[Trading cryptocurrencies] - Crypto Academy / S4W6- Homework Post for @reminiscence01.

My homework submission post for @reminiscence01 which is about Trading cryptocurrencies.

Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading

Spot Trading

Spot trading is a type of trade that is carried out in spot market at market price or spot price. Market price refers to existing price in the market at any point of time. So spot traders place market order. Funds for performing spot trade must be available on the exchange account of the trader. It means spot trade is carried out with the funds that the trader own at the time of carrying out the trade. No leverage or borrow option is available for spot trade.

For example , if i wamt to buy BTC for $1000 in market. Spot trade would allow me to place the buy order for $1000 at the price that is available in the market at the point of carrying out the trade and all the thousand dollars must be available on my exchange account for carrying out the trade successfully

Advantages

Traders cam hold their position as long as they want. No extra charges other than trading fee have to be paid.

Orders get executed instantly.

it is low risk trade as no leverage is involved.

Trader is free to choose quantity of token as their is no minimum token fixed criteria.

Disadvantages

Low profit as compared to margin and future trading.

Funds must be available beforehand to perform trade.

Only Buy trades can be taken. A trade can short sell his position. So opportunities have to be sought only in bullish market.

Margin Trading

Margin trade is a type of trade which is carried out with the help of burrowed funds.

Exchanges that allow margin trading have different types of accounts available for traders like exchange account, lending account and margin account. The funds present in exchange account are used for spot trading as mentioned above. The funds present in lending account are offered to the borrowers for carrying out margin trading and the funds present in the margin account are known as Collateral. Collaterals are not used for carrying out the margin trading but are used as a safety measure for compensation against the borrowed funds.

So funds for margin trading are those funds that are offered by lenders for lending purpose , these are not the collateral funds that are present in the margin account. Once trade position is closed user has to pay back burrowed amount as well as interest of burrowed funds.

For example, i had $1000 as collaterals and i burrow $2000. I cam perform trade for 3000$ and after closure of position, I'll have to pay back 2000$ and interest on 2000$. In case trade goes in wrong direction and falls below requisite position , a trader will receive a margin call asking to add additional funds or decrease the loan amount. In case, trader fails to do so and trade continues going against the position, forceful liquidation is carried out by exchange. For example, on binance exchange, when the margin level reaches 1.3 , user receives the margin call and when it drops to 1.1, forced liquidation is carried out by the exchange.

Advantages

One can take advantage of burrowed funds to gain big profits.

Trader need not have all funds available before hand.

Disadvantages

it is high risk trading as it involves burrowed funds.

Hourly interest rate on burrowed funds is an add on burden.

Future Trading

Future trading is that type of trading whiere a trader uses his funds partly and takes leverage from the exchange to increase the quantity of future contract to be traded. For example, a trader taking a 5x leverage can place a trade for funds which is 5 times more than the funds that he/she has in his future account. As trader can gain more profit, there is also more risk in taking leverage. To minimise loss, future trading also support hedging.

Suppose i have 1000$ in my future account and I plan to perform a future trading with 5x leverage. I can buy crypto contracts worth $5000 where only my $1000 will be utilized and 4000$ will be taken from exchange. In case the trade goes in desired direction, I'll earn 5x profit. If the trade goes in wrong direction, my position will not be closed unless the loss reaches $1000 . Either I'll have to close my position anytime i want or there will be auto closure or liquidation of my position by the exchange at 1000$ loss in case stoploss in not in place.

Advantages

One can take advantage of leveraged funds to gain big profits.

Trader need not have all funds available before hand.

Both Buy and Sell trades can be taken. So we can gain from both falling as well as rising market.

Hedging option is available to minimise risk.

Disadvantages

it is high risk trading as it involves leveraged funds.

We don't actually trade assets but we trade contracts.

Roll over charges have to be paid in case of holding for more than 8 hours.

Explain the different types of orders in trading.

Different types of orders are market order, limit order , stop limit order, OCO order . Order can be either buy or sell type.

Market order

Market order is a type of order in which a buy or sell order is placed at the existing price in the market. The price that exists in the market at any point of time is known as the market price.

