Steemit Crypto Academy Season 2: Week2 | Cryptocurrency Contracts For Difference (CFDs) Trading

Hello Everyone,

I will like to thank @kouba01 for this lecture. I have gone through it and I have learn a lot. I am confident with my entry and hoping it’s one of the best.

Question 1

What is cryptocurrency CFD?

Contracts For Difference is the full meaning of CFD. CFDs can be defined as an agreement that allows a trader to earn or loose on an asset's current value on the market. This type of trade doesn't require that the trader holds the asset, what the trader only needs to do is to predict if the price of the asset will go up or down. He looses or win depending depending on the price movement and his prediction.

For instance, the trader predicts that the price of an asset will increase, if the price of that asset really goes up he will make profit, but if the price goes in the opposite direction, the trader looses.

Prediction that the price of the asset will go up , for each point that the price moves up you will be paid in multiples of the units you bought or sold. prediction that the price will decrease, for every unit that the price goes down you will loose money in the multiples you bought or sold.

Question 2

How do i know if cryptocurrency CFD are suitable for my trading strategy.

it is clear that the value of cryptocurrencies fluctuate with time. There is the need to make some points into consideration before getting involved. lets look at some point into consideration.

To be an investor, you must take some risk, might or might not go your way. This are the risk we have to take to be able to be successful since we dont know what will happen in the next hours.

Buying cryptocurrency is expensive,you need to buy more to get more profit.

As a beginner, you need to do a lot of practice to be perfect in trading. It is advice to always start with a demo account to help you build yourself.

You should always seek for a secure platform in trading. It is important to trade with a secure platform so you can feel safe with your capital. platform like Binance is a secure place to trade.

Investor needs to have some good knowledge about the market. The trader should know what kind of token to invest in and the trend of each token to make a good huge profit and make low or no lose.

Patience is also a key factor. Sometimes you need to wait a little bit longer to see how the price behave. After investing you will need sometime to be able to make some profit.

Question 3

Are CFDs risky financial product?

where ever there is an investment, there is an amount of risk involved. Every investment has to do with money, asset, time, workload etc. What really matters and important is to know the risk involve before going into it. Below are some of the risk involved in CFD.

Price Volatility:The high rate of change of price value in the cryptocurrency market is a risk factor. Some token has the capability to fall to about 40% a day.

Laverage: This is another key feature that comes with risk in CFD. It increases the value of your profit as well as your lose more than your initial capital.

Holding cost: An investor may attract holding cost which depends on the positions he hold and how long he hold usually on a daily basis.

Charges and Founding cost: This is a factor to be considered. This has a huge impact in an investor profit which vary significantly from firm to firm.

Higher probability of profit during rise of fall of crypto value

Easy steps to buy cryptocurrency with your fiat currency

Has tools for better risk management

Easier and lesser steps to open an account

There is high fees for holding a position for a longer time.

Margin trading can lead to huge loss of not controlled properly.

Question 4

Do all brokers offer cryptocurrency CFDs?

No not all brokers offer cryptocurrency. Transactions can be made without the payment of fees to an exchange. Intermediary is not needed for a transaction to be successful.

