How To Analyze Defi Projects By Doing Fundamental Analysis

Namaste 🙏 to all of you. Once again, I am back with another informative post regarding Defi Protocals.

In the crypto space, day by day, Defi-related projects are growing very fast, but most of them are run by scammers. From here, identifying real Defi projects is not so easy.

But we can identify them by doing a simple fundamental analysis. It did not take that much time, but you needed to invest some time and patience. By doing this, we may avoid further losses.

Let's start our article today.

What Purposes Are Defi Protocals Using? |

|---|

In the present crypto market, Defi is playing a big role. Because for interacting on centralized exchanges, we need KYC. But for Defi, just having a decentralized wallet, funds, and an internet connection is enough. No need any kyc for interacting here.

Mostly, we use Defi for lending, borrowing, trading, and earning some APY on our holdings. That's why we go for Defi. But some fake projects offer huge APY on our funds; by seeing that offer, we attract them, so we invest our money there to earn good returns on our investment.

But here, they are collecting needed money and simply shutting down those services. We lost all our hard-earned money here. In Defi, we cannot contact any person or authority who is in charge of this. That's why investing in unknown Defi projects is always risky.So don't invest any money before research.Because Defi is Open source, so any one can develop their projects very easily. That's why my humble request Dont fall in their trap.

That's why, before investing there, we must research their project fundamentals and then only go for it. Only those are discussed in today's article. Just keep reading; you'll gain good knowledge regarding it.

Well-Known and Popula Metrics for Evaluating a Defi Protocal |

|---|

In the crypto market, we have a lot of Defi protocols from this identifying genuine ones is not so difficult. Just by checking 24 hour volume, inflation rate, price, how many users are interacting, last one hour transactions, etc., it helps a lot to know about any Defi project.

Let's Discuss

- Total Value Locked (TVL):

TVL means Total value locked in that particular Defi Protocal. Based on TVL, we may easily identify its popularity and trustworthyness in the market.

Which Defi Protocal Having a huge TVL means it has good investors already, so we may trust those. Because big investors don't invest their money in any scam projects, it's a simple metric to evaluate Defi Protocal.

Knowing this, I just use DefiLlama because it's an Defi aggregator. For knowing any Defi protocols, it's the best platform for knowing all the needed details regarding that Defi protocol.

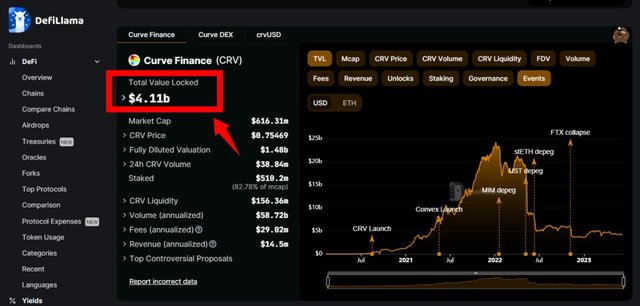

For example, here we choose Curve Dex (CRV) because it's one of the most popular Defi Protocals in the Ethereum Chain.

In the search bar, just type curve dex, and we get all the details.

source

Here you may see a clear picture regarding TVL. At present, nearly $4.11 billion worth of assets are locked up here. That's why its TVL is around $4.11 billion at present. It shows its trustworthiness compared to other protocols.

- Market capitalization:

In Defi, each protocol again has its own token. This token is useful for doing some activities in that protocal.. That's why that particular project's token market cap is also one of the key metrics for evaluating that Defi Protocal.

In general, we can compute market capitalization using present price of a token and current circulation supply. By multiplying both, we get the present market cap.

This market cap indirectly shows protocol utility, adoption, and copitation with other similar protocols. So before investing, you must check this factor too.

For example, here again, choose curve finance.

At present, it has a £616.31 million market cap, a £1.48 billion fully diluted valuation, and a £0.75 CRV price.

Those details here may be checked.

source

It's looking very promising and trustworthy to me.

- Volume for 24 hours :

By evaluating this matric , we may easily identify traders' interest in this project.

24 hour volume means the last 24 hours of trading activities in that Defi Protocal.From this we may know how many users show interest in interacting with it.

A high 24-hour volume shows a lot of users wishing to interact with it, along with its high liquidity.

Low 24-hour volume indicates traders are not showing any interest, so we have low liquidity here.

So before we invest, I must check this matric too.