One thing that traders must keep in mind while placing market order is that they are subjected to variation in price. As trade gets executed at the existing price in the market, if price of asset increases from the time of order placement and order execution then the order will get executed at higer price and vice versa. Similarly in case of low liquidity market where order takes time to get executed, final price of an asset will be subjected to variation in the price during that time.

For example, the current price of BTC is 56000 USDT, if I place a buy or sell order at the same price and it gets executed immediately at the same price then it would be called market order. In case liquidity is low or volatility is high, price will chnage as per market condition at the time of execution which may be low or high.

Limit order

Limit order is that type of order where a trader is not willing to pay market price for an asset and places order (buy /sell) at a price different from the market price . Then that price would be called limit price and the order is known as limit order. Order may take time to get executed because limit price is different from market price. When limit price is reached, order gets executed. On the other hand , market order is executed instantly.

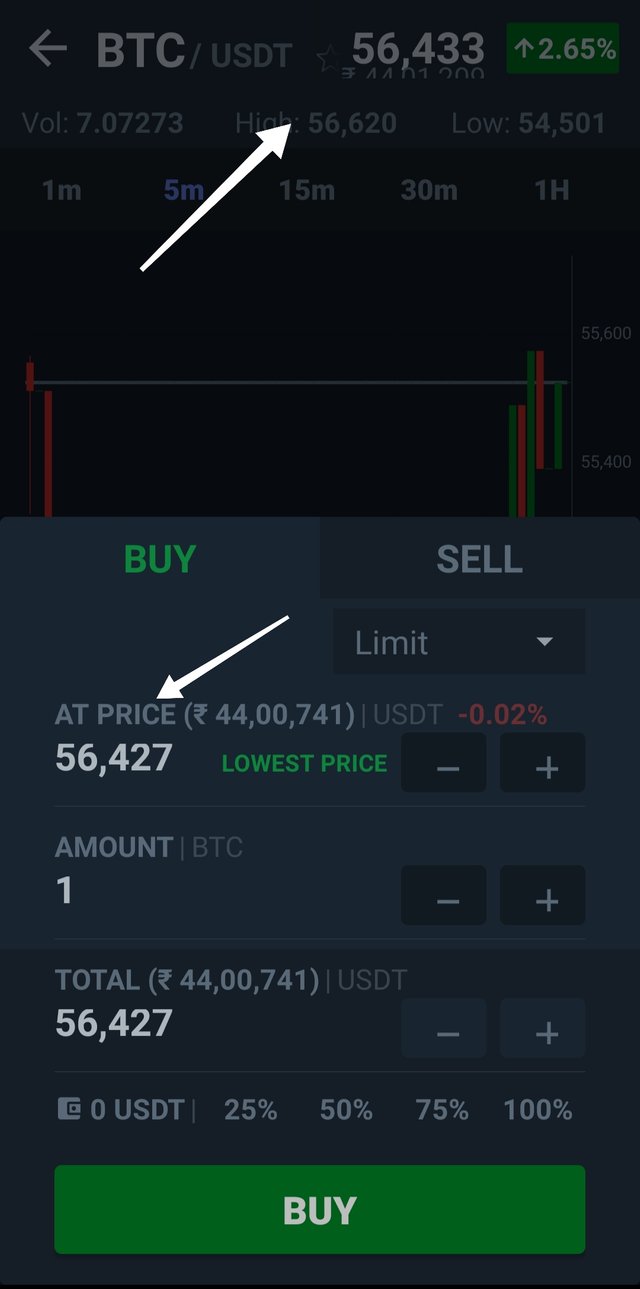

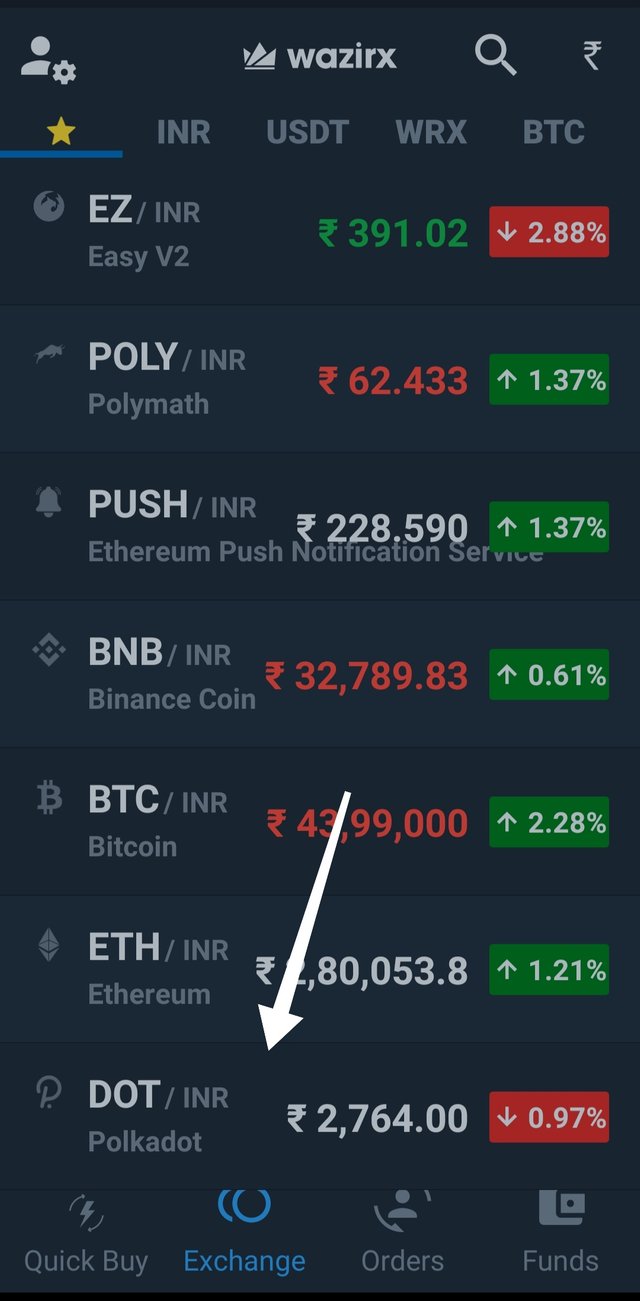

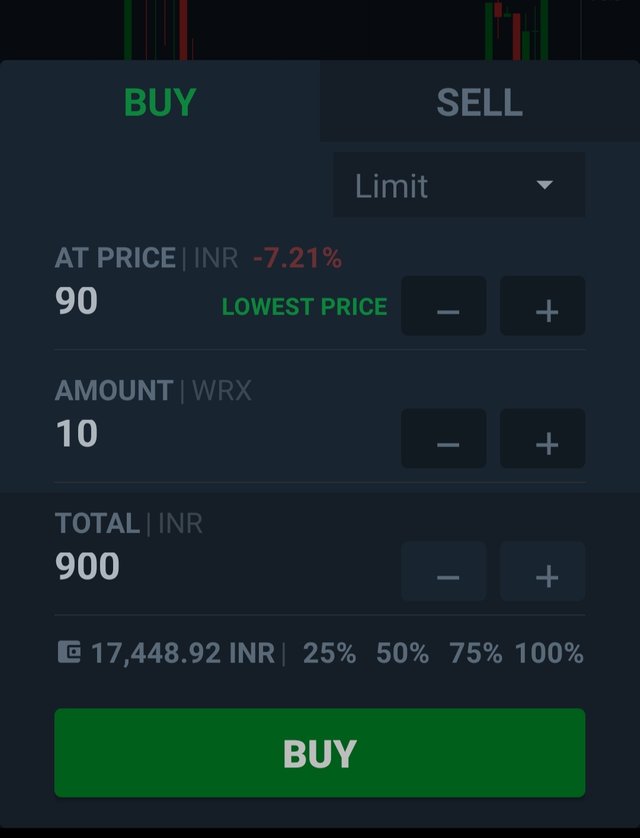

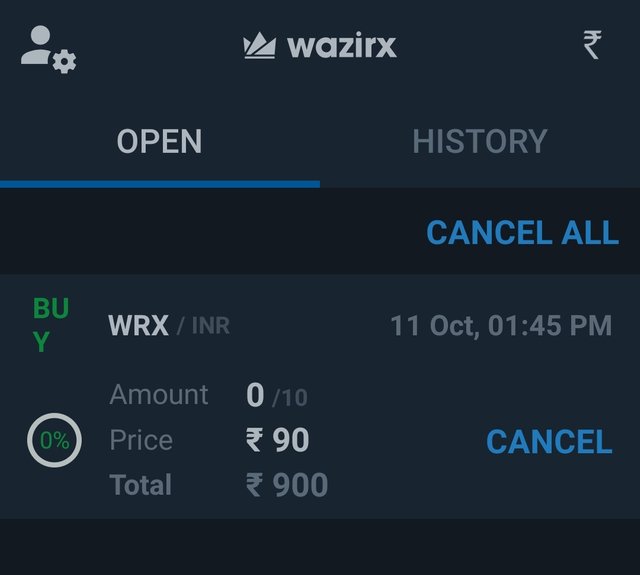

Screenshot from my Wazirx account

For example , the market price of BTC is 56433 USDT. Suppose I place buy limit order at 56427 USDT, i will have to wait for the price to drop down to 56427 USDT for order to get executed.

Stop order

Stop order has two subtypes. Regular stop order and stop limit order. It can be either buy or sell type. In regular stop order, we only need to set stop price. Once stop price is reached, it becomes market order and is executd at market price. In stop limit order, we need to place two prices for order. Stop price and limit price. Stop price is the triggering price of order and limit price is the actual price at which order will get executed.

