How to Trade Bitcoin in 2018

Last year was a stellar one for Bitcoin, as it opened trading at $966 before embarking on a rally that took it to as high as $20,000. Even after the volatility of the past few days, Bitcoin has beaten all the other asset classes by a huge margin.

The big question on everyone’s mind now is: what will happen in 2018 and how should one trade Bitcoin?

The experts are divided in their opinion. The aggressive bulls have given targets of above $60,000 for 2018. That’s a 300% increase from the current levels. On the other hand, the skeptics continue to question the cryptocurrencies’ valuation, calling it a bubble.

Some expect wild swings in 2018. Saxo Bank’s outrageous prediction lists a possible high of $60,000, followed by a drop to $1,000. Similarly, cryptocurrency entrepreneur Julian Hosp believes that Bitcoin will fall to $5,000, but he tends to think that it will also touch $60,000. He is not sure which level will be reached first.

While the predictions offer us different opinions, it is difficult to trade off them. So we have tried to identify a few unique patterns on the charts that repeated in 2017. These can be used as guidelines by the traders to develop a suitable strategy for 2018.

50-day Simple Moving Average

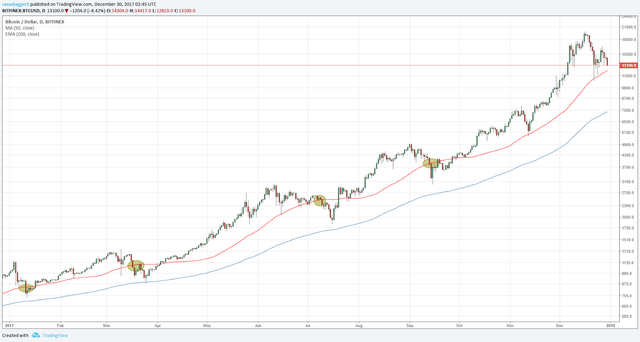

In 2017, 50-day Simple Moving Average (SMA) acted as critical support. As seen in the chart, this level was breached only four times.

In all other instances, the price touched the moving average or dipped below it during intraday, but quickly recovered. So, a purchase close to the 50-day SMA offers a low-risk buying opportunity. Buy close to the 50-day SMA and keep a stop loss below it.

200-day EMA decline as long-term entry opportunity

Bitcoin offered low-risk entry opportunities to the long-term traders en route to its 20-fold rise in 2017. It has not traded below the 200-day exponential moving average (EMA) since October 2015, which is critical support.

In 2017, whenever the cryptocurrency broke below the 50-day SMA, it came within a striking distance of the 200-day EMA. This proved to be an excellent buying opportunity for long-term investors. Even in the next fall, a move close to the 200-day EMA should be seen as a buying opportunity.

The price will not necessarily fall as low as the 200-day EMA, even during a large correction. On Jan. 12, for instance, it bottomed about 6.5 percent above the 200-day EMA. Similarly, on March 25, it was about 2.5 percent above the 200-day EMA. On July 16 the bottom formed 10.7 percent above the 200-day EMA.

Though not perfect, traders can start their purchase about 15 percent above the 200-day EMA, with staggered buy orders below that.

How do we calculate how far above is the price from the 200-day EMA?

Though there doesn’t exist any specific indicator for it, we can use the “Price Oscillator” (PPO) by altering its values smartly. The PPO offers the percentage difference between two exponential moving averages. Therefore, if we need to plot how far away the price is from the 200 EMA, we can feed the values of 1,200, which will give us the desired result.

What if Bitcoin breaks down below 200-day EMA?

If the price breaks down of the long-term moving average, it is a warning signal that things have changed. It indicates that Bitcoin is either entering into a long-term downtrend or into a range-bound action, which will require a different trading strategy.

In trading, profit is made by buying and selling at the opportune time. While we have identified a low-risk buying strategy, we have yet to ascertain the best time to sell. Let's take a look at that, next.

Best place to sell

There was no indicator that would have given a consistent sell signal at the top. But it was noted that a simple trendline did the job perfectly.

As seen above, though a break and close below the trendline did not get you out of the position right at the top, it certainly helped to lock in most of the gains.

Another indicator that could help is ADX.

Even as far back as 2014, a reading above 60 on the ADX has been a good selling point for Bitcoin.

How to approach Bitcoin trading in 2018?

It is easy to identify and fit indicators and trendlines once the chart has formed. Doing the same with live markets is not an easy task. All in all, it is almost impossible to forecast cryptocurrenciy price movements for the whole next year ahead, because the marker is still young to have developed repetitive patterns of price behavior. Try avoiding long-term prognosis. Happy trading.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/how-to-trade-bitcoin-in-2018