USD faces obstacles. Forecast as of 01.11.2022

US dollar fundamental forecast for today

On the one hand, investors understand that the 14% rally of the Dow Jones index in October, the best since 1976, was excessive. Expecting a dovish reversal by the Fed, the markets have been wrong more than once and paid dearly for it. The Fed may punish them again at the November FOMC meeting. On the other hand, pressure on the US regulator is also increasing from politicians. The change in Jerome Powell's stance could be a saving straw for the EURUSD.

Unlike Donald Trump, Joe Biden has openly stated that he will not criticize the Fed. The current US president respects the independence of the central bank. However, times are changing. It's one thing when everything goes well. Another is when the highest inflation in decades and a looming recession anger voters. This could end badly for Democrats in the Nov. 8 midterm elections. Therefore, some of them urge Jerome Powell to show restraint.

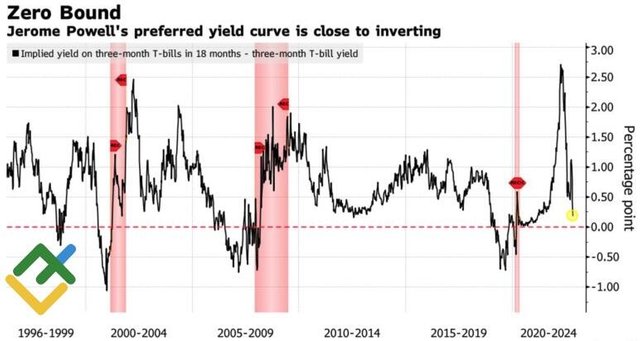

Especially since the key yield curve, with the difference in rates between 3 and 18-month bills, is ready to be inverted. The Fed chairman was once skeptical about bond yield differentials falling below zero with other maturities, citing this curve. Now it is close to signaling an imminent recession.

US yield curve dynamics

For more information follow the link to the website of the LiteForex

https://www.litefinance.org/blog/analysts-opinions/usd-faces-obstacles-forecast-as-of-01112022/?uid=285861726&cid=58534