Lets talk Litecoin !

First , i want to say its gonna be a long read , but if you are interested and got some investment in Litecoin , it could learn you a few things so lets go ! While the Bitcoin community is uncertain as to the new version of the protocol that is adopted by miners and users, the Litecoin network, under the aegis of its creator Charlie Lee, successfully implemented a feature that sends a lot Segregated Witness, paving the way for many innovations like the Lightning Network.

Separate warning: separation of transaction signatures from the rest of the data contained in each block, increasing the number of transactions processed and correcting their malleability, while allowing for the development of further improvements.

Lightning network: parallel network allowing to carry out transactions out of the chain, before reinjection. Greatly improves the scalability of the network.

Originally, Litecoin is a Bitcoin fork, that is, a modification of the original consensus rules. Litecoin's source code appeared on GitHub on October 7, 2011, two years after the creation of Bitcoin.

How does the Litecoin protocol differ from Bitcoin?

The goal was to create, as the name suggests, a lighter Bitcoin, both in block size and transaction costs. This initiative was strongly criticized by the most ardent evangelists of Bitcoin: why create the pale copy of a protocol that already works very well, and whose adoption by the general public is far from being assured?

The improvements proposed by Charlie Lee concerned above all the speed of confirmation of the transactions and their cost: these are currently problems for Bitcoin, which were already foreseeable in 2011. On Litecoin, the confirmation time of the blocks is 2 minutes 30, Four times less than on Bitcoin. As for the production function, it is identical, with the exception of the number of units issued, which is four times higher: 84 million CTL.

The notable difference is in the way the blocks are chained: the hashing algorithm. If Bitcoin uses the SHA 256, Litecoin chose the scrypt system.

Scrypt is a key derivation function that was created by Colin Percival (Tarsnap), originally used to protect its online backup service from brute force attacks.

This function was used for the first time in distributed consensus protocols based on proof of work by Tenebrix and Fairbrix. The goal behind Litecoin's adoption of this method was to be able to use the same hardware to simultaneously undermine Bitcoin and Litecoin. Since 2014, this algorithm is supported by chips specialized in mining (ASICS and FPGA), but the resources in memory that it requires are very important and it is the mining by graphic processors which is the most used.

The market

The idea of creating this decentralized currency by correcting some of the perceived weaknesses at Bitcoin has seduced a small community of users from the start, who defended the bill and nail project despite criticism. The number of transactions per day has increased from 4,000 to almost 20,000 in four months.

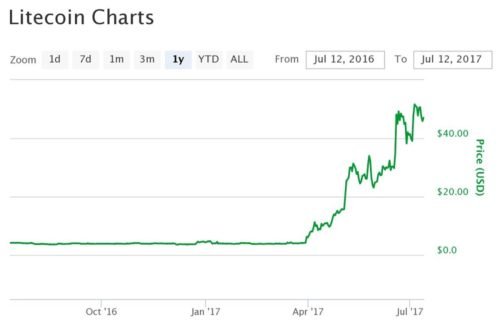

If the price of the Litecoin has long oscillated between $ 3 and $ 5, it suddenly took off in April until reaching a peak at over $ 53 in early July. There are several reasons :

Litecoin took advantage of the general enthusiasm around cryptocurrencies

The successful implementation of SegWit, which had been delayed on Bitcoin, attracted new supporters

The increase in transaction costs on the Bitcoin network has prompted many users to turn to Litecoin

The number of services using Litecoin has also increased significantly.

The Segwit and the Litecoin, what's new!

While the Bitcoin network is heavily involved in political debates around the implementation of SegWit and the size of the blocks (which are currently still full), the Litecoin network is quite far from these issues.

The size of blocks produced on the Litecoin network rarely exceeds 20 KB; So it was not a bottleneck problem that motivated miners to deploy SegWit but the idea of being able to implement many other improvements without having to fork the blockchain (the transaction signatures being separated from the rest of the data, The innovations that rely on the processing of these signatures are facilitated while leaving the developers a great deal of freedom).

