How Bitcoin Prevents Inflation

The people that control the creation of money are more powerful than the politicians

Figure 1: A money printing press.

Figure 1 shows a money printing press which you will find in any central bank in every nation of the world. Now, for you and I to get paper money, currency, we need to spend a lot of blood, sweat, and tears usually by working hard for a job. However, the people who control these money printing machines, the central bankers, have the ability to create an unlimited amount of currency.

Figure 2: The front face of a U.S. one-dollar bill.

Figure 3: The front face of a U.S. one-hundred-dollar bill.

Paper currencies are no different than monopoly money and we are stuck playing the central bankers game!

Have you ever wondered why the buying power of a U.S. one-hundred-dollar bill (Figure 3) is 100 times greater than a U.S. one-dollar bill (Figure 2)? They were both printed on the same paper and are made of the same material. The design is just different and the one-hundred-dollar bill just has a higher number, a 100, printed on it. If this is the case, why doesn’t an arbitrary large number: a million, a billion, a trillion, etc. just be printed on this piece of paper? In some countries, such as Zimbabwe, inflation got so bad that their central bank eventually started printing one-hundred-trillion-dollar bills (Figure 4). Can you imagine having one-hundred-trillion dollars and still not be able to afford to buy a loaf of bread? In some hyper-inflation scenarios this can occur. Today, countries such as Venezuela are experiencing massive inflation as well.

Figure 4: The Zimbabwe one-hundred-trillion-dollar bill

Sound money was abandoned because we left the gold standard

What does the number on central bank notes represent? One of what, a hundred of what, a hundred-trillion of what? Well originally, central banks worldwide were on a gold standard so all their printed bank notes, currency, had to be redeemable in gold bullion. In generations past, you could go to a bank and turn in your bank notes, currency, in exchange for actual gold bullion. However, when the U.S. dollar became the world reserve currency, all the currencies of the world became pegged to it instead of gold on the condition that the dollar maintain a peg to gold. Originally, in accordance to the Bretton Woods agreement, the U.S. dollar was supposed to maintain a peg of $35 USD to 1 ounce of gold bullion. However, the U.S. government spent a lot more money than it was making so it could no longer maintain this peg and have its currency redeemable in gold. On August 15th, 1971 U.S. President Nixon had to close the gold window, the convertibility of the U.S. dollar into gold, and from that day forth, all world currencies became fiat based. In simple words, the buying power of fiat currencies comes from gunpoint instead of an actual commodity backing.

