QuickBooks Self Employed Review and Tutorial!

What makes preparing self-employed taxes a lot easier? QuickBooks Self Employed is what I use to keep track of my income and expenses all year in my business. I have been using it almost 2 years now and love it because it is available totally online with no download necessary! Would you like to learn about it in this review and tutorial here because I wish I had been using QBSE from the day I started my business?

QuickBooks Self Employed Review and Tutorial

Making sure that we have our taxes set up correctly can help save us a lot of time and money when tax season comes around!

If you would like to sign up, would you please use this link to save 50% on your first six months: http://fbuy.me/dGXHJ because I also get a $30 gift card when you sign up?

Why Quickbooks?

Today I'd like to show you QuickBooks Self-Employed, an automated simple solution for doing your self-employed business taxes in the US throughout the year.

This is what I'm using now after the four and a half years I've had my business of doing things really awkward before using spreadsheet applications and trying to keeps things in written documents, and all kinds of other ridiculous ways doing my record keeping. I now have a simple solution here and that's why I'm sharing it with you because I want you to have the chance to have something set up that works easily for you the way this does for me.

Throughout this post I'm going to demonstrate using it here with you so that you can see exactly how it works. This is useful and helpful for me and I don't get anything for telling you this either except satisfaction that maybe I've helped you to have an easier time doing your own business taxes in the future than I have.

Business taxes have been a pain for me since I started my business in 2011. Now, they're easy because of the system I am sharing with you today. If you already are using TurboTax, you might love this because it uses your same Intuit account and you can directly take everything from QuickBooks Self-Employed and import it into TurboTax. I've spent a ton of hours doing my taxes in the past!

What made me get QuickBooks?

Apparently, the average business owner spends hundreds of hours doing their taxes. This system eliminates the majority of that work from my experience using Quickbooks so far. I've signed up for it after seeing I needed something better for my taxes. What I was doing was just having business bank accounts and credit cards to track my expenses. Then I had to manually put everything in through exporting everything in Microsoft Excel documents, and then trying to put them back in TurboTax in a way that makes sense.

Every year I would have inconsistencies. I'd categorize items in the wrong category. I wouldn't remember what I did the year before and as far as getting audited goes, that is a lot of work. That's a sign that you're not doing things very well, which then suggests you need to be audited. Consistency is often the sign that you're doing things well or in the case of fraudulence that you are consistently cheating the same way. Consistency matched with honesty is very powerful and simple.

What is Intuit QuickBooks Online (Self-Employed)?

