5 Warren Buffett Quotes Every Investor Should Live By

At age 86, Warren Buffett is the third wealthiest person on the planet (excluding the illusive Rothschild family and whatever other conspiring wealthy elite family exists out there). With a current net worth of about $60 billion, Buffett is arguably the most successful investor alive today.

I’m not a fan of his political views and economic philosophy, and I don’t doubt that he games the system to gain access to information and opportunity that others are not privileged to. He's no Jim Rogers or Marc Faber. Nonetheless, Buffet has said some smart things and I think we would do well to ponder them.

Here are my top five favourite Warren Buffet quotes:

“Be fearful when others are greedy and greedy when others are fearful.”

I mentor property investors in Australia, where real estate values are extremely inflated. In most parts of Sydney, the median house price is over $1 million. The majority of Aussies believe that home prices are untouchable and that property only ever goes up in value. As a result, investors are still buying, speculating on continued capital growth. There is plenty of greed, but very little fear.

Similar to John Templeton, Buffett has some contrarian tendencies. He grew his fortune using his keen ability to consistently find and purchase underpriced assets. I’ve already written here about the assets I believe to be underpriced today, and why. I’ll give you a hint: one is a shiny metal and the other has something to do with the blockchain.

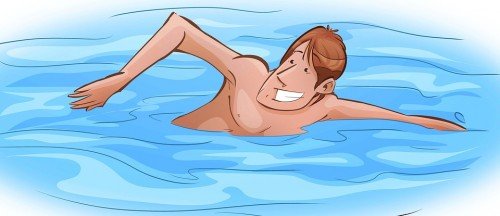

“Only when the tide goes out do you discover who's been swimming naked.”

This quote was taken from his 2001 Berkshire Hathaway Chairman’s Letter. Leading up to making this statement, he was talking about the importance of applying a stress test to one’s investment portfolio and to contemplate what could happen to one’s holdings if there was an economic shift toward a more unfavorable environment.

In a bull market when the tide is high, almost everyone will make money. We’ve seen this in the Aussie real estate market. Many people have lucked into success, at least in terms of unrealized gains.

As long as investors buy into the market at the right time, the wave of growth does all of the work. Even if you make mistakes, or lack skill as an investor, this can be covered up by the strength of the market. During these favourable economic times, the true quality of one’s investments is unclear.

But when the tide goes back out, all will be revealed. Those who are too highly leveraged, who have borrowed and re-borrowed, may get caught with their pants down.

Are you swimming naked? How would a 20 or even 40 percent drop in real estate or share values impact your personal cash flow and net worth?

“Someone is sitting in the shade today because someone planted a tree a long time ago.”

This quote is all about having the ability to foresee your needs long into the future. Why do some people have a more shady retirement than others? Quite simply, they planted a tree a long time ago that would be there when they needed it. That tree seemed pretty small and useless for a while, but eventually, it cast a very large shadow under which they could find protection.

Some of my clients are in their early to mid-20’s and they are already planning for retirement by age 45. But whether you’re 25, 45 or 55, we’re all barrelling toward the day that we will need to live off the income of our assets. Your only hope of avoiding the need to rely upon family or the government (which may not even exist as we know it today, fingers crossed) is to begin dreaming now and developing a vision for what your financial life will look like in 20 or 40 years.

What are your long-term financial goals? How much income will you need to live well in your retirement? What kind of asset base will you need to produce the income that you need?

Take responsibility for your own future and think long-term. Keep posting content and building your following here on Steemit. Who knows? You could be building a tree that will provide shade for your future.

“You can't produce a baby in one month by getting nine women pregnant.”

Making babies is really fun and exciting. Growing babies? Not so much. At least that’s what my wife tells me.

Of course there is that initial phase of joy when you’ve just learned that you’re having a child. But then there’s the waiting, the morning sickness, the weird appetite, the stretch marks, the sleepless nights, the contractions, the screaming and the pushing.

The most valuable things in life only come through an investment of time and hard work. They can’t be rushed. Perhaps this is why so few people seem to possess valuable things. Human nature tends to be impatient and lazy. Impatient and lazy people try to take shortcuts. They are happy to keep doing the fun and exciting things, but not the waiting and the hard work. But some destinations have no short cut.

How’s your character? Are you patient and willing to work? Do you have skill and a proven system? There may be some sleepless nights and a bit of pain along the way. You might even feel like throwing up at times, but if you stay the course, persist through the tough times, and work smart, you are much more likely to achieve your goals.

“Never ask a barber if you need a haircut.”

I’ve noticed that whenever I get my hair cut, I have to be very explicit about how short I want my hair. He seems to want to keep it longer. Perhaps that’s because the shorter he cuts my hair, the longer it could be before I need to come back to see him. The more frequently he can get me in his chair, the more money he will make.

One of the most fatal investing mistakes I see is people relying too heavily on the advice of “professionals.” Rather than learning how to think for themselves and develop their own due diligence system, these naïve investors blindly trust the assertions of agents, brokers or salespeople, and buy because “they said I should.”

When dealing with others, we must be mindful of how they are incentivised. While relationships and building a team is invaluable, we can’t forget that commissions are a reality of the financial industry. We must always take responsibility for our own purchasing decisions, and never blindly follow the opinions of others.

The barber quote is a little intimidating, but I've never been much for haircuts.(though i am warming up to them a little now).

Haha! As long as they stay away from the face.

I need his advice now more than ever. Had to rent out part of the deathstar.

Tough times for the Imperial Military.

"Never Ask The Barber If You Need A Haircut"

Steemon!!!

I will, thanks.

lol, I love "Never ask a barber if you need a haircut"

hahaha.. I can relate

That one seems pretty popular :)

Really interesting @jasonstaggers ! I am going to go with “Someone is sitting in the shade today because someone planted a tree a long time ago.” and add my own contribution "Plant multiple trees, you never now which one will grow enough to provide you the shade you desire"

Great addition @oumar. Diversify and spread your risk!

Thanks @jasonstaggers , of course good old WB would actually say the opposite, but well, he is an expert and can afford to put all his eggs in one basket.

Yeah but when I say diversify I mean buy ten different gold miners instead of just one :)

I had to look up his name to make sure I've been getting it right. So it's two t's, otherwise it's the all-you-can-eat haha.

Yes, although I'd take a buffet over Buffett any day :)

“Only when the tide goes out do you discover who's been swimming naked.” - I like that one very much :)

I think that's my favourite of the five as well.

I love talking about finance! To me, money is time. Gain enough and you can 'buy' your time back.

If more people realized that, they wouldn't be rushing out to replace their car when the current one does the job just fine. They trade their future time for the gadgets of today. Live minimally, enjoy more time doing what you want to do.

Yes! I would much rather live minimally, save for an early retirement and spend money on experiences and making memories with my family. Thanks for your great input.

One of his quote I heard,might be something like even a penny matters. A penny saved is a penny earned,like your ideas. Feel free to check my cosplay work 2. https://steemit.com/cn/@kyleb15/clannad-cosplay-photography-special-edition-clannad-cosplay

"A penny saved is a penny earned" was Ben Franklin. But Buffett did say something similar... "Don't save what is left after spending; spend what is left after saving." That's a great concept.