Figure 5: U.S. President Nixon closed the gold window on August 15th, 1971

If 4 people were stranded on a desert island, this is how banking would work

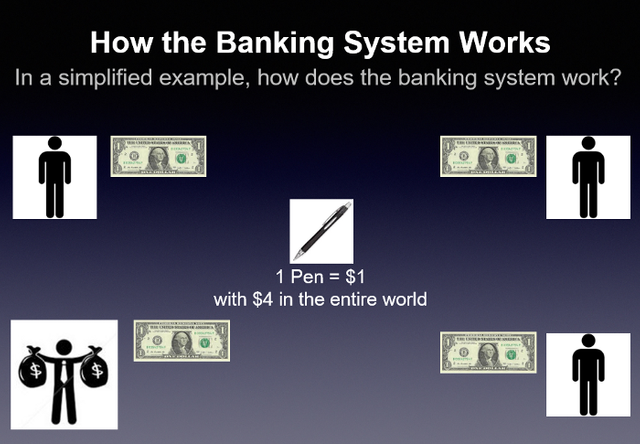

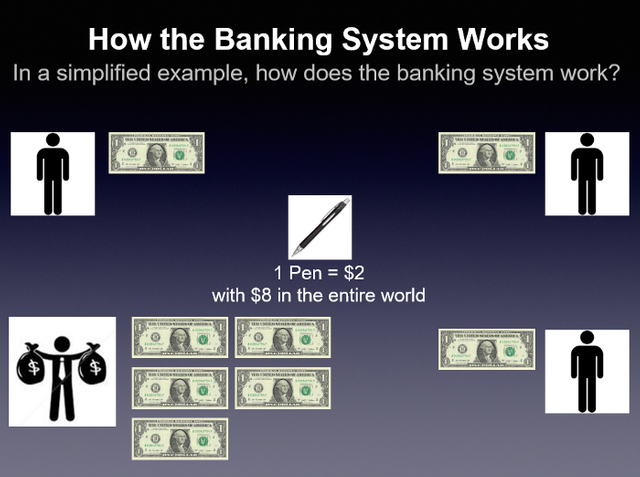

Fiat basically means “let it be” by some legal authority also known as the people who control guns. A fiat based monetary system makes inflation possible. Figure 6 and Figure 7 illustrate how the banking system, inflation, works. Pretend we live in a small community of only 4 people. In the beginning everyone is given 1 dollar so everyone has the same buying power initially. If you would like to buy a pen, which I spent all my hard work to create, it will cost you initially 1 dollar. Now the banker uses his money printing press and creates another 4 dollars out of thin air so there are now 8 dollars in existence. The people with one dollar each can no longer afford to buy this pen because of “inflation”; its price is now 2 dollars. However, the person who printed the currency, the banker, can afford to buy two and a half pens! This is basically how inflation works. Its main purpose is to transfer buying power from the people to the ones who create the money!

Figure 6: How the banking system (inflation) works part 1.

Figure 7: How the banking system (inflation) works part 2.

With larger communities, complexity and compartmentalization make inflation less noticeable

In a small community of just 4 people, it is very easy to see that the banker is taking advantage of this fiat based monetary system to dramatically increase his buying power compared to everyone else. Now let’s say we were in a larger community of 100 people. If the banker printed 4 dollars, the price of the pen wouldn’t be 2 dollars, it would just be $1.04 dollars. The price increase becomes even more subtle, if you factor in time too. Let’s say the banker printed 4 dollars in a span of a 10-year period. The price of the pen will slowly increase to a final price of $1.04 dollars after 10 years so it’s not a real big deal to the other members of the community. This is how inflation works best — in large populations and through long periods of time!

Figure 8: How 4 people in a community will survive together.

A fair exchange of labor is needed in our monetary system again

Now if we were in a small community of just 4 people, are we just going to let the banker just sit on his rear end all day and just print as much money as he wants? Hell no! Of course, if there were just 4 people in our community in order for us to survive, one person would have to go fishing right? Another person would have to raise crops as farmer. Another person would have to be our hunter for food. Instead of the banker just using his printing press to create as much money as he wants, why doesn’t do something more useful such as go mining for precious metals that can be used by the community? This is how commodity based money emerged. A miner could trade 3 ores of mined gold for say 3 fish that a fisherman caught.

Figure 9: Many different kinds of fiat based currency.

Fiat based currencies don’t stand the test of time!

Figure 9 shows the many different kinds of fiat based currency. Ever since, the printing press was created, literally thousands of paper based money have been attempted. In time, the ones responsible for the creation of the paper money become greedy and print more money than they can support with an actual commodity such as gold and the currency becomes fiat based. On the average, the lifespan of a fiat based currency is about 50 years or 2 generations until inflation then hyperinflation occurs — it is a 100% failure rate!

Mining Bitcoin allows for a fair exchange of labor in a digital age

Cryptocurrencies, such as Bitcoin, allow for a return to a sound monetary based system similar to a commodity based monetary system. Instead of only a few people in charge of creating money using a printing press, or typing some numbers into a computer nowadays, everyone has the ability to create money, Bitcoin, by becoming a miner. This way the creation of money is kept decentralized and a fair exchange of labor can occur!

