Cryptovalues worth 110 billion. But bubble risk is lurking!

Bitcoin and beyond. The Criptovalute market, the digital currency traded on the Net, has already broke the $ 100 billion cap of capitalization for the first time and today travels over 110 billion. A dizzying rise, considering that only in January the overall market cap did not exceed 20 billion. The most powerful growth is always that of bitcoin, a pillar that affects 40% of the market with a price of around $ 2,800 per unit and a capitalization of over 45 billion.

The rally is not lonely

But the rally is far from lonely. A competing currency such as Ether, the smart contract exchange platform Ethereum, switched yesterday to peaks over $ 400 and reached a capitalization of $ 36 billion. Ripple, specialized in transferring funds between financial institutions, reaches a total value of $ 10 billion after opening the year just over 236 million. In the background there is an ever-increasing supply of "bitcoin clones", as some have renamed the criptovalutes more similar to the original model of the category. The Coinmarketcap specialist portal has at least a dozen with a portfolio over $ 500,000, although the oscillations are so cumbersome that the list could vary within a few hours.

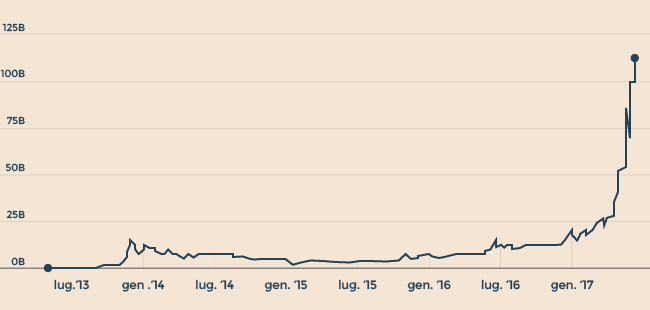

The market cap of the criptovalute at 110 billion dollars

The value rise of digital coins. The peak in the last two months thanks to the bitcoin lever and "rival" as Ether (Source: Coinmarketcap)

Exploit unexpected

Valeria Portal, Blockchain Manager and Distributed Ledger of the Observers of the Politecnico di Milano, admits that the rise of bitcoin and cryptovalues was "a bit unexpected, at least to these levels." The sudden exploitation of online currencies thanks many factors, including a rather unusual: computer attacks. Cases such as WannaCry, the virus that seized data in exchange for bitcoin ransom, ended up accrediting (rather than penalizing) interest in coins out of the traditional market and regulatory logic. On May 10, two days before WannaCry's assault, bitcoin was already rising to nearly $ 1,800 a unit. A month later it was worth 1,000 more: "Maybe the hacker phenomenon has sparked the spotlight on this world even more," says Portal. "Swings are normal, but not at this level."

THE SUPER BITCOIN FOR THE FIRST TIME 3MILL DOLLARS

The best-known cryptography has surpassed the last record between 10 and 11 June. Only in May was worth less than $ 2,000 (Source: CoinDesk)

Bubble risk

The euphoria of exchanges in the virtual currency market has not attracted, of course, only enthusiasm. Some analysts have warned against the classic bubble effect, aggravated in this case by the structural weaknesses of bitcoin and other digital coins: opacity in the use of coins (also for illicit activities), excess volatility and the risk of internal speculation At the expense of less familiar investors with the technicalities of the industry.

As Portale explains, "there is not much clarity about the treatment of cryptovalues" both at the economic and financial level. The peer-to-peer nature (private exchange) of digital coins makes it difficult to understand both the concrete use of resources and their final destination: in other words, if and how the money of a platform is put into the real economy Exists only on the Web.

Leverage effect

Not counting the potentially infinite leverage of speculation on cryptovalutes created and reproduced without the filtering of governments and central banks. "For example, it is unclear whether the increase in demand may have a repercussion on the real economy, in the sense that bitcoins will be really spent, or if it is only financial speculation - says Portal - Often those who buy bitcoin tend to buy other cryptovalutes, Fueling the famous bubble risk. "

The strategy described by Portale is that of a speculative game between the various virtual coins, where bitcoin is leveraged to buy and sell secondary currencies: "Not all criptovalutes will survive for a long time - notes Portal - Resists who has an added value , As can be Ethereum's smart contracts, and it offers a service that does not just depend on bitcoins. "

The emission limit

However, the system that was created around bitcoins travels to a natural maturity: technology has an emission limit of 21 million bitcoins, beyond which it will no longer be possible to "extract" digital coins from the database. "After the stop at" mining ", it will be understood something more - says Portal - There are those who will have difficulty standing and who will survive, even if at present it is not the case to do predictions. "

A few more speculations are also opening up from the normative point of view. After the war winds between central banks and cryptovalues, technology began to receive the first awards. Japan was in the process of paving the way for April to adopt a law recognizing bitcoin as a form of payment: "The regulator can hardly understand the phenomenon immediately," Portal explains. Perhaps, as in all innovations, Understanding the implications can be damaging. "

Source : Translated from Italian to english.

Please (resteemit, upvote)

i worry that bitcoin will drop when surpassed in capitization by ethereum and the drop will cause widespread fear in those that are not yet involved - my view is that steem should grow to a huge network and bring on board all the content creators from facebook and youtube this will lead to steem becoming number one in crypto

Sadly that is the risk in reality for all currency

I know, We must be careful

We humans never learn, that is why there is that saying there is nothing new under the sun. As a species we like to forget and repeat the past.

I really appreciate the amount of effort you poured into this post. Thank You.

I'm agree with basically everything you said, well done!

Thank you :)

Great article!

Thank you :)

We live in risks, but don't take your eyes off the road.

That's right :)