Dollar leaves pack. Forecast as of 04.11.2022

Monthly US dollar fundamental forecast

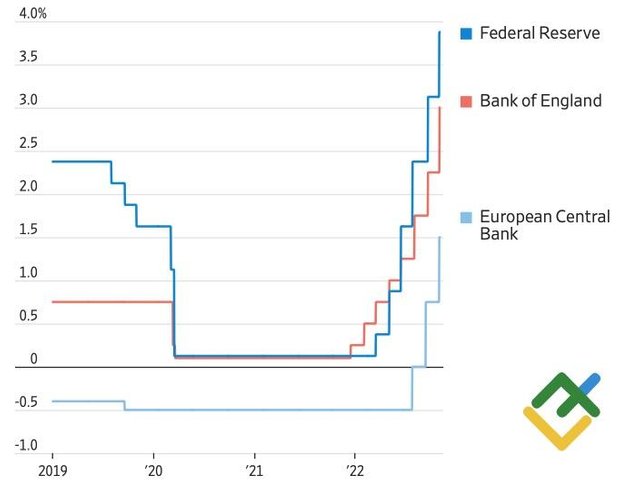

The pack leader intends to raise the rate to 5.15% after the November FOMC meeting, as the futures market expects. But what should the rest of the pack do? Should they continue the race at the risk of triggering recessions, or should they stop and not fight inflation? Christine Lagarde was the first to answer this question. According to her, the ECB does not believe that the upcoming recession in the eurozone will curb inflation. It looks like the ECB is ready to continue raising rates, which temporarily supported EURUSD. But it is unlikely that the intention of the European regulator to continue to follow the pack leader will save the euro.

Christine Lagarde explained the differences in economies and why the deposit rate will not rise as high as the federal funds rate. She noted that the US labor market is extremely tense, as the number of vacancies exceeds the number of unemployed almost twice, while in the eurozone the ratio is 0.3.

Dynamics of central bank rates

For more information follow the link to the website of the LiteForex

https://www.litefinance.org/blog/analysts-opinions/dollar-leaves-pack-forecast-as-of-04112022/?uid=285861726&cid=58534

Dear @liteforex,

I'm @steemitwatcher , a detective from @abuse-watcher team. We found that your article is not original content. Plagiarized content are highly discouraged on Steemit platform.

Contact us on our discord server in "appeal" channel : discord

Thank you.