Origins and History of the central banks of the United States

Like any large institution worth its salt, the Federal-Fed Reserve (Federal Reserve in English, the Central Bank of the United States) US, has an interesting history, conditioned by the political power, which illustrates well the supporters and detractors of the Bank Central. Let's summarize in this article the various central banks that have existed in US and as the Federal Reserve was established in a series of two articles.

The debate about an "audit the Fed" is the latest manifestation of a conflict as old as the nation faces two clearly defined sides. On one side, those who defend the idea that a strong central bank improves the economic stability of the country and, opposite, those who argue that an authoritarian government in monetary matters is a harmful interference to the economy.

The central bank battles have historically faced financial elites who wanted to limit the availability of money and -preservando their value, against farmers, businessmen and other borrowers who were betting on an abundant and cheap money. In this battle, both contenders have sometimes seen as the central bank is positioned as an ally while at other times, the same institution became his worst enemy.

The most notable episodes of this eternal struggle between them and the collected Granville Appelbaum an interesting article in The New York Times. In this series of articles we will echo the quoted text and will take a historical tour of the Fed and the dates or events in the history of this monetary institution.

- Genesis: The Banks of the United States. The first and second 1791-1811 1816-1836

The first two US central banks, -both called US Bank (Bank of the United States in English) - were private institutions, for-profit, and emerged covered by Congress. The first (1791-1811) was created to help the government pay its war debt, stabilize the currency of the country and raise money for the new government. Thus, the dream of Alexander Hamilton, secretary of the Treasury, became a reality once overcame the resistance of Thomas Jefferson who left for history a memorable phrase "I believe that banking institutions are more dangerous to our liberties than standing armies ". After the license granted to the bank for 20 years, Congress decided not to renew it.

The second Bank of the United States (1816-1836) was founded a few years later, about the aftermath of the War of 1812, and again thanks to Congress. But it lasted only 17 years. President Andrew Jackson was a firm believer that the central bank focuses too much economic power with a wealthy elite corrupt the front and vetoed the bill to extend its license in 1832. In this first chapter, supporters of the bank were defeated clearly . Among losers included Henry Clay, Jackson's opponent for reelection that year. Thereafter, funds from the US Treasury (Ministry of Finance) withdrew from the bank and deposited in state banks. The nation would be without a central bank for more than 70 years. As a curious note that the headquarters of both banks are still standing to a block apart in downtown Philadelphia.

"The bank is trying to kill me, but I'll kill you!" Andrew Jackson

- Without a Central Bank, panic tends to be regular?

A severe financial crisis led the US economy into a deep recession in 1837, only a year after the demise of the Second Bank of the US These crises have become recurring events in the lives of Americans and, as the economy grew, so did the size and frequency of crises. Then, banks created the New York Clearing House (Clearinghouse), with support from the private sector, but this initiative was insufficient to the task entrusted and the government found no leeway task. In the absence of a central bank, the United States regulated the value of its currency by ensuring that dollars could be exchanged for gold and silver occasionally. A situation that was evidence that the government could not respond to the financial crisis and the resulting economic recessions, because they could not simply increase the money supply.

In 1907, another crisis that originated in the United Copper Company was overcome thanks to emergency loans led the banker J. Pierpont Morgan. Then, the debate on whether or not a central bank was in favor of those who argued that the government itself needed "a permanent body of fire", triumphing Central Bank's thesis in political and financial fields.

"Unless we have a central bank with adequate control of credit resources, this country will suffer more severe panic money and far-reaching in its history." Jacob Schiff, a prominent banker from New York, 1907

- The Federal Reserve Act of 1913 and the creation of the Federal Reserve-Fed

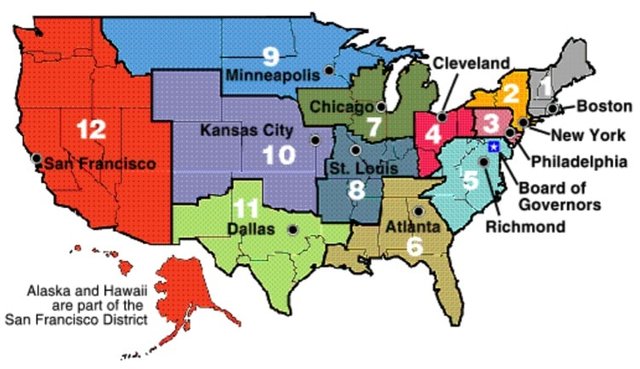

In November 1910, Senator Nelson Aldrich met with a group of bankers in a resort on Jekyll Island (Georgia) to plan the establishment of a Central Bank. The idea summed up many of the great political battles of the era: States against the growing and centralizing power in Washington; Wall Street financiers against smaller banks, especially in the south and west of the country; populists against the elite of the Golden Age ... The bill that emerged after several years of debate was finally signed by President Woodrow Wilson. As stated, there would be 12 banks reserve private property in major cities across the country, preserving thus the power of financial elites. However, these banks would be supervised by a person appointed by the president would be present including Treasury Secretary board. However, before the Fed was fully established, the previous system suffered its last financial crisis (1914) and as happened in 1907 many banks failed.

"We will address our economic system as it is and as it may be modified, not as it might be if we had a blank sheet of paper and step by step it will become what it should be. "Woodrow Wilson, in his first inaugural address

12 regional banks of the Federal Reserve US

- The Great Depression and the response of the Federal Reserve

However, instead of preventing the crisis, the Fed helped cause the Great Depression. The Fed was supposed to manage the gold standard - to ensure that the economy was not asphyxiated by the lack of money- and interest rates. But instead, the Fed was unable to negotiate disagreements between regional banks and the central board. So he let the money supply was reduced by a third. The result was the worst economic crisis in the history of the nation.

Congress responded to the failure of the Fed, greatly increasing its power and responsibilities. In 1934 the president was authorized to devalue the dollar, and began the long process of replacing the gold standard for a coin whose value was maintained by the Fed. In 1935 the Fed assumed responsibility on "the situation of the general credit of the country." Finally, the figure of the secretary of the Treasury of the board of the Federal Reserve was removed and a new decision-making committee was created.

"I would like to say to Milton and Anna as the Great Depression, you are right, we did. We are very sorry. But thanks to you, we will not do it again. "- Ben Bernanke, then a Fed governor, in a speech in 2002 speech in which were present Milton Friedman and Anna Schwartz, who investigated and documented the role and responsibility of the Fed in the Great Depression.

Very good info.

Bankers suckers.