Coinbase in trouble for likely investor disappointment

Today I won't be writing about Bitcoin's price action behavior, I wanted to take a break and share with you all what has been happening with Coinbase and the series of problems it is facing for likely disappointing investors.

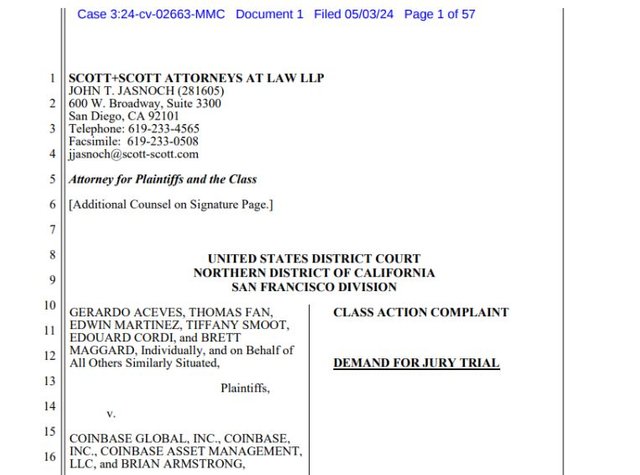

In an article uploaded by Amaka Nwaokocha to the Cointelegraph portal she made it known that, "Cryptocurrency exchange Coinbase and its CEO, Brian Armstrong, face a new class action lawsuit that alleges investors were misled into buying securities and claims the company's business model is illegal."

According to the Nwaokocha article, "The lawsuit was filed in the U.S. District Court for the Northern District of California, San Francisco Division, representing plaintiffs Gerardo Aceves, Thomas Fan, Edwin Martinez, Tiffany Smoot, Edouard Cordi and Brett Maggard of California and Florida."

It was learned that, "Plaintiffs claim that Coinbase admitted to being a "Securities Dealer" in its user agreement, converting digital securities sold by the exchange into investment contracts or other securities. They also assert that the Coinbase Prime brokerage is a securities dealer."

It should be reported that, "Coinbase reported a strong rebound in the first quarter of 2024, backed by an increase in market performance and the launch of Bitcoin exchange-traded funds. The exchange posted USD 1.6 billion in total revenue and USD 1.2 billion in net income for the first quarter, achieving USD 1 billion in adjusted earnings before interest, taxes, depreciation and amortization"

SOURCES CONSULTED

Cointelegraph. Coinbase faces new lawsuit over alleged investor deception. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph

Nowadays it actually looks like there is so much war on the coinbase exchange and they really need to be careful so that it will not affect them negatively