Could a major lock up expiration in GBTC roil the Bitcoin markets?

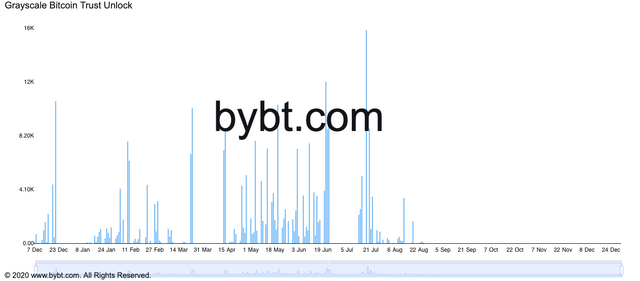

GBTC has major share lockups expiring over the next several weeks that may impact the price of bitcoin...

Remember when bitcoin was running up in late 2020 and early 2021?

Yea that was a lot of fun right?

Well part of the reason for all the demand was due to the bitcoin investment trust, GBTC.

It was trading at a significant premium to its net asset value, which is bitcoin.

They have an exchange program where investors can exchange their bitcoin for shares in the trust, and those shares are issued at NAV.

So, as you can imagine many hedge funds and other investors flocked to the arbitrage trade like flies on you know what.

The only catch was that those shares are locked up for 6 months.

Well, now we are getting to the end of those 6 months for the majority of those purchases:

What will they do?

While some are convinced that they will dump the shares and the selling of GBTC will also impact the spot price of bitcoin.

This is likely due to some tie between investors exchanging bitcoin for shares and interaction in the spot markets such as borrowing etc.

However, I fail to see the major correlation.

In my opinion the most likely hedge would be to short the spot market and long the arbitrage opportunity in GBTC shares.

If that is the case then they would cover the short spot position same time they exited the long arbitrage position.

Which would actually put buying pressure on spot markets.

Either way we are about to know more in roughly 2-3 weeks as that is when some of the largest expirations hit the market.

With arbitrage, someone is always left holding the bag.