The first bitcoin was invented by Satoshi Nakamoto during the late 2008 as a repercussion of the financial crisis. No one personally knows who Satoshi Nakamoto is but he wants to show people that cryptocurrency allows for decentralized finance — no one needs complete control of the creation and use of currency. Satoshi’s creation of Bitcoin, has taken the world by storm and many people firmly believe it and other cryptocurrencies will be the next evolution of money.

The future of money are cryptocurrencies!

Figure 10: A digital handshake.

Cryptocurrencies can profoundly impact today’s business. Bit by bit, people are starting to accept this new type of digital currency because of the benefits offered such as peer-to-peer payments, complete monetary control, and the low fees to transfer money. However, as with all things, there are risks associated with this new type of digital currency. Nevertheless, cryptocurrencies are here to stay! It’s your decision if you want to be one of the early adopters to reap the potentially high rewards with using this exciting new money paradigm.

Don’t miss out on our recommendations and special offerings!

http://www.moneywisealpha.com/recommendations/

Website: http://www.moneywisealpha.com/

Book Site: http://btcmoneytop20.com

Blog Site 1: https://medium.com/money-wise-alpha

Blog Site 2: https://www.publish0x.com/money-wise-alpha/

Blog Site 3: https://steemit.com/@moneywisealpha

Blog Site 4: https://moneywisealpha.tumblr.com/

Blog Site 5: https://moneywisealpha.blogspot.com/

Telegram: https://t.me/MoneyWiseAlpha

Facebook Book Page: https://fb.me/BTCMoneyTop20Ways

YouTube: http://www.moneywisealpha.com/videos

DailyMotion: https://www.moneywisealpha.com/dailymotion

DTube: https://www.moneywisealpha.com/dtube

Bitchute: https://www.moneywisealpha.com/bitchute

Book Promotion:

Twitter: https://twitter.com/my_csales23

LinkedIn: https://www.linkedin.com/in/christian-john-sales-92375ab/

Book Group: https://www.linkedin.com/groups/10472552/

Hello,

We have contacted you on Twitter to verify the authorship of your Steemit blog. We would be grateful if you could respond to us via Twitter, please.

https://twitter.com/steemcleaners/status/1152933449377955840

Please note I am a volunteer that works to ensure that plagiarised content does not get rewarded. I have no way to remove any content from steemit.com.

Thank you

This post was resteemed by @steemvote and received a 99.94% Upvote. Send 0.5 SBD or STEEM to @steemvote

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/money-wise-alpha/how-bitcoin-prevents-inflation-64342c0236f

Congratulations @moneywisealpha! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

This post was upvoted and resteemed by @resteemr!

Thank you for using @resteemr.

@resteemr is a low price resteem service.

Check what @resteemr can do for you. Introduction of resteemr.

Resteemed by @resteembot! Good Luck!

Check @resteembot's introduction post or the other great posts I already resteemed.

You have received a resteem. My 7000 followers will see your post afresh. Your post will also be shown to members of my discord server.

Your post has been tweeted to 2000 followers. See it on twitter

Your post has been shared with 2000 facebook members. See it in facebook group

This post is Powered by @superbot all the way from Planet Super Earth.

Follow @superbot First and then Transfer 0.100 STEEM/STEEM DOLLAR to @superbot & the URL in the

memo that you want Resteemed + get Upvoted & Followed By @superbot and 1 Partner Account.

Your post will Appear in the feed of 1300+ Followers :)

So don't waste any time ! Get More Followers and gain more Visibility With @superbot

#Note - Please don't send amount less than 0.100 Steem/Steem Dollar ,Also a post can only be resteemed once.

Thank you for using @superbot

If you would like to support this bot , Please don't forget to upvote this post :)

Stay Super !

On your reconing the US $ is on the point of death. 1971 + 50.

As the rest of the world is based on the US $ we will have to accept bitvcoin or advance to the past, how much is your fish worth? I have got some butter, want to trade?

lol, yeah I learning how to fish and farm might be a good job in the future!

The world will always want food, of any sort, maybe we need a butter backed dollar?? :-)