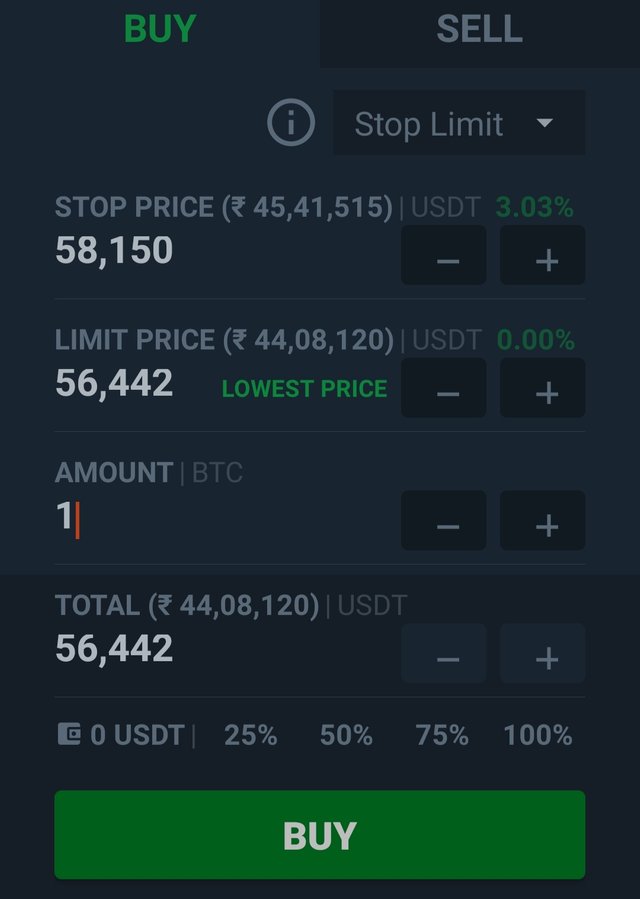

Screenshot from my Wazirx account

In the example above, i am placing stop limit order for buying 1 BTC. Market price of BTC at the time of order was 58150 USDT , stop price is set same as market price , limit price set at 56442 USDT , you can see the final amount that i have to pay is equal to limit price . So order will be executed at limit price.

How can a trader manage risk using an OCO order? (technical example needed).

OCO stands for one cancels the other order. As the name implies, two orders are placed simultaneously and if one order is filled, other order will be cancelled automatically. To put it simply, placing OCO order results in opening of two orders in market. Execution of either of the two orders will cancel the other. OCO order is a potential tool to mitigate risk in high volatile markets.