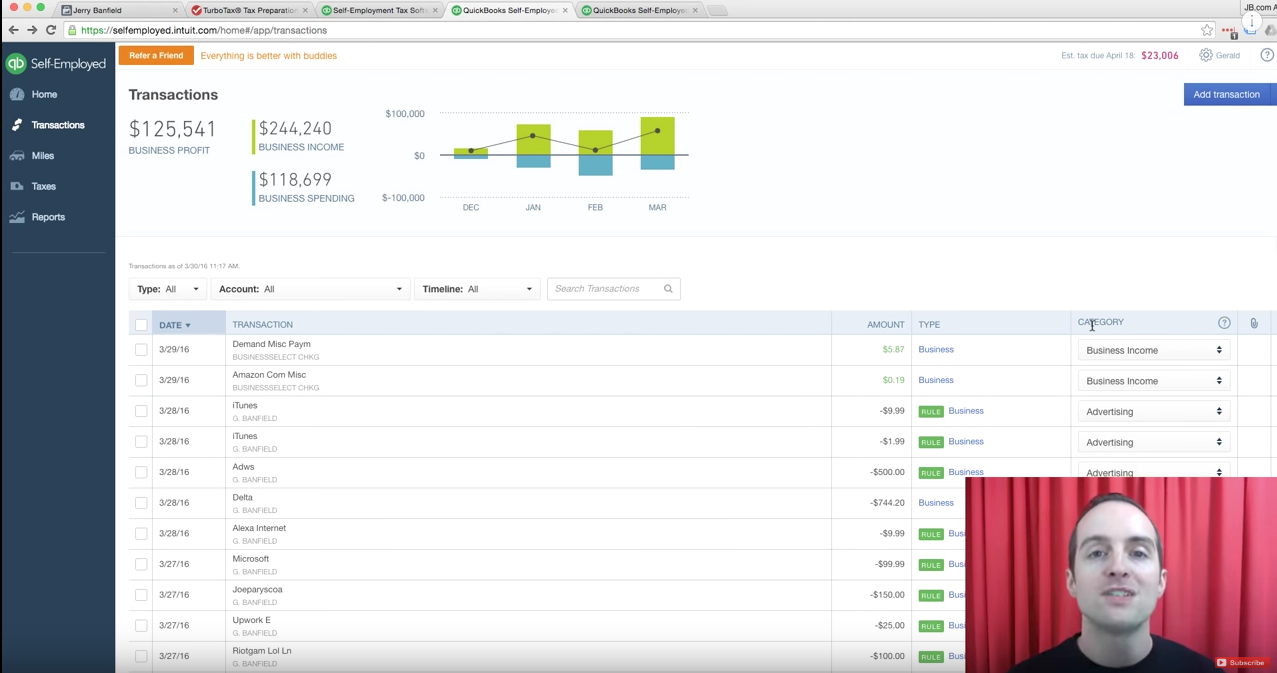

It’s for the self-employed and some of the main features are exciting. It automates and you can sign into your bank accounts. You can sign into any popular payment center you’re with and it will pull the transactions automatically in one view from all your accounts.

I have several different business checking accounts and several different credit cards. QuickBooks can pull them all into one account.

For taxes, I am able to see the categories, which is really nice. I can see exactly what this is, income, advertising, travel, contract, labor and office expenses.

QuickBooks forces me to learn more and to categorize

Then what it forces me to do is to learn more about each type of expense, and then to set things up correctly from the beginning. I wasn't sure whether I should put various expenses in what categories. Well, when I had to categorize it from the beginning and not go do it at the end of the year, then I was motivated to go research more.

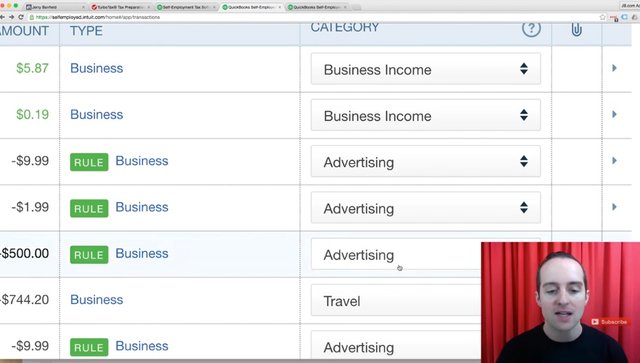

You can see that I have iTunes in the Advertising category, and you might say, "Why is that?"

When you have a website online, the web hosting and back-end of that is part of your advertising expense if you're using the website then to make sales, which my website is used for. These iTunes transactions on the back-end are setup that are part of things for my advertising system. It backs up some of my data, and then this is for iTunes. It bills it this way, but it's for back ups on the Apple iCloud.

Now, I've got these in what seems to be the correct category, and then I have that set up going forward all year. Things like Delta for Travel are obvious, but this was another one, Alexa Internet, where do I put this under?

It supports my tracking for my website and shows me what visitors I'm getting and what ranks, so that is a part of Advertising also. Same thing with these Microsoft expenses for buying Call of Duty points to make videos that then I'm advertising on Facebook, which promote my business to make sales.

I wonder what kind of expense is that? Well, that all goes back to advertising. If you're buying things that you're using to make the creative material that you use in your advertisements, then that goes back to advertising.

QuickBooks helps split business and personal expenses

This can also help you find a bunch of business expenses. I used to spend money on things that were personal, and I figured, "Well, if it's for a video game, I can't possibly write it off."

For my business now, I use video games as a part of my advertising because it costs way less to advertise a gaming video even when I'm talking about something that's not gaming in it. The actual background itself is gaming, so now I'm able to funnel my gaming I do for my advertising videos into my business. This allows me then to also plan all of what I do based around my taxes.

Even with this League of Legends, I spent $100 to buy things I use in the game, then I advertise the videos, and then all the things I do in the game are recorded. It is raw material for advertising and that way I am also able to write that off.

