Dollar sounds the alarm. Forecast as of 23.03.2022

Weekly US dollar fundamental forecast

According to Barclays, if in the short term strong demand for safe-haven assets supports the US dollar, then in the future, the continuation of the global economic recovery and the improvement in global risk appetite will press it down. In the second half of the year, the US economy will lose its exclusivity, and excessive trade deficits and speculative greenback longs will send the US currency down. Looking at the US stocks rally, the forecast seems to be coming true.

After a short pause caused by Jerome Powell's hawkish comments, US stocks resumed growth, which is usually interpreted as an improvement in global risk appetite. Frightened by the speech of the Fed Chair, investors try to spot some positive in his words. For example, Powell dismissed fears of a recession, citing the experience of 1965, 1984, and 1994, when the central bank cooled the economy but did not provoke a recession, which encourages the buyers of the S&P 500 and EURUSD.

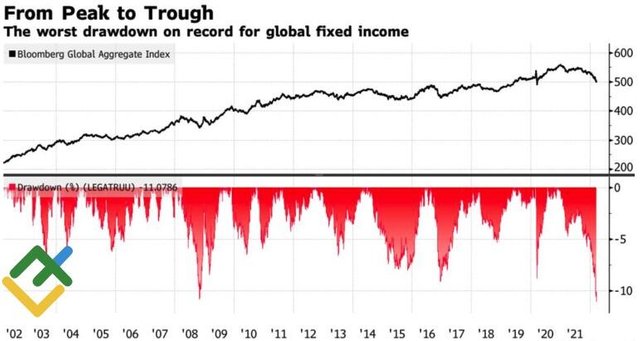

Dynamics of Global Aggregate index

For more information follow the link to the website of the LiteForex

https://www.litefinance.com/blog/analysts-opinions/dollar-sounds-the-alarm-forecast-as-of-23032022/?uid=285861726&cid=58534