Bitcoin's Trajectory - Crypto Academy S4W5 - Homework Post for @imagen

Another week is upon us in this seasons CryptoAcademy, it’s has been quite a journey and we thank God for seeing us through each week. This weeks lecture is all about Bitcoin's Trajectory a very fascinating subject matter. After reading the lecture notes and doing some research, I present my assignment post for this weeks task.

Q1: How many times has Bitcoin hated been having? When is the next one expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that perform or have done "halving".

Let me tackle the first question which is how many times has Bitcoin hated been halving?? Halving is a term that won’t be familiar to many people so to make them more acquainted with the answer I will explain what Bitcoin halving is. Ever since Bitcoin was created in 2009, people created Bitcoin through mining when we say mining it means using super or high power computers to solve complex mathematical problems to verify transactions in the blockchain.

The people who solve these complex problems are called the ‘miners’. It has been 12 years since the establishment of Bitcoin and has been mined up-till now. The question I want to ask is if it has been mined from 2009 shouldn’t it be everywhere?? But it is not so because of ‘Halving’. Bitcoin halving in the sense that after approximately 210,000 blocks are generated by the miner, the rewards are divided into two so that half is given to the miner for creating the blocks.

From 2009, (since the establishment or creation) of Bitcoin it has gone through the halving process only three (3) times, below are years it occurred in and how much was halved.

1 - After it’s development, Bitcoin went through its very first halving in the year 2012. 50BTC was halved to 25BTC which was now rewarded to the miners.

2 - It took approximately 4 years to obtain 210,000 blocks which corresponded to the year 2016. 25BTC was halved to 12.5BTC which was now rewarded to the miners.

3 - The last or recent halving took place another 4 years after, that is in the year 2020. 12.5 BTC was halved to 6.25 BTC and rewarded to the miner.

When is the next one expected?

From the trend after every 4 years the miners produces approximately 210,000 blocks so the next halving we expect it to be in the 2024. The current reward of the miners will be halved again so each miner will earn about 3.125BTC.

What is the current amount that Bitcoin miners receive?

The current halving occurred last year in 2020, which saw 12.5 BTC halved into to 6.25 BTC which was rewarded to the miners. So the current amount receive is 6.25 BTC.

Two (2) cryptocurrencies that perform or have done "halving".

The two Cryptocurrencies I will be talking about are Bitcoin gold and Raven coin. Let’s start

1 - Bitcoin gold

We all know Bitcoin gold is a hard fork of Bitcoin which is also decentralized in nature and runs on an algorithm called 'Equihash‘ Bitcoin gold halving occurred in April 18, 2020 which saw the miners receive a reward of 6.25 BTG per block. The next halving is supposed to occur in the next four years that is in 2024 at a block number of 840000 the reward the miners will receive in 2024 will be 3.125 BTG.

2 - Raven coin

This cryptocurrency is similar to BTC and is yet to experience its first ever halving next year that is 2022 at block number 2,100,000. A total of 5,000 will be produced and halved to 2,500 Raven which will be awarded to the miners. After 2022’s halving the next halving will occur in 2026 and the miners will receive 1250 Raven as reward.

Q2 : What are consensus mechanisms? How are Proof-of-Work and Proof-Staking different?

Consensus mechanisms are algorithms in the blockchain network that come together collectively to make a decision, validate transactions and store them in blocks. This is due to the decentralized nature of the blockchain because it won’t depend on any central authority for any decision concerning the blockchain rather several nodes come together collectively validate and verify the transactions.

The are several consensus mechanisms some of them include proof-of-work (PoW), proof-of-stake (PoS), delegated proof-of-stake (DPoS), for the sake of this assignment I will be talking about the proof of stake (PoS) and proof of work (PoW).

Proof of stake (PoS)

This is a consensus algorithm that aims on improving on some of the flaws of the proof of work consensus algorithm. So you can say that PoS is an upgrade of the PoW. Some of the flaws you will notice in the proof of work algorithm is the high energy consumption, the speed at which it validates transaction is slow and many more.

How do they reduce high energy consumption? Now we all know that on the PoW they use high or super computers to solve complex problems which consumes a lot of energy the PoS differs in a way that users can stake their asset depending on the number of assets they have staked gives them the power of part take in validation. Of transactions.

Let me explain in simple terms what this consensus algorithm means. The users uses his assets to select someone who is referred to as a ‘delegate’. The delegate is now responsible for creating of new blocks and also validating them.

