Acala’s innovation of bringing out DOT derivative lcDOT to unlock liquidity of locked DOT in Blockchain

lcDOT to unlock liquidity of locked DOT tokens that were contributed as crowd loans

Something I find cool in Blockchain is innovations which changes things from what they were before, effectively making a value addition and creating a standard that would be embraced by the industry. Acala team has made such an innovation by introducing a DOT derivative product, called Liquid Crowdloan DOT(lcDOT).

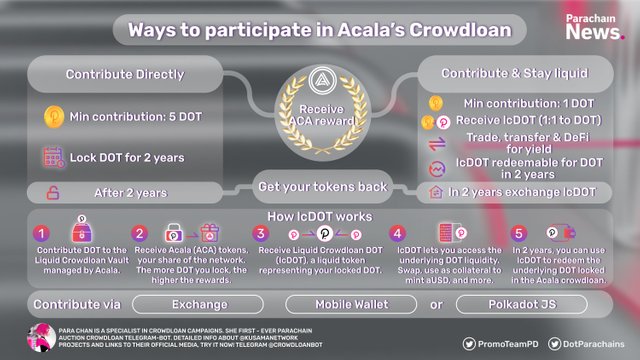

Oh yes, this is all about the DOT we supporters are set to contribute as crowdloans to strengthen Acala’s bid to win Polkadot’s upcoming parachain slot auctions that would take place on November 11th.

Incase, a team wins a parachain slot auction and launches in Polkadot, all those loyal supporters who helped the parachain team win through their valuable DOT crowd loan contributions will be rewarded with tokens of the parachain team, giving them a share in the network. All this is cool, except that the DOT that supporters contributed will be locked until the duration of the parachain slot gets over which is two years.

This is why the Acala team have created Liquid Crowdloan DOT(lcDOT), where the liquidity of the locked DOT tokens can be accessed and used by its holders in DEFI.

The Locked crowd loan DOT can be used in DEFI with its derivative lcDOT

Yes, incase Acala wins a parachain slot and launches in Polkadot, supporters who opted to contribute to crowdloans via Acala’s Liquid Crowdloan vault, will get access to their contributed DOT’s underlying liquidity with an equal amount of lcDOT asset which can be used in Acala DEFI as collateral for getting a aUSD loan or can be swaped in Acala’s AMM Dex.

Infact, in this video, co-founder of Acala, Bette Chen explains that supporters who want their contributed DOT back can exchange lcDOT for DOT in Acala Dex or use it in Acala for DEFI purposes. Cool is it not??!!

Supporters who want lcDOT should contribute crordloans via the Acala Liquid Crowdloan vault

All details are in this article, the only compromise here is that the Acala Liquid Crowdloan vault will be a multisig wallet controlled by Acala initially, as Acala is not yet live as a parachain in Polkadot. However, later when Acala wins a parachain slot in Polkadot, the ownership of this multisig vault shifts to Acala’s parachain account that will be a completely trustless account controlled by Acala’s on-chain governance.

There is a temporary timeframe period where supporters’ contributed DOT would be in control of Acala, so there is a component of trust involved though just initially.

The advantage here is that lcDOT makes the contributed DOT liquid, instead of it getting locked for 2 years in the Crowdloan module, till which time that contributed DOT remains idil.

Can contribute DOT crowdloans via the Crowdloan module and give up access of this DOT for 2 years

Supporters can always opt to just contribute their DOT directly to the Crowdloan module, in which case their DOT will be locked in a smart contract in Polkadot’s relay chain for 2 years and will be released trustless after 2 years. However, they will not have access to this DOT in that time period, it will lie idil.

Taken from twitter

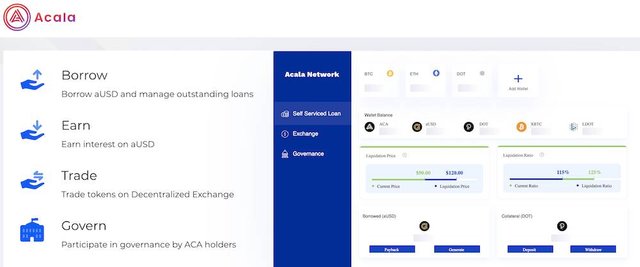

Looking forward to using lcDOT in Acala DEFI

Well, I would go with contributing DOT crowdloans via Acala’s Liquid Crowdloan vault, true there is a short time period where one has to trust Acala in controlling the vault initially, but later it will transition to trustless control inside Polkadot's Blockchain when Acala goes live as a parachain. The advantage here is I can use the liquidity of my contributed DOT in Acala DEFI(: …

Taken from https://acala.network/

All that staked 32 ETH by validators for Ethereum 2.0 should have been a derivative product

Taken from https://ethereum.org/en/

This actually got me thinking of Ethereum where validators of the upcoming Ethereum 2.0 had to stake 32 ETH in Blockchain and they can get access to it only when Ethereum 2 goes live. Perhaps, there could have been a derivative of that staked Ethereum given out to those who staked and those who delegated their stake to validators. Then that derivative can be used in DEFI instead of lying idil. After all we all want our money to work not just sit idil(:

**Thank you for reading!! **

All the options offered by Polkadot DOT, are currently being very well exploited in this blockchain, just before reading your publication I saw in what position is DOT and is currently No. 8, I also believe that soon will be in the top 5, of course without displacing ETH.

The fundamental analysis of Polkadot offers many benefits and has a good future. I have it in my portfolio.

@tipu curate

Upvoted 👌 (Mana: 1/5) Get profit votes with @tipU :)