The aim has always been to offer a competitive alternative, not only in terms of fees but also scalability and confidentiality. The two networks are not enemy brothers, as many developers are working on both projects, and the idea of testing the deployment of SegWit on Litecoin also makes it possible to prove to the bitcoinauts all the interest of the improvement and to get out of the status quo.

The activation of SegWit was a success: the modification was adopted very quickly, which, according to Franklyn Richards, CTO of the Litecoin Foundation, testifies to the coherence of the Litecoin community that wants a fast network, adaptable to scalability and innovative. In a few days, the course of the LTC tripled.

------ Lightning Network

As for the Lightning Network, it is a French startup, Acinq, who successfully completed the first tests in April. Eclair, the implementation of the Lightning Network originally planned for Bitcoin, has been adapted to the Litecoin case (only a few parameters have to be modified).

Fabrice Drouin even pointed out that this improvement could eventually allow two users to exchange LTC against BTC instantly and without going through a trusted third party. By showing the example, this success should also encourage the actors of the Bitcoin network to deploy SegWit then LN, statements confirmed by the recent events!

What is it?

In reality, the Litecoin Foundation is quite active and the network does not present any malfunction requiring emergency patches. Developers are therefore focusing on the long term, and now the Litecoin Foundation intends to do a lot of marketing to increase the adoption of the fourth most valuable cryptomonetary ecosystem. The recipe for success is quite simple: implement the innovations proposed for Bitcoin before Bitcoin.

Confidentiality of transactions:

It is a hot topic for all cryptomonies. In the case of Litecoin, there are several ways to hide the amount of inputs and outputs while guaranteeing the integrity of the transactions in a cryptographic manner: using a technique called Pedersen commitment (requires soft fork) or Using circle signatures like Monero (requires a hard fork).

MAST (Merkelized Abstract Syntax Trees):

The idea behind MAST is to link the P2SH (Pay to Script Hash) script system with the possibilities offered by Merkle trees in order to implement even more complex scripts, and why not, smart-contracts on the (BIP 114).

Signatures of Schnorr:

The cryptographic signatures used to verify the validity of a transaction using its data and the public key of the issuer are based on the ECDSA method. Schnorr signatures are currently regarded as the best performers because they add signatories very easily, and greatly increase the current level of confidentiality.

TumbleBit:

TumbleBit is certainly the most promising innovation in terms of confidentiality within the Bitcoin network, especially since its development is already at an advanced stage. It is a mixing service: via a TumbleBit server, the sender of a transaction is assured that the receiver will not know the origin of the bitcoins because they will be mixed with those of the many other connected users, (The cryptographic methods used protect against theft of corners and make it impossible to disclose the parties, even to the server).

Litecoin: a value proportional to the difficulties encountered by Bitcoin?

Litecoin is attracting more and more users because of its low transaction costs. In addition, as we approach the fateful date of August 1 when miners will begin deploying SegWit, many investors are switching to altcoins to avoid the inconvenience that could be caused by these new implementations. Litecoin could therefore be criticized for having only a temporary interest on the part of the users of cryptomonies, and to conclude that the price increase is relatively artificial.

This is an argument that is relevant to some extent but the benefits of the Litecoin network are real and the efforts provided by developers to continue to develop new features and implement them before Bitcoin are obvious. Charlie Lee himself left his position at Coinbase in order to devote himself fully to Litecoin. The age of the network and its correct level of decentralization inspire confidence.

The market for cryptomedies is going through a period of correction, which is neither the first nor the last. The less relevant altcoins will ultimately disappear, but there is room for everyone in this fast-growing market and the segmentation of this universe is far from definitive. If Bitcoin has established itself as digital gold, Litecoin may well be digital money ... In the race for capitalization, Litecoin is certainly not about to disappear from the front row!

very nice article and well documented on litecoin.

But Litecoin, to impose himself as the digital money have still miles to go. Because it's clearly not the only candidate for that (XRP for example can be something that can be used, especially with the fact that it's convenient for countries as they can still be in charge and not totally out of it) even if i strongly prefer to see litecoin perform and be used more.