Proof of work (PoW)

This a a consensus algorithm that most popular cryptocurrencies like Bitcoin, Litecoin and Ethereum uses. The proof of work algorithm uses high power computers to solve complex mathematical problems in other to validate a transaction due to the need of super computers to mine the blocks there is a lot of energy consumption and also the speed at which the blocks are validated is slow as compared to the PoS.

Differences between PoS and PoW

| PoW | PoS |

|---|---|

| High power computers are needed to solve complex mathematical problems | There is no need of any high power computers |

| A lot of energy is consumed because of the usage of the super computers | The energy consumed is at a minimum level |

| The amount of blocks you mine will determine your reward | The amount of asset you stake will determine your voting power |

| You only earn work | You can earn by staking your asset. |

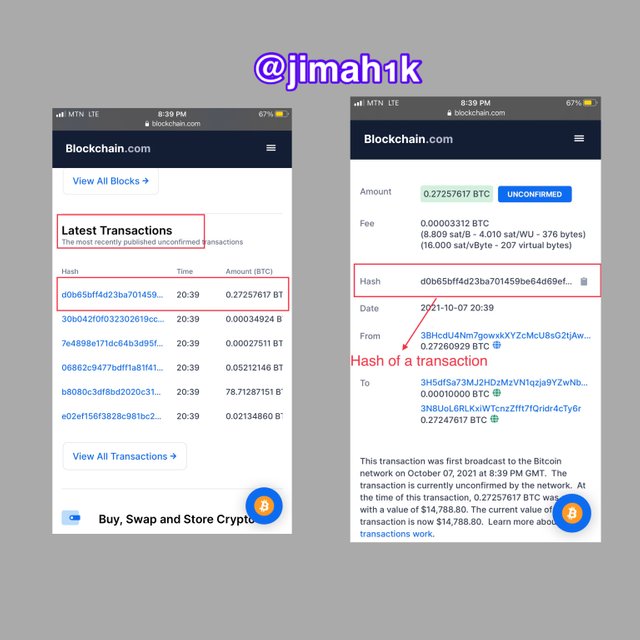

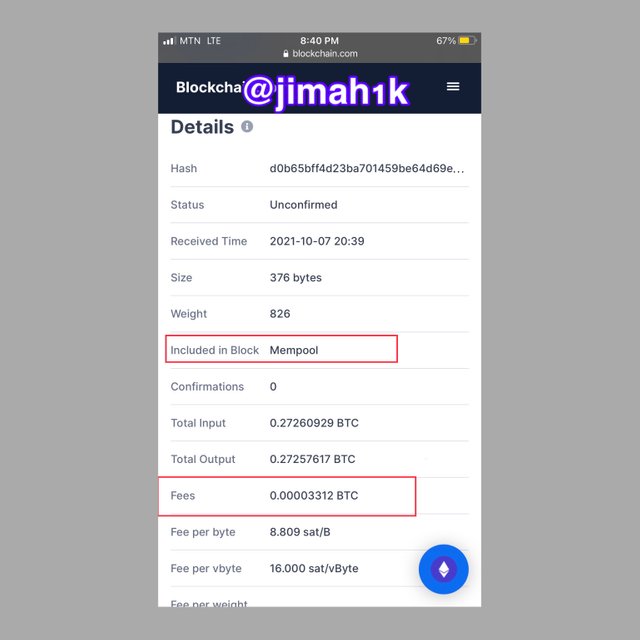

Q3 : Enter the Bitcoin browser and indicate the hash corresponding to the last transaction. Show Screenshot.

First of all you will need to access this LINK after accessing the website the last transaction according to the screenshot below has a hash of d0b65bff4d23ba701459be64d69efae29771c29345a1ad07feacd6819c9b346c

In the detail of the last transaction, I observed that the transaction was added to a block called mempool with a transaction fee of 0.00003312BTC

Q4 : What is meant by Altcoins Season? Are we currently in Altcoins Season? When was the last Altcoins season? Mention and show 2 Altcoins graphs followed by their growth in the most recent season. Reason your answer.

Altcoins are cryptocurrencies that are not Bitcoin they include steem, cardano and many more. So Altcoins season according to the alt coin season index is when over 75% of the top 60 altcoins Perform more than Bitcoin. This is usually measured with 90days (3months), 30days or 365days.

In altcoins season’s, BTC losses some of its dominance level and the other altcoins gains some dominance in the crypto space. How do altcoins seasons happen? This mains mainly happens when users sell their BTC to buy some altcoins in other to gain profits this thereby increases the prices and the dominance level of the asset and gradually reduces BTC’s own.