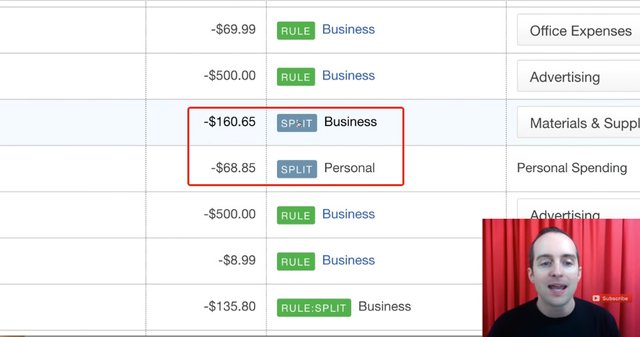

When using QuickBooks, I'm able to plan everything out and a neat feature is being able to split business and personal expenses.

I use Audible.com to have essentially the books and supplies I would have for an office. If I bought physical books to have around for my office, those would be in Materials and Supplies. Well, I listen to all my books, things like, "How to build a business online," or "The Personal MBA." The same kind of books I would buy and put around in my office, I buy them on Audible.

I also buy books for personal use on Audible like Harry Turtledove. I don't do anything with my business for about 30% of the books I read, and they have no business application. The other 70% have a business application into the advertising I'm doing, into the knowledge that I'm doing, into the videos that I'm making.

I'm able to split that up then and I make a rule in it that when I spend money on an Audible subscription, it splits it between business and personal automatically, then I don't have to go do that after the fact.

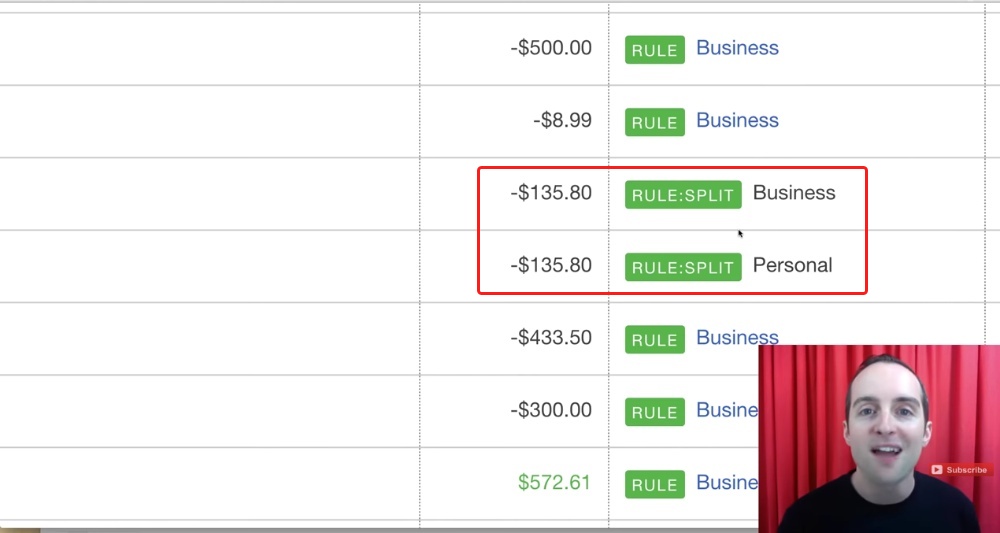

Then, that makes things so much simpler. Same thing with the cell phone bill I've got here, it splits automatically my Verizon Wireless bill ($135 split). I use about 50% personal and 50% business. I have phones that are just for business on it and I have phones that are just for personal, and then phones that end up overlapping. With six phones, it's about 50/50 business and personal.

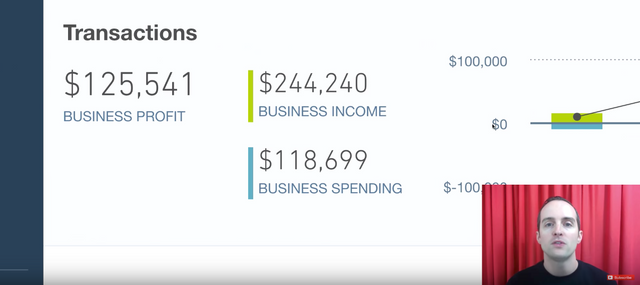

QuickBooks helps you track income and expenses

This is such a simple system and the beauty of it is then that I'm able to track my expenses and my income. Before I started using this I had a hard time tracking my income. Before I tracked carefully my income and my expenses in my business, I consistently lost money. Even now with my business doing very well, it's still making up for all of the mistakes I made in the past.

