain securely within the limitations people offer to the fund managers.

Fund managers can then invest the capital to draw in returns as they would in a normal pension fund, except in this scenario, people retain their savings and the compound interest earned on those savings. Presently, the returns will be allocated to sustain the retirement plans of previous generations’ pension plans; soon, possibly even the principal would start dwindling. Akropolis aims to offer an alternative which delivers a new, decentralized pension system.

Huobi Prime

The Akropolis project launched nearly a year ago and has been focused on development, capital raise, and community growth since then.

The AKRO token will be made available to the public for the first time through Huobi Global on July 16. Huobi Prime has certain participation requirements which include account verification and a minimum token hold. Depending on the amount of tokens that have been held within an account, a pre-decided limited allocation will be made available to a buyer. A detailed explanation of participation requirements are explained in this article.

A strategic launch via Huobi Prime will enable Akropolis to expand its community and inform a wider portion of the Crypto community (and beyond) on how it intends to reshape the world’s pension system.

Connect with me:

Cryptocurrency News Cryptocurrency Airdrops Best ICO List Ripple XRP News Ethereum News Crypto Bounties Blockchain News Blockchain Lawyers Recover Lost or Stolen Crypto How to Store ERC-20 Tokens Comparing Best Hardware Wallets

Actually this is an interesting article

286/5000

Interesting article; which is based on the problems for the current pension system, taking into account that every day, there are fewer young people quoting the pension system, and a greater number of senior citizens, thickening the retirement stage. Retirement systems at this pace will enter into liquidity problems. It is possible that the present generations, have to implement other methods to guarantee a flow of income for the alternative alternative to the current pension systemsGreetings @hatu

Hmmmmm... The declining birth rates are certainly a problem. The pension and retirement are just the tip of the iceberg. Though like Akropolis people will always find solutions!

Hi @hatu

I've never personally heard about Akropolis and it's interesting that they are trying to solve "pension system problem".

That will be very challenging task. Mainly because of generation this project is aimig: older people. Somehow retired people and blockchain technology doesn't seem to go well together.

Yours,

Piotr

I haven't heard about the Akropolis project. A cryptocurrency to pensions system, sounds interesting.

Posted using Partiko Android

Interesting article

I live in Finland and this is how our country handles our pension reform

https://www.etk.fi/en/the-pension-system/dynamic-pension-scheme/pension-reform-in-2017/

@hatu, Decentralisation of Pension System is vital because in many cases people face lot of struggle after retirement and they face many loop holes in the system which gives them tough time afterwords. Let's hope that this change will be implemented soon. Stay blessed.

Posted using Partiko Android

The US system aka social security is based on, not only the life-long participation of the pension receiver, but the system integration with younger participants as well continually infusing new funds into the system. That seems to be the crucial element in these "modern" times.

Given the numbers of particiants in the "reproductive rights" universe...and the length of time it has been going on, another element in the birth rate scenario which is growing exponentially in these "modern" times.

Most Pension Systems are set up under financial models not political ones. Making the issue of "reproductive rights" invisible to the "numbers". Yes we are living longer, a lot longer than in the 1930's, but our society is more intent on elimination of the "unwanted" than the inclusion of the rights of the long term participants.

So, social security does not really exist? Or is it just invisible. You have a lot of resteems, which looks like the content has struck some kind of chord, and your readers are interested in the solution.

Of which more government is not one. but neither are the rights of women. Aging is a birth deffect. As long as it is untreated it will continue to plague the financial/pension system. The power of such a system is based on actuarial integrity. Not political integrity. Government has no place in a pension system because it is self serving it seems. In other words, political.

Posted using Partiko Android

Meh, i thought this was a cool steem based game called acropolis lie a greek city builder, now thatd be cool.

You could shoot that idea in utopian; maybe some one will pick it up.