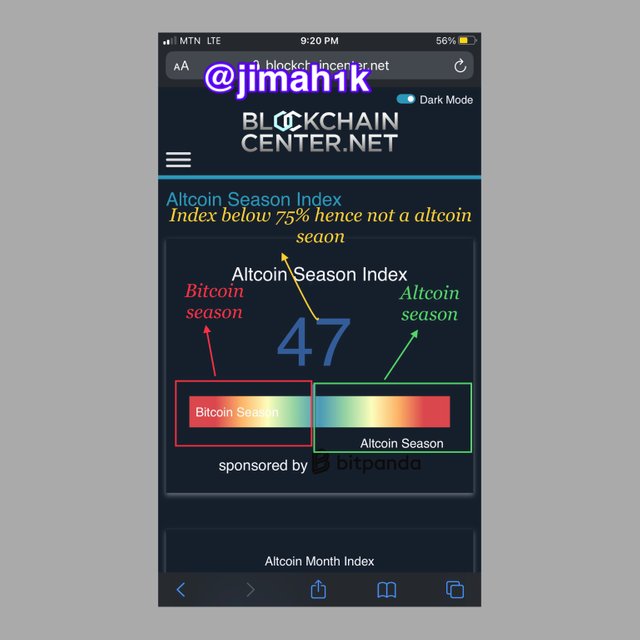

Are we currently in Altcoins Season?

You will need to access the blockchain center to get the index to determine whether ewe are in an altcoin season or not. Now according to the screenshot, 47% of the top 50 altcoins are doing better than BTC. This clearly shows that we are not in an altcoin season because to be in an altcoin season 75% of the top 50 altcoins has to be doing better than BTC.

When was the last Altcoins season?

The last altcoin started from 26th March where 75% of the altcoins performed better than BTC. This whole season lasted for about three months because it ended in June. One main cause of this season like I said earlier will be a lot of trades opting out of BTC and purchasing a lot of altcoins. Below is a screenshot from blockchain center.

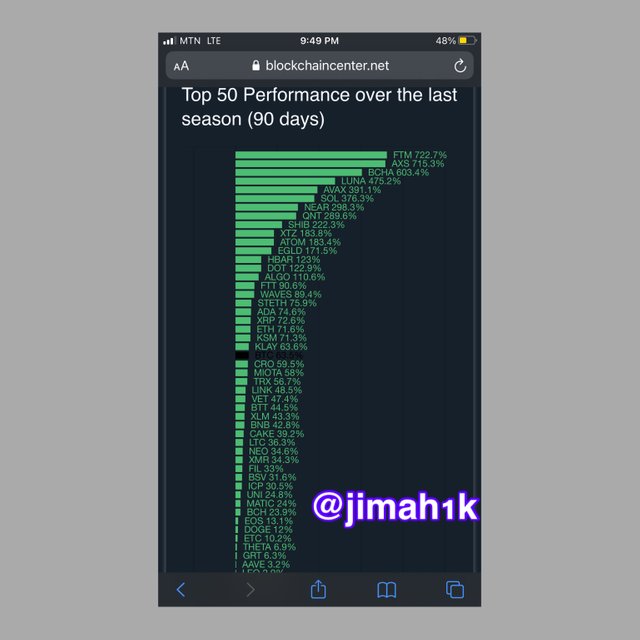

Two (2) Altcoins graphs followed by their growth last 90days.

From the screenshot above the two cryptocurrencies that have grown in the last 90days are Luna and AXS. Let’s start with AXS

AXS

The above is a chart of AXS/tether showing the altcoin season which starts from 25th March and ends in June. As can be seen in the chart the price of the asset in that season was in a continuous rise. With a growth of 715% in the last 90 days. Currently the price of this asset is at $123.38 according to the coin market cap with a market dominance of 0.33%. The growth of this altcoin has been significant from the $0.1 price to a all time high of $155.

Luna

The above is a chart of Luna/tether, in the altcoin season that is from March to June, this altcoin price sky rocketed from a growth of 475.2%. With a current price of $46.8 according to coin market cap and also has a market dominance of 0.82%. The growth of this altcoin has also been significant from $0.2 to $49.

Q5 : Make a purchase from your verified exchange account of your preference of at least 15 USD in a currency that is not in Coinmarket's top 25 (SD, tron or steem are not allowed). Why did you choose this coin? What is the objective or purpose behind this project? Who are its founders/developers? Indicate ATH of the currency and its current price. Reason your answers. Show Screenshots.

