Turkey Already on the Threshold of Economic Crisis: Lira Tumbles 20%

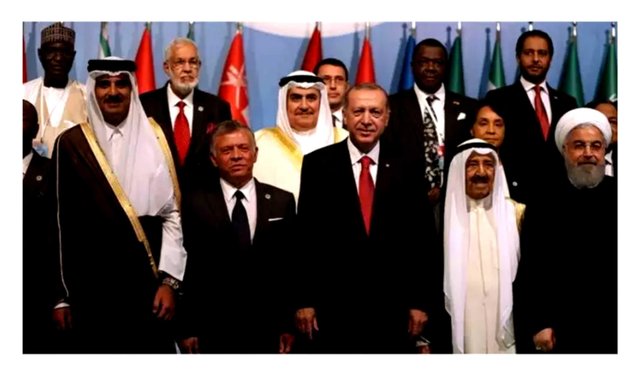

Turkish President Recep Tayyip Erdogan and leader of the OIC

ISTANBUL - Turkish economic data shows the country's economy is booming. However, the financial markets show the exact opposite where the Turkish economy is at stake.

Just so you know, lira, the national currency Turkikembali fall one day after the national central bank raised its main interest rate.

Although lira had strengthened after the increase in interest rates, but the strengthening did not last long. It shows the prevailing market uncertainty.

On Thursday (24/5), the lira fell again by 2% against the US dollar and euro and a 20% trim throughout the year to the weakest record.

In fact, the central bank has raised its benchmark interest rate to 16.5% from the previous 13.5%.

Investors are busy releasing lira as their anxiety relates to monetary policy. Especially after Turkish President Tayyip Erdogan, a figure described as an enemy of interest rates, said last week that he would impose more control over financial policy after the June 24 elections.

His statement is increasingly deepening market concerns about the ability of the central bank to cut inflation which has now reached double digits.

Erdogan insisted, the volatility of lira does not reflect economic reality.

He even warned that he would not allow the type of global government to ruin the country.

He called on Turks not to vote for foreign currency rather than lira and said authorities "will definitely take steps to lower inflation and account deficits run in a very different way after the election."

The last time the central bank raised interest rates at an emergency meeting was in January 2014 in a bid to halt a similar sell-off.

Instead, Erdogan wants lower borrowing costs to boost economic expansion as he enters parliamentary and presidential elections next month.

Previously, the international rating agency Fitch ratings expressed concerns about the central bank's independence regarding Erdogan's remarks.

According to Fitch, Erdogan's statement last week that he plans to have a greater vote in monetary policy if he wins the June election increases the likelihood of the country's economic policies becoming more unpredictable after the vote.

The next monetary policy meeting of Turkey's central bank will take place on 7 June.

However, economists are calling on the central bank to hold an emergency meeting before that date in order to implement a sharp rise in interest rates before it is too late to have no effect whatsoever.

Fitch, like other global rating agencies, currently assesses Turkish debt goes into junk status alias junk. Fitch warned that the erosion of central bank independence would put "further pressure on Turkish foreign debt credit profile."

@musawir