The first year I had my business, it was completely haphazard. I didn't track my expenses. It was a total disaster because I didn't see when I was wasting money on things in with all the other things I was spending. It essentially increased my overall expenses. Now, this gives me a simple interface. I was using mint.com to track everything, but the problem was that my personal expenses and my business expenses were all tracked together.

QuickBooks isolates my business and what I want to do is to see what business income I have, and then separate that from whatever I'm spending personally. My personal expenses tend to be pretty fixed and yet sometimes there are things like buying a house or random things that come along. Then if I'm tracking all that with my business income, it's hard to see. Now I can see how my business is doing.

I'm grateful my business is doing very well now, it was doing poorly for most of the time I had it, in fact, I was literally paying to work the first three years of my business. In other words, any job I would have had, I would have come out much farther ahead up until 2016 and the last several months before that.

The key to this has been tracking everything, because when you watch the numbers go in the red every month, it forces you to do something about it. If you don't track it and you don't look at it, if you don't see how much money you're wasting, it's a lot easier to waste a lot of money.

When you track your business and personal together, it can be easy to think your business isn't doing that good. If then you're wasting the money on things personally, or if you've had some big personal expenses come along, you couldn't control, and then it looks like you're barely breaking even, but in reality, your business is doing well.

Supporting those personal costs or sometimes you even get some money related that's not from your business. Then, if your business isn't making much and you track it altogether, then it looks like your business is doing well, even though the money you got was from a relative or a friend, or some other form not related to your business. QuickBooks breaks it down, keeps everything in one spot.

QuickBooks helps you save money

The best thing is now I have peace of mind that I've learned about my taxes well enough that I can in good faith go forward and do my best on my taxes feeling like I have a system in place that's within the rules that I understand.

Ignorance of the rules does not make you exempt from them. Often, when starting a business you spend a ton of money paying for professional help. If I hired a professional, I estimate it would cost somewhere between $2,000 and $10,000 to get the same kind of thing I can set up right here to do it all automated.

I would imagine that's why on the QuickBooks Self-Employed page they say that you can save an average of $3,800 in tax per year. I don't know if they're counting things you wouldn't have noticed otherwise or not having a tax professional, or both.

The cool thing I like is that the cost is only $11 a month. I paid for the whole 12 months. It's very cheap compared to paying a tax professional and it gives me the ability to do these things myself.

QuickBooks synchs to your business accounts, automatizes everything and shows your estimated tax due

The key thing to making all this work is you need to go add your accounts and get all your business accounts synced up. Whatever it is you're doing, whatever business accounts you're using, to get them synced up in here so that they pull automatically.

Importing them manually can be very stressful and time consuming. It takes so much time and which is why I would guess small business owners spend hundreds of hours a year doing taxes.

I've spent a lot of time doing my taxes and it frustrated me.

Now, when I have these little rules set up, every time iTunes bills, it automatically sticks it in Advertising. Every time Upwork bills or certain people send an invoice, it automatically sticks it in Contract Labor. Every time Google AdWords bills, it sticks it automatically in Advertising. Every time Verizon Wireless bills, it automatically splits it to business and personal.

It makes it so much simpler for me!

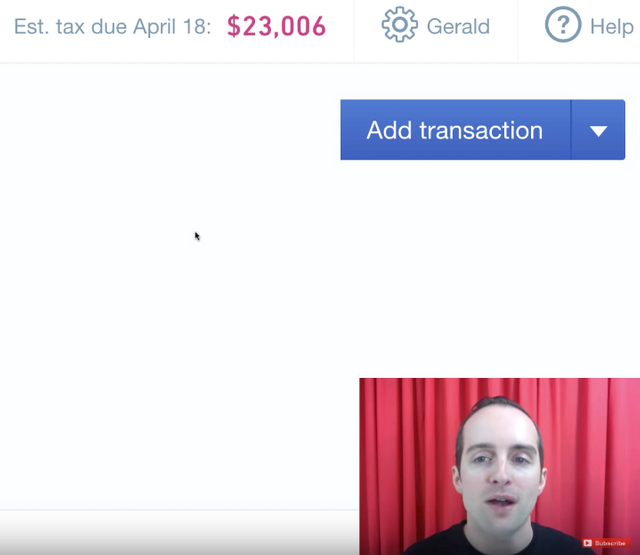

Then, it even tells me what my estimated tax due is. Trying to figure out the estimated taxes was one of the most difficult things I had, doing things the way I did before.