I choose to invest in Dent token I will explain why I choose this coin below but let me take you through the processes. I’m going to make this purchase through my verified Binance account.

Screenshot taken from Binance

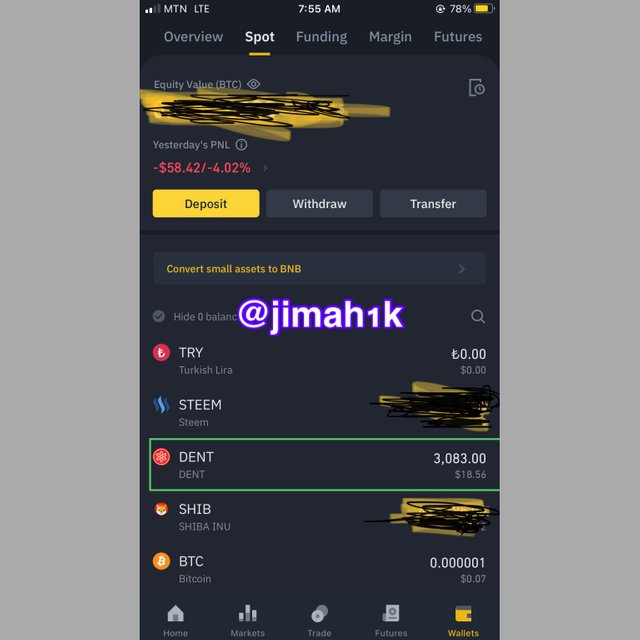

1 - On the search engine I searched for Dent/USDT pair because I was going to exchange my USDT for Dent

2 - I clicked on buy Dent and placed the order

Screenshot taken from Binance

After a while the order got filled and I purchased debt worth $18

Screenshot taken from Binance

Why did you choose this coin?

Dent is a cryptocurrencies that was developed in the year 2017, which uses the proof of stake consensus algorithm hence a Ethereum based ERC-20 token. Dent is the digital operator that offers electronic sims, data plans, additional phone call minutes and more.

Current over half of the population can not access mobile services because of their huge charges. Dent has come in to cancel all this by offering free roaming fees and also suitable data plans for its users.

Who Are the Founders of Dent?

Dent was founded by Tero Katajainen and Mikko Linnamäki who is the co-founder of DENT Wireless. Tero has master’s degree diploma in sciences in 1999.

Goal of dent

The main goal of dent is to make mobile services and data services to be made accessible to anybody in this world without any restrictions. Whiles making them accessible they should also be cheap. By the end of 2021, dent plans on expanding to new markets currently over 25 million have joined the dent services.

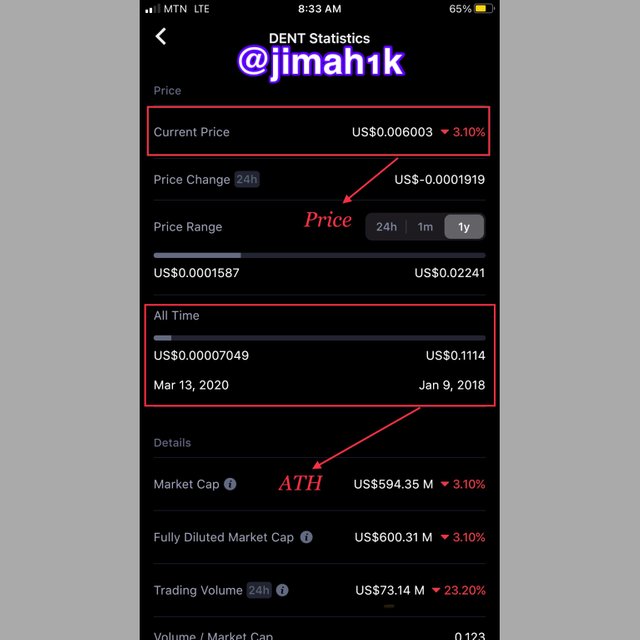

ATH of the dent and its current price

Source

From the screenshot we have the current price of dent to be $0.006003 and ATH of $0.1114 which was recorded in 9th January 2018.

Conclusion

I very big thank you to our professor for this wonderful lecture through this lecture I have learnt that when 75% of the the top 50 altcoins are doing better than btc it is termed as altcoin season. And also the proof of work consumes a lot of energy due to its requirement of a super computer to solve complex mathematical problems. Hence the proof of stake doesn’t use super computers to solve complex mathematical problems rather users select delegates to verify and validate transactions.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.