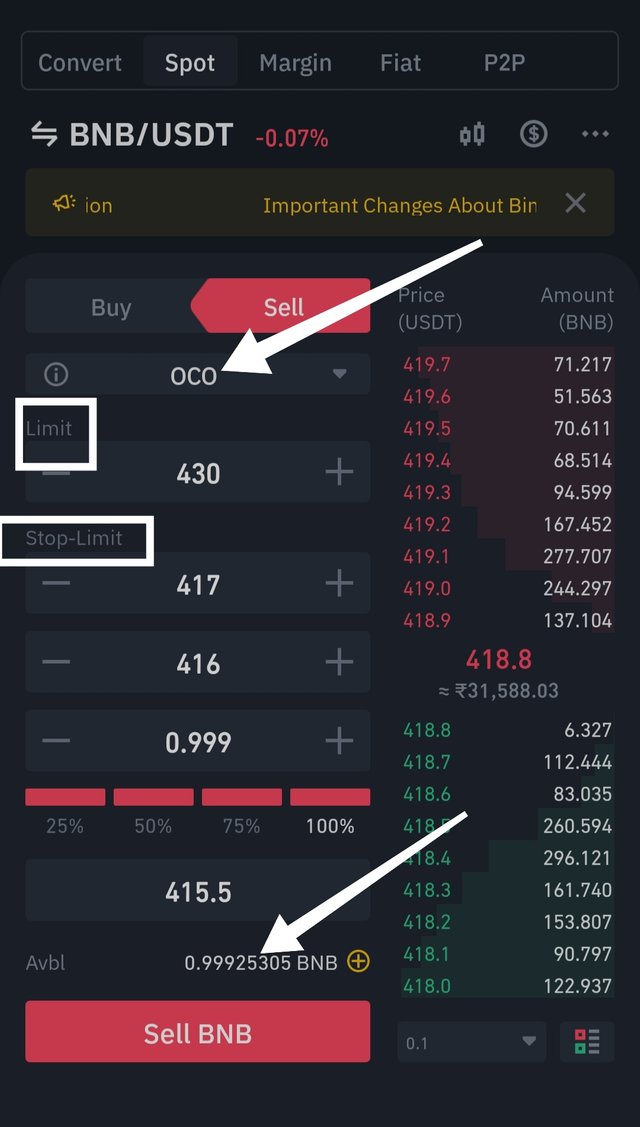

For example, i am having 1 BNB coin in my account and market seems to be fluctuating wildly. There is a chance of wild swing down and that may lead to huge loss . There is also a possibility that market may take a huge swing up and there are chances of booking a huge profit but for that I'll have to keep watching the market because in highly volatile markets, swings won't take too much time. Presuming that I don't have enough time to keep watching the market. I can place OCO order which is composed of limit order and stop limit order. I'll place limit price towards swing high and stop limit order towards swing low. Let me give a real example from my Binance account.

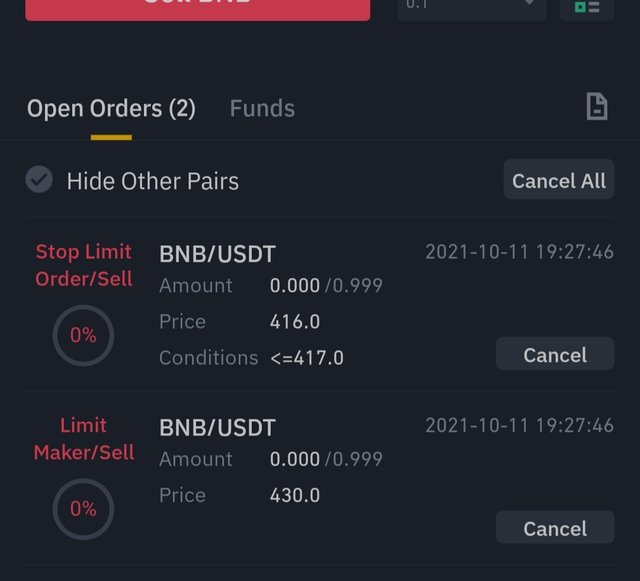

I am having 0.999 BNB in my account. Market price of BNB is 418.9 USDT. I have placed OCO order for the same where i set limit order above at limit price of 430 USDT and a stop limit order below where i set stop price at 417 USDT and limit price of 416 USDT . The purpose is that if BNB went up and reached 430 USDT, my limit order will be executed and srop limit order will cancel and I'll exit by booking profit. On the other hand, if the market took down turn, my stop limit order will be triggered at 417 USDT and will be executed at 416 USDT. so I'll exit with minimum anticipated loss. So in this way, OCO is used to mitigate risk.