Question 5

Explain how you can trade with cryptocurrency CFDs on one of the brokers

I Visit https://www.etoro.com/ which is the official website

Create an account and logged in

Visit my profile and input the information needed

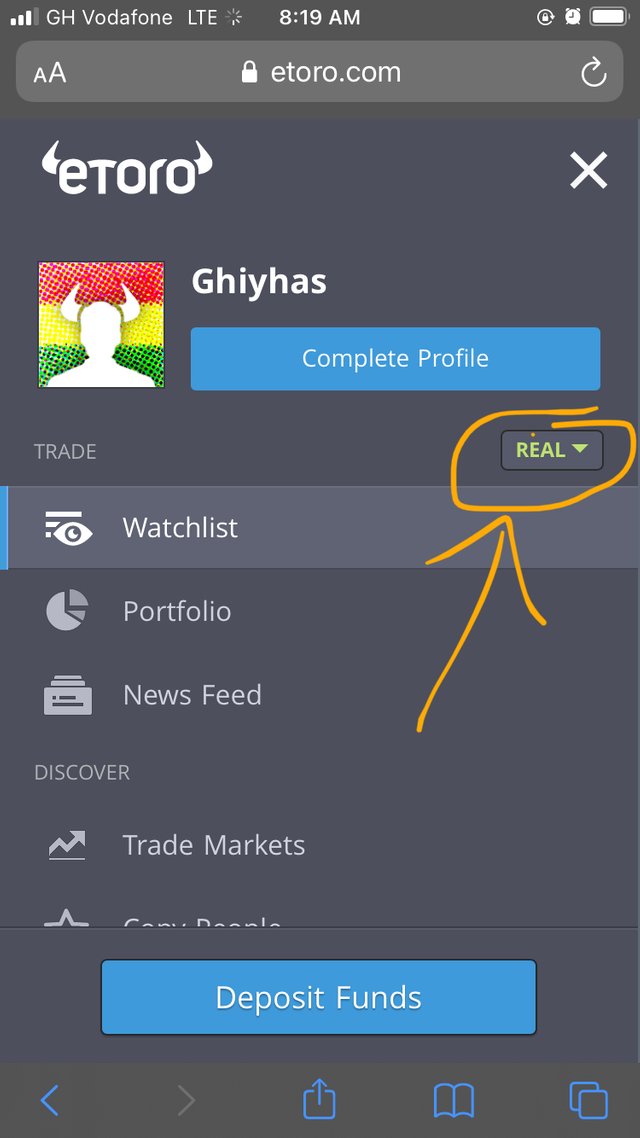

Switch from real portfolio to virtual portfolio

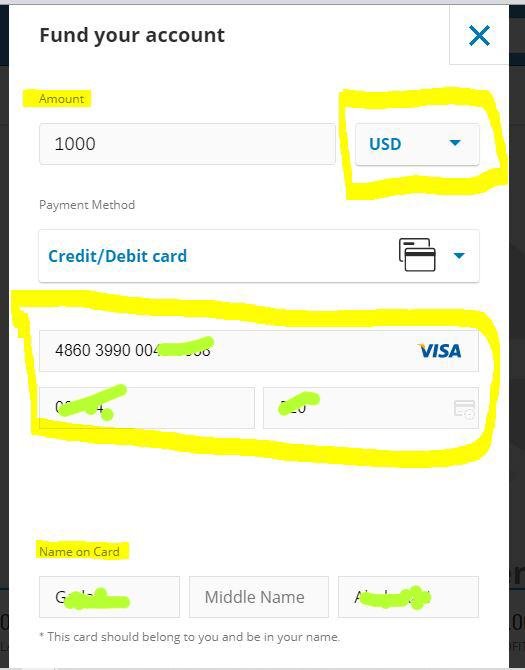

Deposit some funds into my account using a Card

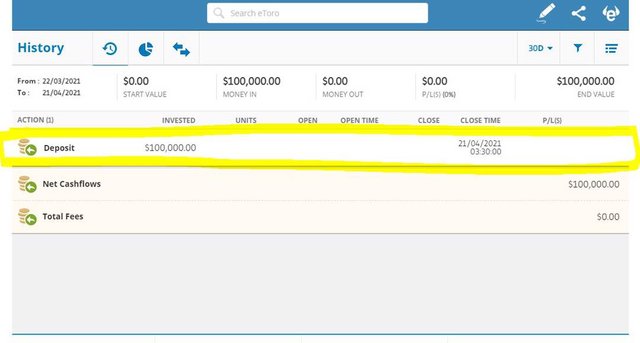

check virtual portfolio to confirm my transaction

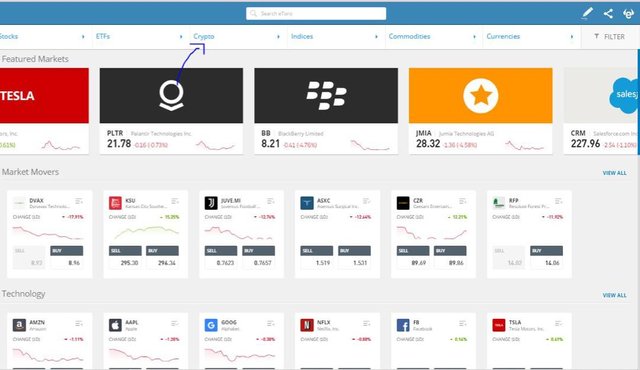

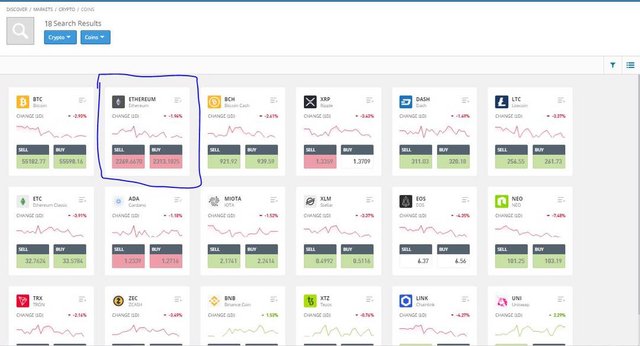

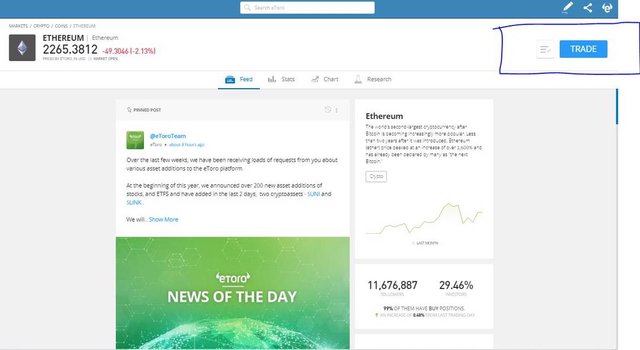

Navigate to the trade market

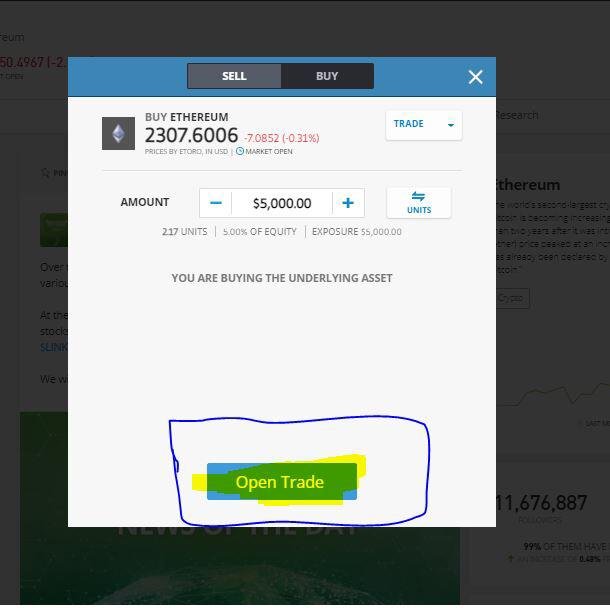

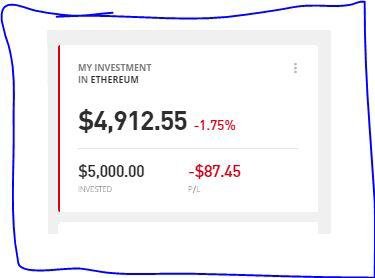

I opened trade of $5000 for Ethereum

CONCLUSION

Every investment has an amount of risk. it’s important to know the risk involved in every investment. Since it’s a risky game, always invest an amount you can afford to loose, everything might go wrong leaving you stranded. Let’s avoid that.

Hi @mahamaghiyas2

Thanks for your participation in the Steemit Crypto Academy

Feedback

Good work. Well done with your research on CFDs

Homework task

7

Your post has been very nice. This is the best quality post. If anyone sees your post they will fall in love with your post. I also really fell in love with your post. Thank you so much for such a post.