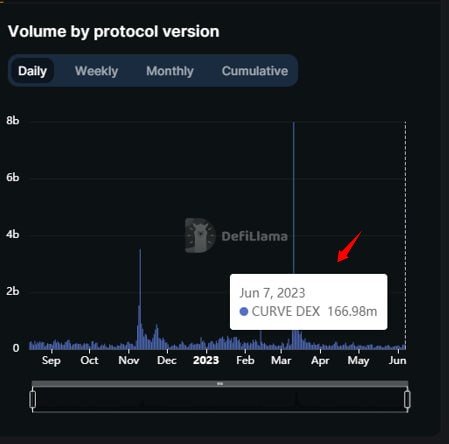

For example, again, I am choosing curve finance.

Here you may see in the last 24-hour volume in Curve Finance.

Around 166.78 million volumes were generated on June 7, 2023. Those details may be checked here.

source

Curve Finance supports up to 7 different networks; here we may also check each network's separate volume for the last 24 hours.

On June 7, 2023, the volume of Curve Protocal in the Ethereum chain will be 148.9 million, Arbiturm 9.72 million, Optimisum 3.66 million, Polygon 1.78 million, Avalanche 981.97k, Fantom 616.99k, and XDai 321.24 million. Like that, all those details must be checked before we go through them.

Those details may be checked below.

source

By spending just a few minutes, we may identify needed information regarding any Defi Protocal.

- Price-to-Sales Ration

By using this metric, we can determine whether Defi Protocal is undervalued or overvalued.

To know the price-to-sale ratio, we need to divide the fully diluted market cap of that defined protocal by its annual revenue. If its ratio is low, we may say it is more undervalued, so it has a high chance of growing faster. If its ratio is high, you may see that it is overvalued, so it has a high chance of collapsing soon.

For example, here again, choosing Curve Finance. It has a fully diluted market cap of around £1.49 billion with £14.5 million in revenue.

If we divide those 1049 by 14.5, we get 72. Its ratio is the price-to-sale ratio. It looks undervalued, so this protocol is very safe.Here first I convert billion into million then divide both.

Those details may be checked below.

source

Like that, we can easily find out the price-to-sale ratio for any Defi Protocal.By checking those details too we easily evaluate genuine Defi Protocal in crypto space.

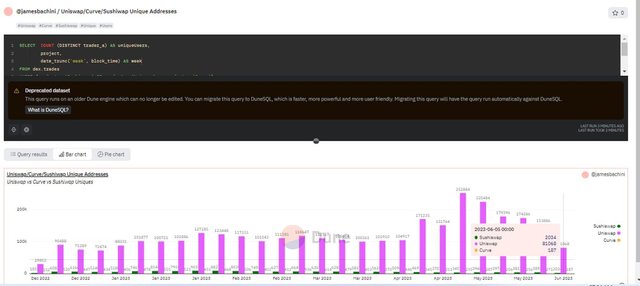

- Unique Address Count:

It's one of the criteria for evaluating Defi Protocals. Because it represents how many unique users are interacting with this practical and showing interest in investing here.

If the unique address count is increasing, it represents a lot of users showing interest in that protocal. If it is decreasing, it means that day by day its ability is decreasing, so it's better to avoid it.

But checking this address count is not so easy. By hardly finding one query using this, we may compare Uniswap, Curve Finance, and Sushiswap's unique address counts for each month.

Those details may be checked below.

source

Note: I exactly Dont know how much fair this Tool is, just for educational purpose I use it

By checking this, Curve is slowly sustaining its users. Due to the bear market, it's also a reason. But uniswap is going well compared to the other two.

Like those metrics, they help evaluate Defi projects in the crypto space. Before checking, their fundamental metrics didn't interact with it.

Along with that, we must examine the project team, the technology they are employing, the token economy of that project, the security measures they are implementing, the communities and adoption of that project, and many other things. We must initially evaluate them before investing your funds there.

Without checking, don't go blindly by hearing others words; it's always risky.

Conclusion |

|---|

In the crypto space, day by day we see a lot of Defi projects, but evaluating a trusted one is not so easy. But by applying some metrics like project team, adoption, TVL, unique user count, and many more factors, we can identify the trustworthy one.

It's better to not invest huge amounts of money in one place. What you wish to lose is only investing in crypto. Don't invest all of your hard-earned money in crypto. It's not a good strategy.

Thanks for reading my article.

https://twitter.com/lavanya15bhavya/status/1666692410322350081?t=KWBfVcx9bOEpP73AHMdrSg&s=19

Upvoted! Thank you for supporting witness @jswit.

Hi, @lavanyalakshman dm in discord I need to talk on something it will be profitable for you sure.