Screenshot from Binance account

Screenshot from Binance account

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

For this task I'll use wazirx exchange app.

Open wazirx app and from bottom panel of options click on Exchanges.

Select the trading pair say WRX/INR. I'll use INR equivalent of 5 USDT minimum.

Click on WRX/INR and than select buy .

From order type, select limit order.

Market price of WRX is Rs 97.2. As i am placing Buy limit order . I'll alter price from 97.2 to 90.

Click Buy option. Order is placed but is pending execution. I'll have to wait for price to drop to 90 Rs for order to get executed.

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

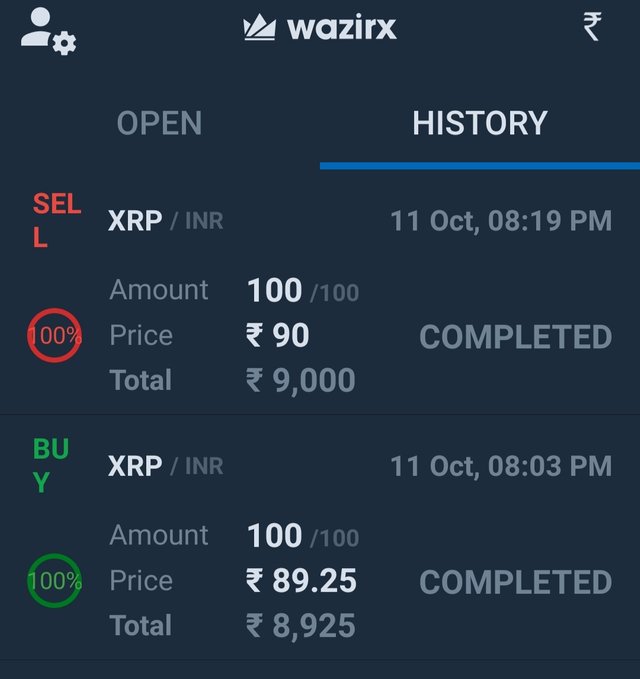

For this task i am choosing wazirx account and my trading pair will be XRP/INR. Technical analysts is carried out on tradingview app.

Reason for choosing XRP/ISDT is the solid foundation of XRP. In case of XRP, there is no apprehension of dumping of coin. Secondly, XRP has potential of giving good profit as for its current market dynamics is concerned.

The coinmarketcap rank of XRP is 6 which is a very good rank. Moreover, its other parameters are rock solid. The live XRP has trading volume of $4,564,513,917 USD and has market cap of $54,112,192,915 USD. It has a circulating supply of 46,805,773,456 XRP coins and a max. supply of 100,000,000,000 XRP coins.

As for indicator is concerned, i don't rely on indicators too much. I am more of a price action trader. However, i have taken RSI into consideration. RSI was coming from below upwards and was at 50 which is a good value to take buy trade. As for price action is concerned, XRP was at important support level. It has already taken support from this line multiple times as shown by arrows.

ETH/USDT Chart from my trading view where buy entry was spotted

Take profit hit

I took entry at second bullish candle after retesting of support line. I set stoploss below the low of bearish candle behind the entry and take profit was set such that SL:TP is 1:1 . Within 10 minutes of entry TP was hit.

Proof of completed buy and exit position

Conclusion

Different types of markets are there and so are different types of orders. Each market type and each order type has its own pros and cons. Different order types suit different trading personalities and expertise. To begin with spot trade from spot market is the ideal option to get started. Other trading strategies follow as users get more and more knowledge and expertise.

Hello @magmuz, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thank you. I'll surely act as adviced.