Yes, I have a pretty fat estimated tax bill coming up. I just made the payment they required, and now I have the chance to make even bigger payments before the deadline, due to having just got this set up and everything. I know what my estimated tax should be now without having to go calculate it every few months.

What did I do before?

I was just lazy. I didn't bother calculating my estimated tax. I just paid whatever the IRS told me to pay. In 2015, they said I needed to pay $1,700 every three months or something like that, so I just paid that.

Then, when things went well at the end of the year, I paid an extra $5,000 or $10,000 just free styling it, figuring, "Okay, I made some extra. I better pay some extra." I had to pay a $3 fine that year for underpayment. I'm grateful three dollars is not too bad.

That said, without doing this now, I likely would end up paying a lot more. Now I know what my estimated tax is, and I haven't put in all my deductions yet, I actually can deduct healthcare costs because I am paying that now. With my wife finishing her job off, I need to put the Cobra payment in for our health care coverage that the business is now paying for.

You can add all these deductions in. I can go put my car miles in. I need to finish doing that and getting this set up all the way in terms of the deductions, and then take a second look at my estimated tax. It's not likely to be a whole lot lower, but you can see how simple this is compared to the way I did it before.

Prerequisite to this, if you don't have your business bank account set up already, this isn't going to work. Now, I made it almost a year ago. I have a friend who has been working with me as a contractor. He hasn't been doing any of the business bank accounts either up until now.

You can do it that way. The IRS doesn't say that you have to segregate your business and your personal expenses from each other. However, it makes it a lot easier. If you don't have a business bank account and business credit card set up, you can't use this very effectively. You can still do it though. Originally, I just had all of my accounts and expenses together. You can still use this, but it will be a lot messier and you don't want things to be messy.

If you had all your personal stuff, you'd have to go in your interface and click on things, and set them over to personal. Then you'd have all these things in here that either would be split or setup just with personal spending. It'd be a lot of extra work.

If you don't already, you want a business bank account set up that has online banking. Since QuickBooks has a lot of payment centers that you can connect, it's got all of these options here for you where it can directly import it.

The automation is the key to this. If I had to do this manually, I might as well just save up to the end of the year and just do what I've been doing. The automation is the beauty of this. Being able to just export this at the end of the year should save me 20 to 40 hours doing my taxes. That to me is worth quite a bit.

Final words

I hope this has been useful for you because this is the kind of thing that I didn't even think to think about. I didn't even realize that I didn't know a better way to do my taxes until this year when I sat down, went to do them and said, "There's got to be a better way."

This is really aggravating to do this at the end of every year. I almost missed $50,000 of expenses in payments out for contract labor, because I missed that little line in the spreadsheet. I assumed I'd already entered all of them.

Then I said, "I've got to have a better way to do my taxes. This is a disaster"

Thank you very much for reading this post, which was originally filmed as the video below!

The feedback on the video was so positive that I spent about $100 to get this post created for you here out of the video transcript by GoTranscript, and then edited it prior to publishing! I appreciate you being here and I hope you have a wonderful day today.

If you found this post helpful on Steemit, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield with edits by @gmichelbkk

Shared on:

- Facebook page with 2,255,789 likes.

- YouTube channel with 201,369 subscribers.

- Twitter to 105,563 followers.

PS: Witness votes are the most important votes we make on Steem because one vote for a witness lasts indefinitely! Would you please make a vote for jerrybanfield as a witness or set jerrybanfield as a proxy to handle all witness votes at https://steemit.com/~witnesses because when we make our votes, we feel in control of our future together? Thank you to the 516 accounts voting for me as a witness, the 190.6M VESTS assigned from users trusting me to make all witness votes by setting me as proxy, and @followbtcnews for making these .gif images!

interesting

Yes of course!

My tax ain't that complicated yet but i will keep this tutorial just in case I get into business as well... very nice post as always

Thanks for turning this into a blog post. I remember this course really helped me out when you realised it a while back!!

highly educational video - tax awarness for a business man/woman is one of the key qualities for success

Great information >>>>>>>>>>>>>>>>>Thanks For Sharing........................

Keep It Up:)

Being assertive and calculated, positive thats the first rule

I use QB online and it's great to get everything sorted out. The ins, the outs and everything in between. Reconciliation is awesome when you can connect with various banks online.

Very good @jerrybanfield . . I like your post and follow next post 👍👍👍👏

Very Good Post !! ^ ^

Love your work Jerry!