Sell In May and Go Away? Not for Bitcoin Bulls

Sell in May and go away? While the month may traditionally give equity bulls cold feet, it should probably not be a cause of worry for the bitcoin market.

Indeed, it is actual the month of can also is usually a vulnerable duration for equities, and that bitcoin has acted as a hazard asset (shifting in tandem with equities) considering that february. As such, cryptocurrency investors might also fear that a capability drop in equities may want to become dragging bitcoin costs decrease.

However, ancient facts indicates that bitcoin is more likely to build upon its april rally this month.

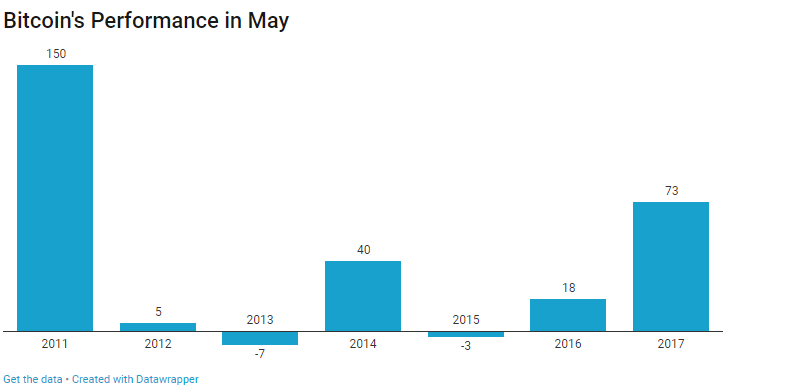

Significantly, the world's largest cryptocurrency by market capitalization has scored profits in the month of may additionally in 5 out of the ultimate seven years, in keeping with CoinDesk's Bitcoin Price Index. .

According to the data:

- BTC appreciated by 73 percent in May 2017 as it jumped from $1,348 to $2,330.

- The decline in the years the price did drop (2015 and 2013) was moderate (less than 10 percent).

Moreover, btc has fared well in every 2nd area for the reason that its creation - the highest being 1,964 percentage in q2 2011, while bitcoin jumped from $zero.Seventy eight to $16.10.

Virtually, records is on the bulls' side. Similarly, the seasonality evaluation handiest adds credence to the bullish installation as seen within the bitcoin chart under.

As discussed the previous day, the located bull pennant breakout ought to see the current rally from the april low of $6,425 (bitfinex rate) amplify to $10,000 or maybe higher.

The cryptocurrency has been confined to a narrowing price variety for extra than every week and has spent a better part of the remaining 12 hours trading between $nine,a hundred and fifty and $9,three hundred.

Because the technical principle has it, the longer the period of the consolidation quarter, the more violent the breakout has a tendency to be. So, btc should flow properly above the $10,000 mark in an hour or put up-breakout, if the bulls benefit the upper hand.

View

Btc has a tendency to carry out nicely in may additionally, for this reason an upside breakout of the narrowing rate variety is much more likely and could yield a quick move higher to $10,000.

Alternatively, a drawback break could open the doorways to $eight,490 (38.2 percent fibonacci retracement of the rally from $6,425 to $nine,767.4).

Only a day by day near (as in keeping with utc) under $7,823 (april 17 low) would signal a undergo revival.

Credit : http://bit.do/coindesklink

Congratulations @mianusman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP